PNC Bank 2012 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

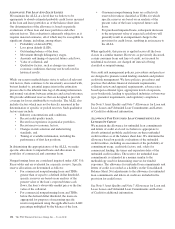

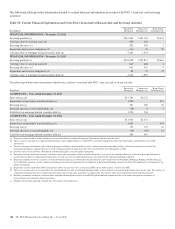

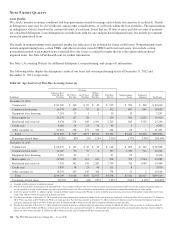

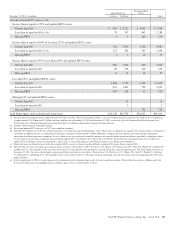

Table 60: Assets and Liabilities of Consolidated VIEs (a)

In millions

Aggregate

Assets

Aggregate

Liabilities

December 31, 2012

Market Street $7,796 $7,796

Credit Card Securitization Trust 1,782

Tax Credit Investments 2,162 853

December 31, 2011

Market Street $5,490 $5,491

Credit Card Securitization Trust 2,175 494

Tax Credit Investments 2,503 723

(a) Amounts in this table differ from total assets and liabilities in the preceding “Consolidated VIEs—Carrying Value” table due to the elimination of intercompany assets and liabilities in

the preceding table.

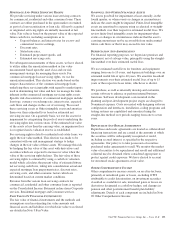

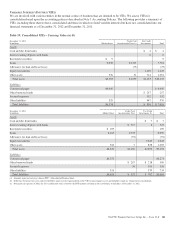

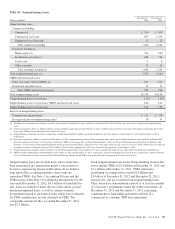

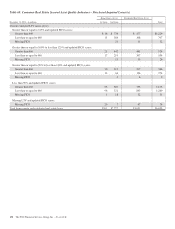

Table 61: Non-Consolidated VIEs

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC

Risk of

Loss

Carrying

Value of

Assets

Carrying

Value of

Liabilities

December 31, 2012

Commercial Mortgage-Backed Securitizations (a) $ 72,370 $ 72,370 $1,829 $1,829(c)

Residential Mortgage-Backed Securitizations (a) 42,719 42,719 5,456 5,456(c) $ 90(e)

Tax Credit Investments and Other (b) 5,960 2,101 1,283 1,283(d) 623(e)

Total $121,049 $117,190 $8,568 $8,568 $713

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC

Risk of

Loss

Carrying

Value of

Assets

Carrying

Value of

Liabilities

December 31, 2011

Commercial Mortgage-Backed Securitizations (a) $ 75,961 $ 75,961 $2,079 $2,079(c)

Residential Mortgage-Backed Securitizations (a) 44,315 44,315 4,667 4,667(c) $ 99(e)

Tax Credit Investments and Other (b) 5,395 2,384 837 837(d) 352(e)

Total $125,671 $122,660 $7,583 $7,583 $451

(a) Amounts reflect involvement with securitization SPEs where PNC transferred to and/or services loans for a SPE and we hold securities issued by that SPE. Asset amounts equal

outstanding liability amounts of the SPEs due to limited availability of SPE financial information. We also invest in other mortgage and asset-backed securities issued by third-party

VIEs with which we have no continuing involvement. Further information on these securities is included in Note 8 Investment Securities and values disclosed represent our maximum

exposure to loss for those securities’ holdings.

(b) Aggregate assets and aggregate liabilities are based on limited availability of financial information associated with certain acquired partnerships.

(c) Included in Trading securities, Investment securities, Other intangible assets, and Other assets on our Consolidated Balance Sheet.

(d) Included in Equity investments on our Consolidated Balance Sheet.

(e) Included in Other liabilities on our Consolidated Balance Sheet.

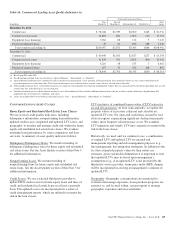

M

ARKET

S

TREET

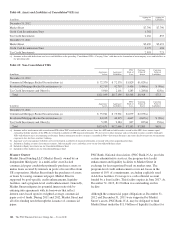

Market Street Funding LLC (Market Street), owned by an

independent third-party, is a multi-seller asset-backed

commercial paper conduit that primarily purchases assets or

makes loans secured by interests in pools of receivables from

US corporations. Market Street funds the purchases of assets

or loans by issuing commercial paper. Market Street is

supported by pool-specific credit enhancements, liquidity

facilities, and a program-level credit enhancement. Generally,

Market Street mitigates its potential interest rate risk by

entering into agreements with its borrowers that reflect

interest rates based upon its weighted-average commercial

paper cost of funds. During 2011 and 2012, Market Street met

all of its funding needs through the issuance of commercial

paper.

PNC Bank, National Association, (PNC Bank, N.A.) provides

certain administrative services, the program-level credit

enhancement and liquidity facilities to Market Street in

exchange for fees negotiated based on market rates. The

program-level credit enhancement covers net losses in the

amount of 10% of commitments, excluding explicitly rated

AAA/Aaa facilities. Coverage is a cash collateral account

funded by a loan facility. This facility expires in June 2017. At

December 31, 2012, $1.2 billion was outstanding on this

facility.

Although the commercial paper obligations at December 31,

2012 and December 31, 2011 were supported by Market

Street’s assets, PNC Bank, N.A. may be obligated to fund

Market Street under the $11.9 billion of liquidity facilities for

142 The PNC Financial Services Group, Inc. – Form 10-K