PNC Bank 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Parent Company Liquidity – Sources

The principal source of parent company liquidity is the

dividends it receives from its subsidiary bank, which may be

impacted by the following:

• Bank-level capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

The amount available for dividend payments by PNC Bank,

N.A. to the parent company without prior regulatory approval

was approximately $1.5 billion at December 31, 2012. There

are statutory and regulatory limitations on the ability of

national banks to pay dividends or make other capital

distributions or to extend credit to the parent company or its

non-bank subsidiaries. See Note 22 Regulatory Matters in the

Notes To Consolidated Financial Statements in Item 8 of this

Report for a further discussion of these limitations. Dividends

may also be impacted by the bank’s capital needs and by

contractual restrictions. We provide additional information on

certain contractual restrictions under the “Trust Preferred

Securities” section of the Off-Balance Sheet Arrangements

And Variable Interest Entities section of this Item 7 and in

Note 14 Capital Securities of Subsidiary Trusts and Perpetual

Trust Securities in the Notes To Consolidated Financial

Statements in Item 8 of this Report.

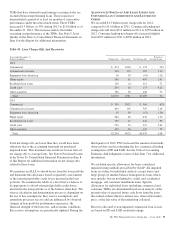

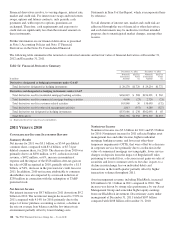

In addition to dividends from PNC Bank, N.A., other sources

of parent company liquidity include cash and investments, as

well as dividends and loan repayments from other subsidiaries

and dividends or distributions from equity investments. As of

December 31, 2012, the parent company had approximately

$3.4 billion in funds available from its cash and investments.

We can also generate liquidity for the parent company and

PNC’s non-bank subsidiaries through the issuance of debt

securities and equity securities, including certain capital

securities, in public or private markets and commercial paper.

We have an effective shelf registration statement pursuant to

which we can issue additional debt, equity and other capital

instruments. Total senior and subordinated debt and hybrid

capital instruments decreased to $11.5 billion at December 31,

2012 from $16.0 billion at December 31, 2011 primarily due

to $4.0 billion in maturities and $2.3 billion in redemptions

partially offset by $1.5 billion in new borrowings.

During 2012 we issued the following securities under our

shelf registration statement:

• $1.0 billion of senior notes issued March 8, 2012 and

due March 8, 2022. Interest is paid semi-annually at a

fixed rate of 3.30%. The offering resulted in gross

proceeds to us, before offering related expenses, of

$990 million,

• Sixty million depositary shares, each representing a

1/4,000th interest in a share of our Fixed-to-Floating

Rate Non-Cumulative Perpetual Preferred Stock,

Series P, issued April 24, 2012, resulting in gross

proceeds to us, before commissions and expenses, of

$1.5 billion,

• Eighteen million depositary shares, each representing

a 1/4,000th interest in a share of our 5.375% Non-

Cumulative Perpetual Preferred Stock, Series Q,

issued September 21, 2012, resulting in gross

proceeds to us, before commissions and expenses, of

$450 million. On October 9, 2012, pursuant to the

underwriting agreement for this offering, we issued

an additional 1.2 million depositary shares in

satisfaction of an option granted to the underwriters

in the agreement to cover over-allotments, resulting

in additional gross proceeds of $30 million, and

• On November 9, 2012, PNC issued $500.1 million of

its parent company Senior Notes due November 9,

2022 (the “Senior Notes”), which were sold in a

secondary public offering made in connection with the

remarketing of PNC’s Remarketable 8.729% Junior

Subordinated Notes due 2043 (the “Subordinated

Notes”) owned by the National City Preferred Capital

Trust I (the “Trust”). In the remarketing, the Trust sold

the Subordinated Notes and PNC exchanged with the

purchasers of the Subordinated Notes the Senior

Notes. The Senior Notes were then sold by the

purchasers in the secondary public offering. The

Senior Notes bore interest at 8.729% from and

including June 10, 2012, to but excluding November 9,

2012, and thereafter bear interest at 2.854% per

annum. The proceeds of the remarketing were used by

the Trust to purchase $500.1 million of PNC’s Non-

Cumulative Perpetual Preferred Stock, Series M (the

“Preferred Stock”) on December 10, 2012. PNC

redeemed all of the Preferred Stock from the Trust

immediately upon its issuance, and the Trust in turn

redeemed all $500.0 million outstanding of its 12%

Fixed-to-Floating Rate Normal APEX and $.1 million

Common Securities of the Trust. After the closing of

these transactions, including the redemption of the

Normal APEX, only the Senior Notes due

November 9, 2022 remain outstanding.

The parent company, through its subsidiary PNC Funding

Corp, has the ability to offer up to $3.0 billion of commercial

paper to provide additional liquidity. As of December 31,

2012, there were no issuances outstanding under this program.

Note 19 Equity in the Notes To Consolidated Financial

Statements in Item 8 of this Report describes our February

2010 redemption of all 75,792 shares of our Fixed Rate

Cumulative Perpetual Preferred Shares, Series N (Series N

Preferred Stock) that had been issued on December 31, 2008

to the US Treasury under the Troubled Asset Relief Program

(TARP) Capital Purchase Program, the acceleration of the

accretion of the remaining issuance discount on the Series N

Preferred Stock in the first quarter of 2010 (and a

corresponding reduction in retained earnings of $250 million

102 The PNC Financial Services Group, Inc. – Form 10-K