PNC Bank 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

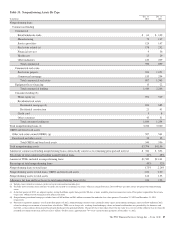

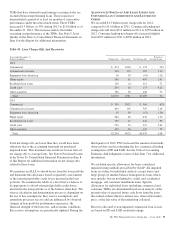

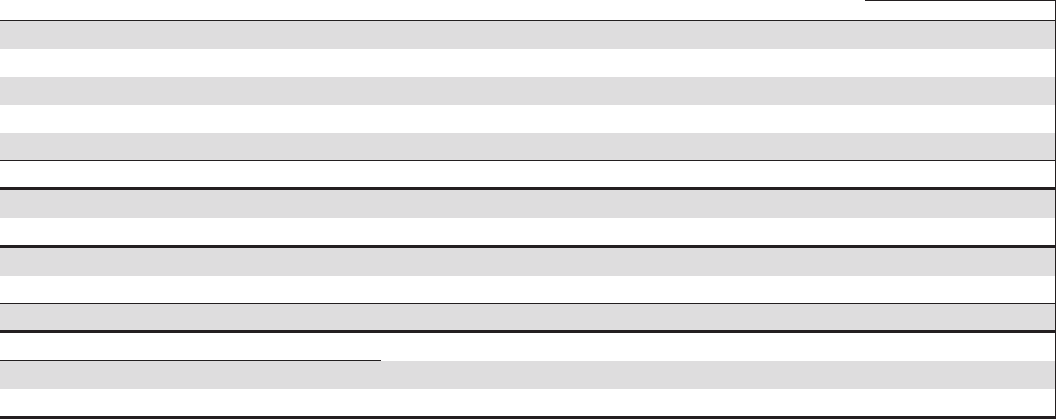

Table 44: Allowance for Loan and Lease Losses

Dollars in millions 2012 2011

January 1 $ 4,347 $ 4,887

Total net charge-offs (1,289) (1,639)

Provision for credit losses 987 1,152

Net change in allowance for unfunded loan commitments and letters of credit (10) (52)

Other 1 (1)

December 31 $ 4,036 $ 4,347

Net charge-offs to average loans (for the year ended) .73% 1.08%

Allowance for loan and lease losses to total loans 2.17 2.73

Commercial lending net charge-offs $ (359) $ (712)

Consumer lending net charge-offs (930) (927)

Total net charge-offs $(1,289) $(1,639)

Net charge-offs to average loans (for the year ended)

Commercial lending .35% .86%

Consumer lending 1.24 1.33

As further described in the Consolidated Income Statement

Review section of this Item 7, the provision for credit losses

totaled $1.0 billion for 2012 compared to $1.2 billion for

2011. For 2012, the provision for commercial lending credit

losses declined by $39 million or 22% from 2011. Similarly,

the provision for consumer lending credit losses decreased

$126 million or 13% from 2011.

At December 31, 2012, total ALLL to total nonperforming

loans was 124%. The comparable amount for December 31,

2011 was 122%. These ratios are 79% and 84%, respectively,

when excluding the $1.5 billion and $1.4 billion, respectively,

of allowance at December 31, 2012 and December 31, 2011

allocated to consumer loans and lines of credit not secured by

residential real estate and purchased impaired loans. We have

excluded consumer loans and lines of credit not secured by

real estate as they are charged off after 120 to 180 days past

due and not placed on nonperforming status. Additionally, we

have excluded purchased impaired loans as they are

considered performing regardless of their delinquency status

as interest is accreted based on our estimate of expected cash

flows and additional allowance is recorded when these cash

flows are below recorded investment. See Table 33:

Nonperforming Assets By Type within this Credit Risk

Management section for additional information.

The ALLL balance increases or decreases across periods in

relation to fluctuating risk factors, including asset quality

trends, charge-offs and changes in aggregate portfolio

balances. During 2012, improving asset quality trends,

including, but not limited to, delinquency status, improving

economic conditions, realization of previously estimated

losses through charge-offs and overall portfolio growth,

combined to result in reducing the estimated credit losses

within the portfolio. As a result, the ALLL balance declined

$311 million, or 7%, to $4.0 billion during the year ended

December 31, 2012.

See Note 7 Allowances for Loan and Lease Losses and

Unfunded Loan Commitments and Letters of Credit and Note

6 Purchased Loans in the Notes To Consolidated Financial

Statements in Item 8 of this Report regarding changes in the

ALLL and in the allowance for unfunded loan commitments

and letters of credit.

C

REDIT

D

EFAULT

S

WAPS

From a credit risk management perspective, we use credit

default swaps (CDS) as a tool to manage risk concentrations

in the credit portfolio. That risk management could come from

protection purchased or sold in the form of single name or

index products. When we buy loss protection by purchasing a

CDS, we pay a fee to the seller, or CDS counterparty, in return

for the right to receive a payment if a specified credit event

occurs for a particular obligor or reference entity.

When we sell protection, we receive a CDS premium from the

buyer in return for PNC’s obligation to pay the buyer if a

specified credit event occurs for a particular obligor or

reference entity.

We evaluate the counterparty credit worthiness for all our

CDS activities. Counterparty creditworthiness is approved

based on a review of credit quality in accordance with our

traditional credit quality standards and credit policies. The

credit risk of our counterparties is monitored in the normal

course of business. In addition, all counterparty credit lines are

subject to collateral thresholds and exposures above these

thresholds are secured.

CDSs are included in the “Derivatives not designated as

hedging instruments under GAAP” section of Table 54:

Financial Derivatives Summary in the Financial Derivatives

section of this Risk Management discussion.

The PNC Financial Services Group, Inc. – Form 10-K 97