PNC Bank 2012 Annual Report Download - page 249

Download and view the complete annual report

Please find page 249 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management believes our indemnification and repurchase

liabilities appropriately reflect the estimated probable losses

on indemnification and repurchase claims for all loans sold

and outstanding as of December 31, 2012 and 2011. In making

these estimates, we consider the losses that we expect to incur

over the life of the sold loans. While management seeks to

obtain all relevant information in estimating the

indemnification and repurchase liability, the estimation

process is inherently uncertain and imprecise, and,

accordingly, it is reasonably possible that future

indemnification and repurchase losses could be more or less

than our established liability. Factors that could affect our

estimate include the volume of valid claims driven by investor

strategies and behavior, our ability to successfully negotiate

claims with investors, housing prices, and other economic

conditions. At December 31, 2012, we estimate that it is

reasonably possible that we could incur additional losses in

excess of our accrued indemnification and repurchase liability

of up to approximately $332 million for our portfolio of

residential mortgage loans sold. At December 31, 2012, the

reasonably possible loss above our accrual for our portfolio of

home equity loans/lines sold was not material. This estimate

of potential additional losses in excess of our liability is based

on assumed higher repurchase claims and lower claim

rescissions than our current assumptions.

Reinsurance Agreements

We have two wholly-owned captive insurance subsidiaries

which provide reinsurance to third-party insurers related to

insurance sold to our customers. These subsidiaries enter into

various types of reinsurance agreements with third-party

insurers where the subsidiary assumes the risk of loss through

either an excess of loss or quota share agreement up to 100%

reinsurance. In excess of loss agreements, these subsidiaries

assume the risk of loss for an excess layer of coverage up to

specified limits, once a defined first loss percentage is met. In

quota share agreements, the subsidiaries and third-party

insurers share the responsibility for payment of all claims.

These subsidiaries provide reinsurance for accidental death &

dismemberment, credit life, accident & health, lender placed

hazard, and borrower and lender paid mortgage insurance with

an aggregate maximum exposure up to the specified limits for

all reinsurance contracts as follows:

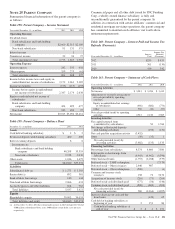

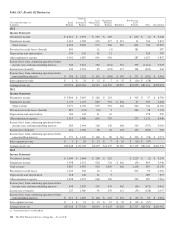

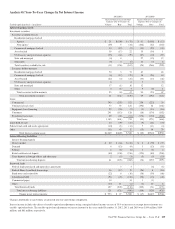

Table 156: Reinsurance Agreements Exposure (a)

In millions

December 31

2012

December 31

2011

Accidental Death & Dismemberment $2,049 $2,255

Credit Life, Accident & Health 795 951

Lender Placed Hazard (b) 2,774 2,899

Borrower and Lender Paid Mortgage

Insurance 228 327

Maximum Exposure $5,846 $6,432

Percentage of reinsurance agreements:

Excess of Loss – Mortgage Insurance 3% 4%

Quota Share 97% 96%

Maximum Exposure to Quota Share

Agreements with 100% Reinsurance $ 794 $ 950

(a) Reinsurance agreements exposure balances represent estimates based on availability

of financial information from insurance carriers.

(b) Through the purchase of catastrophe reinsurance connected to the Lender Placed

Hazard Exposure, should a catastrophic event occur, PNC will benefit from this

reinsurance. No credit for the catastrophe reinsurance protection is applied to the

aggregate exposure figure.

A rollforward of the reinsurance reserves for probable losses

for 2012 and 2011 follows:

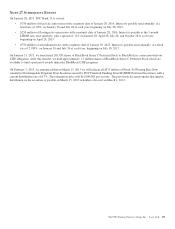

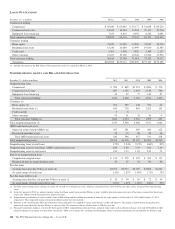

Table 157: Reinsurance Reserves – Rollforward

In millions 2012 2011

January 1 $ 82 $ 150

Paid Losses (66) (109)

Net Provision 45 41

December 31 $ 61 $ 82

There were no changes to the terms of existing agreements,

nor were any new relationships entered into or existing

relationships exited.

There is a reasonable possibility that losses could be more

than or less than the amount reserved due to ongoing

uncertainty in various economic, social and other factors that

could impact the frequency and severity of claims covered by

these reinsurance agreements. At December 31, 2012, the

reasonably possible loss above our accrual was not material.

Repurchase and Resale Agreements

We enter into repurchase and resale agreements where we

transfer investment securities to/from a third party with the

agreement to repurchase/resell those investment securities at a

future date for a specified price. These transactions are

accounted for as collateralized borrowings/financings.

230 The PNC Financial Services Group, Inc. – Form 10-K