PNC Bank 2012 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In early 2013, PNC and PNC Bank, along with

twelve other residential mortgage servicers,

reached agreements with the OCC and the

Federal Reserve to amend these consent orders.

Pursuant to the amended consent orders, in

order to accelerate the remediation process,

PNC agreed to make a payment of

approximately $70 million for distribution to

potentially affected borrowers in the review

population and to provide approximately

$111 million in additional loss mitigation or

other foreclosure prevention relief, which may

be satisfied pursuant to the amended consent

orders by a variety of borrower relief actions or

by additional cash payments or resource

commitments to borrower counseling or

education. Fulfillment of these commitments

will satisfy all of PNC’s and PNC Bank’s

obligations under the consent orders in

connection with the independent foreclosure

review. We do not expect any additional

financial charges related to the amendment to

the consent orders to be material. PNC’s and

PNC Bank’s obligations to comply with the

remaining provisions of the consent orders

remain.

• On February 9, 2012, the Department of Justice,

other federal regulators and 49 state attorneys general

announced agreements with the five largest mortgage

servicers. Written agreements were filed with the

U.S. District Court for the Southern District of New

York in March 2012. Under these agreements, the

mortgage servicers will make cash payments to

federal and state governments, provide various forms

of financial relief to borrowers, and implement new

mortgage servicing standards. These governmental

authorities are continuing their review of, and have

engaged in discussions with, other mortgage

servicers, including PNC, that were subject to the

interagency horizontal review, which could result in

the imposition of substantial payments and other

forms of relief (similar to that agreed to by the five

largest servicers) on some or all of these mortgage

servicers, including PNC. Whether and to what

extent any such relief may be imposed on PNC and

other smaller servicers is not yet known.

• PNC has received subpoenas from the U.S.

Attorney’s Office for the Southern District of New

York concerning National City Bank’s lending

practices in connection with loans insured by the

Federal Housing Administration (FHA) as well as

certain non-FHA-insured loan origination, sale and

securitization practices. The U.S. Attorney’s Office

inquiry is in its early stage and PNC is cooperating

with the investigation.

• The SEC previously commenced investigations of

activities of National City prior to its acquisition by PNC.

The SEC has requested, and we have provided to the

SEC, documents concerning, among other things,

National City’s capital-raising activities, loan

underwriting experience, allowance for loan losses,

marketing practices, dividends, bank regulatory matters

and the sale of First Franklin Financial Corporation. In

February 2013, the SEC staff informed PNC that it had

completed its investigation and does not intend to

recommend enforcement action.

Our practice is to cooperate fully with regulatory and

governmental investigations, audits and other inquiries,

including those described in this Note 23.

Other

In addition to the proceedings or other matters described

above, PNC and persons to whom we may have

indemnification obligations, in the normal course of business,

are subject to various other pending and threatened legal

proceedings in which claims for monetary damages and other

relief are asserted. We do not anticipate, at the present time,

that the ultimate aggregate liability, if any, arising out of such

other legal proceedings will have a material adverse effect on

our financial position. However, we cannot now determine

whether or not any claims asserted against us or others to

whom we may have indemnification obligations, whether in

the proceedings or other matters described above or otherwise,

will have a material adverse effect on our results of operations

in any future reporting period, which will depend on, among

other things, the amount of the loss resulting from the claim

and the amount of income otherwise reported for the reporting

period.

See Note 24 Commitments and Guarantees for additional

information regarding the Visa indemnification and our other

obligations to provide indemnification, including to current

and former officers, directors, employees and agents of PNC

and companies we have acquired, including National City.

N

OTE

24 C

OMMITMENTS AND

G

UARANTEES

E

QUITY

F

UNDING AND

O

THER

C

OMMITMENTS

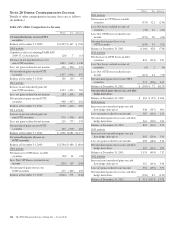

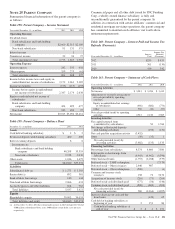

Our unfunded commitments at December 31, 2012 included

private equity investments of $182 million, and other

investments of $3 million.

S

TANDBY

L

ETTERS OF

C

REDIT

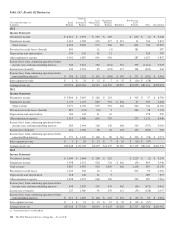

We issue standby letters of credit and have risk participations

in standby letters of credit issued by other financial

institutions, in each case to support obligations of our

customers to third parties, such as insurance requirements and

the facilitation of transactions involving capital markets

product execution. Net outstanding standby letters of credit

and internal credit ratings were as follows:

226 The PNC Financial Services Group, Inc. – Form 10-K