PNC Bank 2012 Annual Report Download - page 56

Download and view the complete annual report

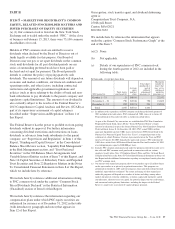

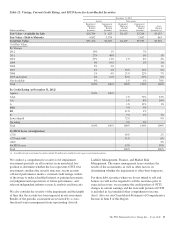

Please find page 56 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.per share, an increase of 5 cents per share, or 14

percent. PNC purchased $190 million of common

stock in 2012 under a $250 million authorization as

part of its existing 25 million share repurchase

program in open market or privately negotiated

transactions.

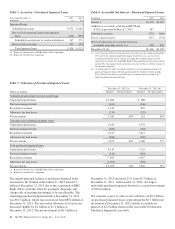

Our Consolidated Income Statement Review section of this

Item 7 describes in greater detail the various items that

impacted our results for 2012 and 2011.

A

VERAGE

C

ONSOLIDATED

B

ALANCE

S

HEET

H

IGHLIGHTS

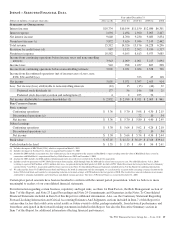

Total assets were $305.1 billion at December 31, 2012

compared with $271.2 billion at December 31, 2011. The

increase from year end 2011 was primarily due to the addition

of assets from the RBC Bank (USA) acquisition and organic

loan growth.

Various seasonal and other factors impact our period-end

balances whereas average balances are generally more

indicative of underlying business trends apart from the impact

of acquisitions and divestitures. The Consolidated Balance

Sheet Review section of this Item 7 provides information on

changes in selected Consolidated Balance Sheet categories at

December 31, 2012 compared with December 31, 2011.

Total average assets increased to $295.0 billion for 2012

compared with $265.3 billion for 2011, reflecting an increase

of $24.2 billion in average interest-earning assets to $248.6

billion for 2012, compared with $224.3 billion in 2011. The

increase in average interest-earning assets was primarily

driven by an increase in average total loans, including those

acquired from the RBC Bank (USA) acquisition.

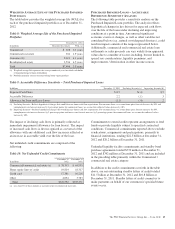

Total loans at December 31, 2012 increased $26.8 billion to

$185.9 billion compared to December 31, 2011. Average total

loans increased by $24.6 billion to $176.6 billion for 2012

compared with 2011, primarily due to increases in average

commercial loans of $17.2 billion and in average consumer

loans of $5.1 billion. Loans added from the RBC Bank (USA)

acquisition contributed to the increase. In addition, average

commercial loans increased from organic loan growth

primarily in corporate banking, real estate and asset-based

lending and average consumer loans increased due to growth

in indirect auto loans. Loans represented 71 percent of average

interest-earning assets for 2012 compared to 68 percent for

2011.

Average investment securities increased $1.1 billion to $60.8

billion in 2012 compared with 2011. Total investment

securities comprised 24 percent of average interest-earning

assets for 2012 and 27 percent for 2011.

Average noninterest-earning assets totaled $46.5 billion in

2012 compared with $41.0 billion in 2011. The increase

included the impact of higher adjustments for net unrealized

gains on securities, which are included in noninterest-earning

assets for average balance sheet purposes, the impact of the

RBC Bank (USA) acquisition, including goodwill, and an

increase in equity investments.

Average total deposits increased by $18.5 billion to $201.6

billion in 2012 compared with 2011. This increase primarily

resulted from an increase in average transaction deposits of

$23.9 billion partially offset by a decrease of $7.4 billion in

retail certificates of deposit attributable to runoff of maturing

accounts. Growth in average noninterest-bearing deposits,

average money market deposits and average interest-bearing

demand deposits drove the increase in transaction deposits,

which resulted from deposits added in the RBC Bank (USA)

acquisition and organic growth. Average transaction deposits

were $161.9 billion for 2012 compared with $138.0 billion for

2011. Total deposits at December 31, 2012 were $213.1

billion compared with $188.0 billion at December 31, 2011

and are further discussed within the Consolidated Balance

Sheet Review section of this Item 7.

Average total deposits represented 68 percent of average total

assets for 2012 and 69 percent for 2011.

Average borrowed funds increased to $41.8 billion for 2012

compared with $35.7 billion for 2011. An increase in

commercial paper and net issuances of Federal Home Loan

Bank (FHLB) borrowings during 2012 drove the increase

compared with 2011. Total borrowed funds at December 31,

2012 were $40.9 billion compared with $36.7 billion at

December 31, 2011 and are further discussed within the

Consolidated Balance Sheet Review section of this Item 7. In

addition, the Liquidity Risk Management portion of the Risk

Management section of this Item 7 includes additional

information regarding our sources and uses of borrowed

funds.

B

USINESS

S

EGMENT

H

IGHLIGHTS

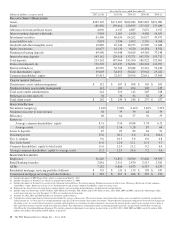

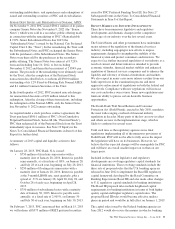

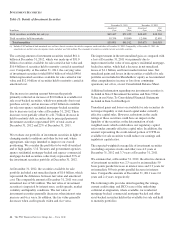

Total business segment earnings were $3.4 billion for 2012

and $3.1 billion for 2011. Highlights of results for 2012 and

2011 are included below. Enhancements were made to the

internal funds transfer pricing methodology during the second

quarter of 2012. Retrospective application of our new funds

transfer pricing methodology has been made to the prior

period reportable business segment results and disclosures to

create comparability to the current period presentation, which

we believe is more meaningful to readers of our financial

statements. Key reserve assumptions and estimation processes

react to and are influenced by observed changes in loan

portfolio performance experience, the financial strength of the

borrower, and economic conditions. Key reserve assumptions

are periodically updated. During the third quarter of 2012,

PNC increased the amount of internally observed data used in

estimating the key commercial lending assumptions of

Probabilities of Default (PDs) and Losses Given Default

(LGDs). The estimated impact as of the beginning of the third

quarter 2012 was approximately an increase of $41 million

and a decrease of $55 million to the provision for credit losses

of Retail Banking and Corporate & Institutional Banking,

respectively. Prior periods are not presented on a comparable

basis as it is not practicable to do so.

The PNC Financial Services Group, Inc. – Form 10-K 37