PNC Bank 2012 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

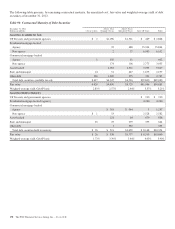

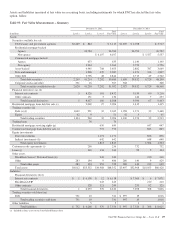

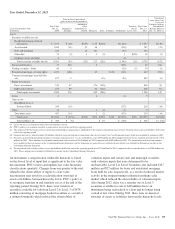

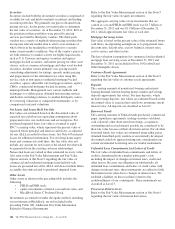

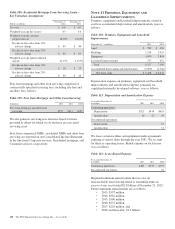

Quantitative information about the significant unobservable inputs within Level 3 recurring assets and liabilities follows.

Table 95: Fair Value Measurement—Recurring Quantitative Information

Level 3 Instruments Only

Dollars in millions

Fair Value

Dec. 31

2012 Valuation Techniques Unobservable Inputs Range (Weighted Average)

Residential mortgage-backed non-agency $ 6,107 Priced by a third-party vendor

using a discounted cash flow

pricing model (a)

Constant prepayment rate (CPR) 1.0%-30.0% (5.0%) (a)

Constant default rate (CDR) 0.0%-24.0% (7.0%) (a)

Loss Severity 10.0%-95.0% (52.0%) (a)

Spread over the benchmark curve (b) 315bps weighted average (a)

Asset-backed 708 Priced by a third-party vendor

using a discounted cash flow

pricing model (a)

Constant prepayment rate (CPR) 1.0%-11.0% (3.0%) (a)

Constant default rate (CDR) 1.0%-25.0% (9.0%) (a)

Loss Severity 10.0%-100.0% (70.0%) (a)

Spread over the benchmark curve (b) 511bps weighted average (a)

State and municipal 130 Discounted cash flow Spread over the benchmark curve (b) 100bps-280bps (119bps)

209 Consensus pricing (c) Credit and Liquidity discount 0.0%-30.0% (8.0%)

Other debt 48 Consensus pricing (c) Credit and Liquidity discount 7.0%-95.0% (86.0%)

Residential mortgage loan commitments 85 Discounted cash flow Probability of funding 8.5%-99.0% (71.1%)

Embedded servicing value .5%-1.2% (.9%)

Trading securities – Debt 32 Consensus pricing (c) Credit and Liquidity discount 8.0%-20.0% (12.0%)

Residential mortgage loans held for sale 27 Consensus pricing (c) Cumulative default rate 2.6%-100.0% (76.1%)

Loss Severity 0.0%-92.7% (55.8%)

Gross discount rate 14.0%-15.3% (14.9%)

Residential mortgage servicing rights 650 Discounted cash flow Constant prepayment rate (CPR) 3.9%-57.3% (18.8%)

Spread over the benchmark curve (b) 939bps-1,929bps (1,115bps)

Commercial mortgage loans held for sale 772 Discounted cash flow Spread over the benchmark curve (b) 485bps-4,155bps (999bps)

Equity investments – Direct investments 1,171 Multiple of adjusted earnings Multiple of earnings 4.5-10.0 (7.1)

Equity investments – Indirect (d) 642 Net asset value Net asset value

Loans 127 Consensus pricing (c) Cumulative default rate 2.6%-100.0% (76.3%)

Loss Severity 0.0%-99.4% (61.1%)

Gross discount rate 12.0%-12.5% (12.2%)

BlackRock Series C Preferred Stock 243 Consensus pricing (c) Liquidity discount 22.5%

BlackRock LTIP (243) Consensus pricing (c) Liquidity discount 22.5%

Other derivative contracts (72) Discounted cash flow Credit and Liquidity discount 37.0%-99.0% (46.0%)

Spread over the benchmark curve (b) 79bps

Swaps related to sales of certain Visa

Class B common shares

(43) Discounted cash flow Estimated conversion factor of

Class B shares into Class A shares 41.5%

Estimated growth rate of Visa

Class A share price 12.6%

Insignificant Level 3 assets, net of

liabilities (e) 19

Total Level 3 assets, net of liabilities (f) $10,612

(a) Level 3 residential mortgage-backed non-agency and asset-backed securities with fair values as of December 31, 2012 totaling $5,363 million and $677 million, respectively, were

priced by a third-party vendor using a discounted cash flow pricing model, that incorporates consensus pricing, where available. The significant unobservable inputs for these

securities were provided by the third-party vendor and are disclosed in the table. Our procedures to validate the prices provided by the third-party vendor related to these securities are

discussed further in the Fair Value Measurement section of this Note 9. Certain Level 3 residential mortgage-backed non-agency and asset-backed securities with fair value as of

December 31, 2012 of $744 million and $31 million, respectively, were valued using a pricing source, such as a dealer quote or comparable security price, for which the significant

unobservable inputs used to determine the price were not reasonably available.

(b) The assumed yield spread over the benchmark curve for each instrument is generally intended to incorporate non-interest-rate risks such as credit and liquidity risks.

(c) Consensus pricing refers to fair value estimates that are generally internally developed using information such as dealer quotes or other third-party provided valuations or comparable

asset prices.

(d) The range on these indirect equity investments has not been disclosed since these investments are recorded at their net asset redemption values.

(e) Represents the aggregate amount of Level 3 assets and liabilities measured at fair value on a recurring basis that are individually and in the aggregate insignificant. The amount

includes loans and certain financial derivative assets and liabilities and other assets.

(f) Consists of total Level 3 assets of $10,988 million and total Level 3 liabilities of $376 million.

180 The PNC Financial Services Group, Inc. – Form 10-K