PNC Bank 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.dominant form of Tier 1 capital. As a result, regulators are

now emphasizing the Tier 1 common capital ratio in their

evaluation of bank holding company capital levels, although a

formal ratio for this metric is not provided for in current

regulations. We seek to manage our capital consistent with

these regulatory principles, and believe that our December 31,

2012 capital levels were aligned with them.

Dodd-Frank requires the Federal Reserve Board to establish

capital requirements that would, among other things, eliminate

the Tier 1 treatment of trust preferred securities following a

phase-in period expected to begin in 2013. Accordingly, PNC

has redeemed some of its trust preferred securities and will

consider redeeming others on or after their first call date,

based on such considerations as dividend rates, future capital

requirements, capital market conditions and other factors. See

the Capital and Liquidity Actions portion of the Executive

Summary section of this Item 7 for additional information

regarding our April 2012, May 2012, July 2012, and

November 2012 redemptions of trust preferred securities and

hybrid capital securities. See Note 14 Capital Securities of

Subsidiary Trusts and Perpetual Trust Securities in the Notes

To Consolidated Financial Statements in Item 8 of this Report

for additional information on trust preferred securities.

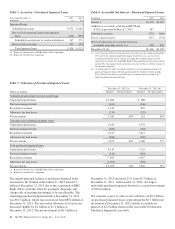

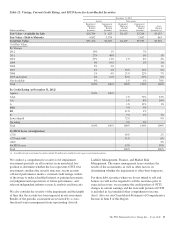

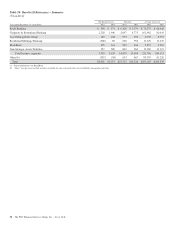

Our Tier 1 common capital ratio was 9.6% at December 31,

2012, compared with 10.3% at December 31, 2011. Our Tier 1

risk-based capital ratio decreased 100 basis points to 11.6% at

December 31, 2012 from 12.6% at December 31, 2011. Our

total risk-based capital ratio declined 110 basis points to

14.7% at December 31, 2012 from 15.8% at December 31,

2011. The decline in these ratios was primarily due to the

RBC Bank (USA) acquisition, which resulted in higher

goodwill and risk-weighted assets, partially offset by retention

of earnings which more than offset organic asset growth. Our

Tier 1 risk-based capital ratio reflected our 2012 capital

actions of issuing approximately $2.0 billion of preferred

stock and redeeming approximately $2.3 billion of trust

preferred securities and hybrid capital securities. Basel I risk-

weighted assets increased $30.1 billion from $230.7 billion at

December 31, 2011 to $260.8 billion at December 31, 2012

due to the RBC Bank (USA) acquisition and organic loan

growth for 2012.

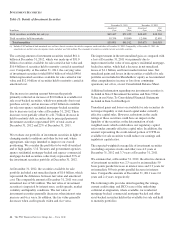

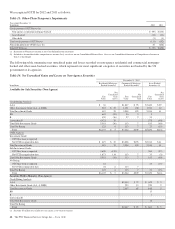

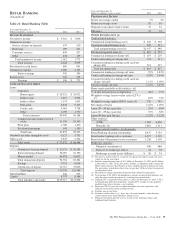

At December 31, 2012, PNC Bank, N.A., our domestic bank

subsidiary, was considered “well capitalized” based on U.S.

regulatory capital ratio requirements under Basel I. To qualify

as “well-capitalized”, regulators currently require banks to

maintain capital ratios of at least 6% for Tier 1 risk-based,

10% for total risk-based, and 5% for leverage. See the

“Supervision and Regulation” section of Item 1 and Note 22

Regulatory Matters in the Notes To Consolidated Financial

Statements in Item 8 of this Report for additional information.

We believe PNC Bank, N.A. will continue to meet these

requirements during 2013.

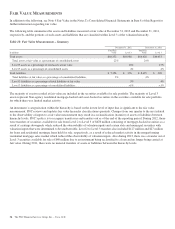

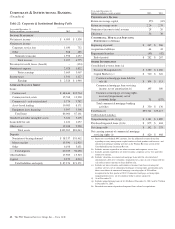

PNC and PNC Bank, N.A. entered the “parallel run”

qualification phase under the Basel II capital framework on

January 1, 2013. The Basel II framework, which was adopted

by the Basel Committee on Banking Supervision in 2004,

seeks to provide more risk-sensitive regulatory capital

calculations and promote enhanced risk management practices

among large, internationally active banking organizations. The

U.S. banking agencies adopted final rules to implement the

Basel II capital framework in December 2007 and in June

2012 requested comment on proposed modifications to these

rules (collectively referred to as the “advanced approaches”).

See Recent Market and Industry Developments in the

Executive Summary section of this Financial Review. Prior to

fully implementing the advanced approaches to calculate risk-

weighted assets, PNC and PNC Bank, N.A. must successfully

complete a “parallel run” qualification phase. This phase must

last at least four consecutive quarters, although, consistent

with the experience of other U.S. banks, we currently

anticipate a multi-year parallel run period.

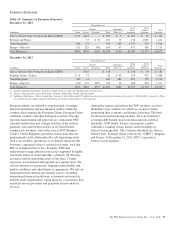

The access to and cost of funding for new business initiatives,

the ability to undertake new business initiatives including

acquisitions, the ability to engage in expanded business

activities, the ability to pay dividends or repurchase shares or

other capital instruments, the level of deposit insurance costs,

and the level and nature of regulatory oversight depend, in

large part, on a financial institution’s capital strength.

We provide additional information regarding enhanced capital

requirements and some of their potential impacts on PNC in

Item 1A Risk Factors of this Report.

52 The PNC Financial Services Group, Inc. – Form 10-K