PNC Bank 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

E

UROPEAN

E

XPOSURE

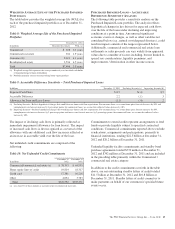

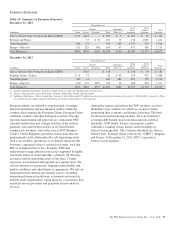

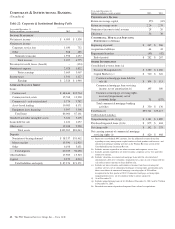

Table 19: Summary of European Exposure

December 31, 2012 Direct Exposure

Total

Exposure

Funded Unfunded Total

Direct

Exposure

Total

Indirect

ExposureIn millions Loans Leases Securities Total Other (a)

Greece, Ireland, Italy, Portugal and Spain (GIIPS) $ 85 $122 $ 207 $ 3 $ 210 $ 31 $ 241

Belgium and France 73 $ 30 103 35 138 1,083 1,221

United Kingdom 698 32 730 449 1,179 525 1,704

Europe - Other (b) 113 529 168 810 63 873 838 1,711

Total Europe (c) $896 $756 $198 $1,850 $550 $2,400 $2,477 $4,877

December 31, 2011

Direct Exposure

Total

Exposure

Funded Unfunded Total

Direct

Exposure

Total

Indirect

ExposureIn millions Loans Leases Securities Total Other (a)

Greece, Ireland, Italy, Portugal and Spain (GIIPS) $118 $ 118 $ 118 $ 63 $ 181

Belgium, France, Turkey $ 11 75 86 $ 68 154 935 1,089

United Kingdom 452 14 466 381 847 529 1,376

Europe - Other (b) 100 475 $357 932 36 968 803 1,771

Total Europe (c) $563 $682 $357 $1,602 $485 $2,087 $2,330 $4,417

(a) Includes unfunded commitments, guarantees, standby letters of credit, and sold protection credit derivatives.

(b) Europe - Other primarily consists of Denmark, Germany, Netherlands, Sweden, and Switzerland.

(c) Included within Europe - Other is funded direct exposure of $168 million and $357 million consisting of sovereign debt securities at December 31, 2012 and 2011, respectively. There

was no other direct or indirect exposure to European sovereigns as of December 31, 2012 and 2011.

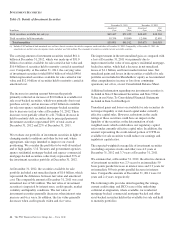

European entities are defined as supranational, sovereign,

financial institutions and non-financial entities within the

countries that comprise the European Union, European Union

candidate countries and other European countries. Foreign

exposure underwriting and approvals are centralized. PNC

currently underwrites new foreign activities if the credit is

generally associated with activities of its United States

commercial customers, and, in the case of PNC Business

Credit’s United Kingdom operations, transactions that are

predominantly well collateralized by self liquidating assets

such as receivables, inventories or, in limited situations, the

borrower’s appraised value of certain fixed assets, such that

PNC is at minimal risk of loss. Formerly, PNC had

underwritten foreign infrastructure leases supported by highly

rated bank letters of credit and other collateral, US Treasury

securities and the underlying assets of the lease. Country

exposures are monitored and reported on a regular basis. We

actively monitor sovereign risk, banking system health, and

market conditions and adjust limits as appropriate. We rely on

information from internal and external sources, including

international financial institutions, economists and analysts,

industry trade organizations, rating agencies, econometric data

analytical service providers and geopolitical news analysis

services.

Among the regions and nations that PNC monitors, we have

identified seven countries for which we are more closely

monitoring their economic and financial situation. The basis

for the increased monitoring includes, but is not limited to,

sovereign debt burden, near term financing risk, political

instability, GDP trends, balance of payments, market

confidence, banking system distress and/or holdings of

stressed sovereign debt. The countries identified are: Greece,

Ireland, Italy, Portugal, Spain (collectively “GIIPS”), Belgium

and France. At December 31, 2012, PNC’s exposure to

Turkey was de minimis.

The PNC Financial Services Group, Inc. – Form 10-K 55