PNC Bank 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In April 2011, the FASB issued ASU 2011-03 Transfers and

Servicing (Topic 860), Reconsideration of Effective Control

for Repurchase Agreements. This ASU removes from the

assessment of effective control (i) the criterion requiring the

transferor to have the ability to repurchase or redeem the

financial assets on substantially the agreed terms, even in the

event of default by the transferee, and (ii) the collateral

maintenance implementation guidance related to that criterion.

Other criteria applicable to the assessment of effective control

have not been changed by this ASU. The adoption of ASU

2011-03 on January 1, 2012 did not have a material effect on

our results of operations or financial position.

N

OTE

2A

CQUISITION AND

D

IVESTITURE

A

CTIVITY

RBC B

ANK

(USA) A

CQUISITION

On March 2, 2012, PNC acquired 100% of the issued and

outstanding common stock of RBC Bank (USA), the US retail

banking subsidiary of Royal Bank of Canada. As part of the

acquisition, PNC also purchased a credit card portfolio from

RBC Bank (Georgia), National Association. PNC paid $3.6

billion in cash as consideration for the acquisition of both

RBC Bank (USA) and the credit card portfolio. The

transactions added approximately $18.1 billion of deposits and

$14.5 billion of loans to PNC’s Consolidated Balance Sheet.

RBC Bank (USA), based in Raleigh, North Carolina, operated

more than 400 branches in North Carolina, Florida, Alabama,

Georgia, Virginia and South Carolina. The primary reasons for

the acquisition of RBC were to enhance shareholder value, to

improve PNC’s competitive position in the financial services

industry, and to further expand PNC’s existing branch

network in the states where it currently operates as well as

expanding into new markets.

The RBC Bank (USA) transactions noted above were

accounted for using the acquisition method of accounting and,

as such, assets acquired, liabilities assumed and consideration

exchanged were recorded at their estimated fair value on the

acquisition date. All acquired loans were also recorded at fair

value. No allowance for loan losses was carried over and no

allowance was created at acquisition. In connection with the

acquisition, the assets acquired, and the liabilities assumed,

were recorded at fair value on the date of acquisition, as

summarized in the following table:

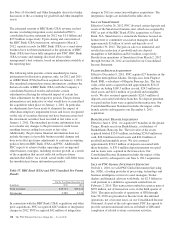

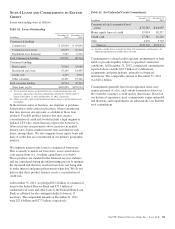

Table 55: RBC Bank (USA) Purchase Accounting (a) (b)

In millions

Purchase price as of March 2, 2012 $ 3,599

Recognized amounts of identifiable assets acquired

and (liabilities assumed), at fair value (c)

Cash due from banks 305

Trading assets, interest-earning deposits with banks,

and other short-term investments 1,493

Loans held for sale 97

Investment securities 2,349

Net loans 14,512

Other intangible assets 180

Equity investments 35

Other assets 3,383

Deposits (18,094)

Other borrowed funds (1,321)

Other liabilities (290)

Total fair value of identifiable net assets 2,649

Goodwill $ 950

(a) The table above has been updated to reflect certain immaterial adjustments,

including final purchase price settlement.

(b) These amounts include assets and deposits related to Smartstreet, which was sold

effective October 26, 2012.

(c) These items are considered as non-cash activity for the Consolidated Statement of

Cash Flows.

In many cases the determination of estimated fair values

required management to make certain estimates about

discount rates, future expected cash flows, market conditions

and other future events that are highly subjective in nature.

The most significant of these determinations related to the fair

valuation of acquired loans. See Note 6 Purchased Loans for

further discussion of the accounting for purchased impaired

and purchased non-impaired loans, including the

determination of fair value for acquired loans.

The amount of goodwill recorded reflects the increased market

share and related synergies that are expected to result from the

acquisition, and represents the excess purchase price over the

estimated fair value of the net assets acquired by PNC. The

goodwill was assigned primarily to PNC’s Retail Banking and

Corporate & Institutional Banking segments, and is not

deductible for income tax purposes. Other intangible assets

acquired, as of March 2, 2012 consisted of the following:

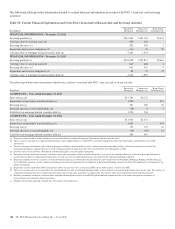

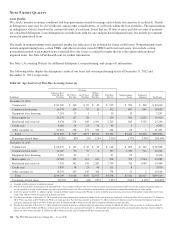

Table 56: RBC Bank (USA) Intangible Assets

As of March 2, 2012

Intangible Assets (in millions)

Fair

Value

Weighted

Life

Amortization

Method

Residential mortgage servicing

rights $ 16 68 months (a)

Core deposits 164 144 months Accelerated

Total $180

(a) Intangible asset accounted for at fair value.

The PNC Financial Services Group, Inc. – Form 10-K 137