PNC Bank 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.P

ROVISION

F

OR

C

REDIT

L

OSSES

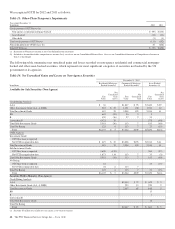

The provision for credit losses totaled $1.0 billion for 2012, a

decrease of $.2 billion, or 14 percent, compared with $1.2

billion for 2011. The decline in the comparison was driven by

overall credit quality improvement.

We currently expect our provision for credit losses in the first

quarter of 2013 to be between $200 and $300 million, as we

expect the benefit of commercial loan reserve releases to be

lower in 2013 compared to 2012.

The Credit Risk Management portion of the Risk Management

section of this Item 7 includes additional information

regarding factors impacting the provision for credit losses. See

also Item 1A Risk Factors and the Cautionary Statement

Regarding Forward-Looking Information section of Item 7 of

this Report.

N

ONINTEREST

E

XPENSE

Noninterest expense was $10.6 billion for 2012 and $9.1

billion for 2011. Noninterest expense for 2012 included

noncash charges of $295 million related to redemption of trust

preferred securities, integration costs of $267 million, $225

million of residential mortgage foreclosure-related expenses,

and a noncash charge of $45 million for residential mortgage

banking goodwill impairment. Noninterest expense for 2011

included $324 million of residential mortgage foreclosure-

related expenses, $198 million of noncash charges related to

redemption of trust preferred securities and $42 million of

integration costs. The increase in noninterest expense in 2012

compared with 2011 also reflected operating expense for the

RBC Bank (USA) acquisition, higher personnel expense,

higher settlements for other litigation and increased expenses

for other real estate owned.

In the first quarter of 2013, we expect noninterest expense to

decrease by at least $300 million compared to noninterest

expense in fourth quarter 2012 of $2.8 billion. This expected

decline is primarily due to our expectations for a significant

reduction in residential mortgage foreclosure-related

compliance expenses, which were $91 million in the fourth

quarter and included the impact of a charge of approximately

$70 million for the early 2013 amendment to our foreclosure

consent orders, and for no anticipated noncash charges related

to redemption of trust preferred securities and goodwill

impairment, and integration costs, which were $70 million,

$45 million and $35 million in the fourth quarter of 2012,

respectively.

For full year 2013, we have increased our continuous

improvement expense savings goal to $700 million, which

represents approximately 7 percent of our noninterest expense

in 2012 and reflects an expected decline in residential

mortgage foreclosure-related compliance expenses. We expect

that amount to be offset by investments in our businesses and

infrastructure, including the full year impact of investing in

the Southeast. However, we are not expecting to incur

integration costs in 2013 and anticipate the charges for any

noncash charges related to redemption of trust preferred

securities to be approximately $60 million or less in 2013.

As a result, we currently expect total noninterest expense for

2013 to decline by mid-single digits on a percentage basis

compared with 2012.

E

FFECTIVE

I

NCOME

T

AX

R

ATE

The effective income tax rate was 23.9% in 2012 compared

with 24.5% in 2011. The effective tax rate is generally lower

than the statutory rate primarily due to tax credits PNC

receives from our investments in low income housing

partnerships and other tax exempt investments.

We expect our 2013 full year effective tax rate to be between

25 to 26 percent, reflecting expected higher pre-tax income.

The PNC Financial Services Group, Inc. – Form 10-K 41