PNC Bank 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We sold $2.2 billion of commercial mortgages held for sale

carried at the lower of cost or market in 2012. The comparable

amount in 2011 was $2.4 billion. The increase in these loans

to $620 million at December 31, 2012, compared to $451

million at December 31, 2011, was due to an increase in loans

awaiting sale to government agencies.

We recognized total net gains of $41 million in 2012 and $48

million in 2011 on the valuation and sale of commercial

mortgage loans held for sale, net of hedges.

Residential mortgage loan origination volume was $15.2

billion in 2012 compared with $11.4 billion in 2011.

Substantially all such loans were originated under agency or

Federal Housing Administration (FHA) standards. We sold

$13.8 billion of loans and recognized related gains of $747

million during 2012. The comparable amounts for 2011 were

$11.9 billion and $384 million, respectively.

Interest income on loans held for sale was $168 million in

2012 and $193 million in 2011. These amounts are included in

Other interest income on our Consolidated Income Statement.

Additional information regarding our loan sale and servicing

activities is included in Note 3 Loan Sale and Servicing

Activities and Variable Interest Entities in our Notes To

Consolidated Financial Statements included in Item 8 of this

Report.

G

OODWILL AND

O

THER

I

NTANGIBLE

A

SSETS

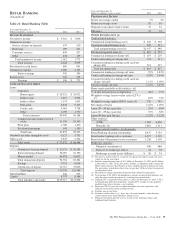

Goodwill and other intangible assets totaled $10.9 billion at

December 31, 2012 and $10.1 billion at December 31, 2011.

During 2012, we recorded goodwill of $950 million and other

intangible assets of $180 million associated with the RBC

Bank (USA) acquisition. In the fourth quarter of 2012, we sold

certain deposits and assets of the Smartstreet business unit,

which was acquired by PNC as part of the RBC Bank (USA)

acquisition, which resulted in a reduction of goodwill and core

deposit intangibles by approximately $46 million and $13

million, respectively. Also in the fourth quarter of 2012, we

recorded a $45 million noncash charge for goodwill

impairment related to PNC’s Residential Mortgage Banking

business segment. See Note 2 Acquisition and Divestiture

Activity and Note 10 Goodwill and Other Intangible Assets in

the Notes To Consolidated Financial Statements included in

Item 8 of this Report.

F

UNDING AND

C

APITAL

S

OURCES

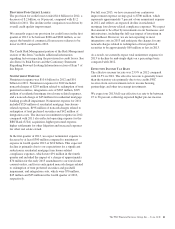

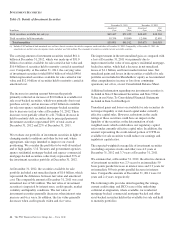

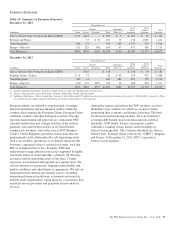

Table 16: Details Of Funding Sources

In millions

December 31

2012

December 31

2011

Deposits

Money market $102,706 $ 89,912

Demand 73,995 57,717

Retail certificates of deposit 23,837 29,518

Savings 10,350 8,705

Time deposits in foreign offices and

other time 2,254 2,114

Total deposits 213,142 187,966

Borrowed funds

Federal funds purchased and

repurchase agreements 3,327 2,984

Federal Home Loan Bank borrowings 9,437 6,967

Bank notes and senior debt 10,429 11,793

Subordinated debt 7,299 8,321

Commercial paper 8,453 4,271

Other 1,962 2,368

Total borrowed funds 40,907 36,704

Total $254,049 $224,670

See the Capital and Liquidity Actions portion of the Executive

Summary section of this Item 7 for additional information

regarding our 2012 capital and liquidity activities and 2013

activities to date.

Total funding sources increased $29.4 billion at December 31,

2012 compared with December 31, 2011.

Total deposits increased $25.2 billion, or 13%, at

December 31, 2012 compared with December 31, 2011. On

March 2, 2012, our RBC Bank (USA) acquisition added $18.1

billion of deposits, including $6.9 billion of money market,

$6.7 billion of demand, $4.1 billion of retail certificates of

deposit, and $.4 billion of savings. Excluding acquisition

activity, money market and demand deposits increased during

2012, partially offset by the maturity of retail certificates of

deposit. Interest-bearing deposits represented 67% of total

deposits at December 31, 2012 compared to 69% at

December 31, 2011. Total borrowed funds increased $4.2

billion from December 31, 2011 to $40.9 billion at

December 31, 2012, due to increases in Federal funds

purchased and repurchase agreements, FHLB borrowings and

commercial paper net issuances, partially offset by net

repayments and maturities of bank notes and senior debt and a

reduction in subordinated debt due to redemptions of trust

preferred securities and hybrid capital securities.

50 The PNC Financial Services Group, Inc. – Form 10-K