PNC Bank 2012 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and will be provided in the first quarter 2013. We adopted

ASU 2011-11 on January 1, 2013 for our derivatives that we

offset in accordance with ASC 815-10-45 and for our

repurchase/resale arrangements under enforceable master

netting arrangements, which we do not currently offset on our

Consolidated Balance Sheet. The new guidance did not

change the accounting for these arrangements or require them

to be offset and thus had no impact on our statement of

financial position.

In December 2011, the FASB also finalized ASU 2011-10,

Property, Plant, and Equipment (Topic 360) – Derecognition

of in Substance Real Estate – a Scope Clarification (a

consensus of the FASB Emerging Issues Task Force). This

ASU clarified that the guidance in ASC 360-20 applies to a

parent that ceases to have a controlling financial interest (as

described in ASC 810-10) in a subsidiary that is in substance

real estate as a result of default on the subsidiary’s

nonrecourse debt. The amendments within this update should

be applied on a prospective basis and are effective for fiscal

years, and interim periods within those years, beginning on or

after June 15, 2012. We adopted ASU 2011-10 on January 1,

2013. There was no material impact to our results of

operations or financial position upon adoption of ASU 2011-

10 on January 1, 2013.

In September 2011, the FASB issued ASU 2011-08,

Intangibles – Goodwill and Other (Topic 350) : Testing

Goodwill for Impairment. The ASU permits an entity to first

assess qualitative factors to determine whether it is more

likely than not that the fair value of a reporting unit is less

than its carrying amount. If an entity qualitatively determines

the fair value of a reporting unit is greater than its carrying

amount, it is not required to perform the Step 1 quantitative

goodwill impairment test for the reporting unit. ASU 2011-08

is effective for annual and interim goodwill impairment tests

performed for fiscal years beginning after December 15, 2011.

We did not utilize this guidance in our 2012 annual goodwill

impairment test. The adoption of this ASU did not have a

financial impact since the method for determining the amount

of impairment (Step 2) remained unchanged.

In June 2011, the FASB issued ASU 2011-05 Comprehensive

Income (Topic 220): Presentation of Comprehensive Income.

This ASU required an entity to present each component of net

income along with total net income, each component of other

comprehensive income along with total other comprehensive

income, and a total amount for comprehensive income either

in a single continuous statement of comprehensive income or

in two separate but consecutive statements. In both

presentation options, the tax effect for each component must

be presented in the statement in which other comprehensive

income is presented or disclosed in the notes to the financial

statements. This ASU did not change the items that must be

reported in other comprehensive income or when an item of

other comprehensive income must be reclassified to net

income. In December 2011, the FASB issued ASU 2011-12,

Comprehensive Income (Topic 220): Deferral of the Effective

Date for Amendments to the Presentation of Reclassifications

of Items Out of Accumulated Other Comprehensive Income in

ASU 2011-05. This ASU deferred those changes in ASU

2011-05 that relate to the presentation of reclassification

adjustments pending further Board deliberation. We adopted

ASU 2011-05 and ASU 2011-12 on January 1, 2012. Our

2012 financial statements and disclosures continue to report

reclassifications out of accumulated other comprehensive

income consistent with the presentation requirements in effect

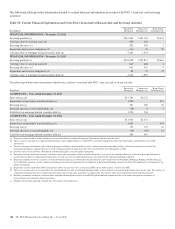

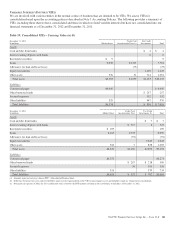

before ASU 2011-05. See the Consolidated Statement of

Comprehensive Income, Consolidated Statement of Changes

in Equity and Note 20 Other Comprehensive Income for

additional information. In February 2013, the FASB issued

ASU 2013-02, Comprehensive Income (Topic 220): Reporting

of Amounts Reclassified Out of Accumulated Other

Comprehensive Income. This ASU requires companies to

present information about reclassification adjustments from

accumulated other comprehensive income in a single note or

on the face of the financial statements. Additionally,

companies are to disclose by component reclassifications out

of accumulated other comprehensive income and their effects

on the respective line items on net income and other

disclosures currently required under U.S. GAAP. ASU 2013-

02 is effective for annual and interim reporting periods

beginning after December 15, 2012 and we will present these

disclosures in the first quarter of 2013.

In May 2011, the FASB issued ASU 2011-04 Fair Value

Measurement (Topic 820), Amendments to Achieve Common

Fair Value Measurement and Disclosure Requirements in U.S.

GAAP and International Financial Reporting Standards

(IFRS). This ASU provides guidance to clarify the concept of

highest and best use valuation premise, how a principal

market is determined, and the application of the fair value

measurement for instruments with offsetting market or

counterparty credit risks. It also extends the prohibition on

blockage factors to all fair value hierarchy levels. This ASU

required additional disclosures for the following:

(i) quantitative information about the significant unobservable

inputs used in all Level 3 financial instruments, (ii) the

valuation processes used by the reporting entity as well as a

narrative description of the sensitivity of the fair value

measurement to changes in unobservable inputs, (iii) a

reporting entity’s use of a nonfinancial asset in a way that

differs from the asset’s highest and best use if the fair value of

the asset is reported, (iv) the categorization by level of the fair

value hierarchy for items that are not measured at fair value in

financial statements, and (v) any transfers between Level 1

and 2 and the reason for those transfers. The adoption of this

new guidance did not have a material effect on our results of

operations or financial position. We adopted ASU 2011-04 on

January 1, 2012. See Note 9 Fair Value for additional

information.

136 The PNC Financial Services Group, Inc. – Form 10-K