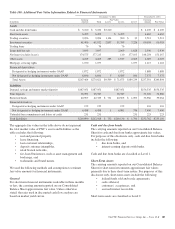

PNC Bank 2012 Annual Report Download - page 194

Download and view the complete annual report

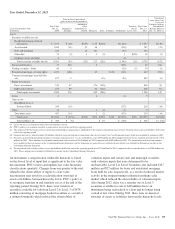

Please find page 194 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.from brokers and investors is heavily relied upon.

Accordingly, based on the significance of unobservable

inputs, these loans are classified as Level 3.

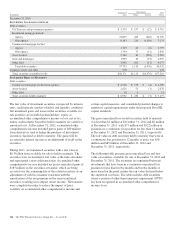

Residential Mortgage Servicing Rights

Residential mortgage servicing rights (MSRs) are carried at

fair value on a recurring basis. Assumptions incorporated into

the residential MSRs valuation model reflect management’s

best estimate of factors that a market participant would use in

valuing the residential MSRs. Although sales of residential

MSRs do occur, residential MSRs do not trade in an active,

open market with readily observable prices so the precise

terms and conditions of sales are not available. As a

benchmark for the reasonableness of its residential MSRs fair

value, PNC obtained opinions of value from independent

parties (“brokers”). These brokers provided a range (+/- 10

bps) based upon their own discounted cash flow calculations

of our portfolio that reflect conditions in the secondary market

and any recently executed servicing transactions. PNC

compares its internally-developed residential MSRs value to

the ranges of values received from the brokers. If our

residential MSRs fair value falls outside of the brokers’

ranges, management will assess whether a valuation

adjustment is warranted. For the periods presented, PNC’s

residential MSRs value did not fall outside of the brokers’

ranges. We consider our residential MSRs value to represent a

reasonable estimate of fair value. Due to the nature of the

valuation inputs, residential MSRs are classified as Level 3.

The significant unobservable inputs used in the fair value

measurement of residential MSRs are constant prepayment

rates and spread over the benchmark curve. Significant

increases (decreases) in prepayment rates and spread over the

benchmark curve would result in lower (higher) fair market

value of residential MSRs.

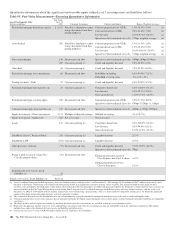

Commercial Mortgage Loans Held for Sale

We account for certain commercial mortgage loans classified

as held for sale at fair value. The election of the fair value

option aligns the accounting for the commercial mortgages

with the related hedges.

We determine the fair value of commercial mortgage loans

held for sale by using a discounted cash flow model. Fair

value is determined using sale valuation assumptions that

management believes a market participant would use in

pricing the loans. When available, valuation assumptions

include observable inputs based on the benchmark LIBOR

interest rate swap curve and whole loan sales. The significant

unobservable input is management’s assumption of the spread

applied to the benchmark rate. The spread over the benchmark

curve includes management’s assumptions of the impact of

credit and liquidity risk. Significant increases (decreases) in

the spread applied to the benchmark would result in a

significantly lower (higher) asset value. The wide range of the

spread over the benchmark curve is due to the varying risk and

underlying property characteristics within our portfolio. Based

on the significance of unobservable inputs, we classified this

portfolio as Level 3.

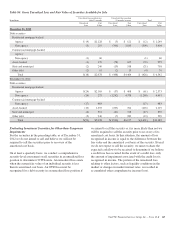

Equity Investments

The valuation of direct and indirect private equity investments

requires significant management judgment due to the absence

of quoted market prices, inherent lack of liquidity and the

long-term nature of such investments. The carrying values of

direct and affiliated partnership interests reflect the expected

exit price and are based on various techniques including

multiples of adjusted earnings of the entity, independent

appraisals, anticipated financing and sale transactions with

third parties, or the pricing used to value the entity in a recent

financing transaction. A multiple of adjusted earnings

calculation is the valuation technique utilized most frequently

and the multiple of earnings is the primary and most

significant unobservable input used in such calculation. The

multiple of earnings is utilized in conjunction with portfolio

company financial results and our ownership interest in

portfolio company securities to determine PNC’s interest in

the enterprise value of the portfolio company. Significant

decreases (increases) in the multiple of earnings could result

in a significantly lower (higher) fair value measurement. The

magnitude of the change in fair value is dependent on the

significance of the change in the multiple of earnings and the

significance of portfolio company adjusted earnings.

Valuation inputs or analysis are supported by portfolio

company or market documentation. Due to the size, private

and unique nature of each portfolio company, lack of liquidity

and the long-term nature of investments, relevant

benchmarking is not always feasible. A valuation committee

reviews the portfolio company valuations on a quarterly basis

and oversight is provided by senior management of the

business.

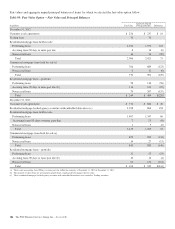

We value indirect investments in private equity funds based

on net asset value as provided in the financial statements that

we receive from their managers. Due to the time lag in our

receipt of the financial information and based on a review of

investments and valuation techniques applied, adjustments to

the manager-provided value are made when available recent

portfolio company information or market information

indicates a significant change in value from that provided by

the manager of the fund. These investments are classified as

Level 3.

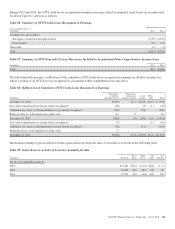

Customer Resale Agreements

We have elected to account for structured resale agreements,

which are economically hedged using free-standing financial

derivatives, at fair value. The fair value for structured resale

agreements is determined using a model that includes

observable market data such as interest rates as inputs.

Readily observable market inputs to this model can be

validated to external sources, including yield curves, implied

volatility or other market-related data. These instruments are

classified as Level 2.

The PNC Financial Services Group, Inc. – Form 10-K 175