PNC Bank 2012 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280

|

|

N

OTE

4L

OANS AND

C

OMMITMENTS TO

E

XTEND

C

REDIT

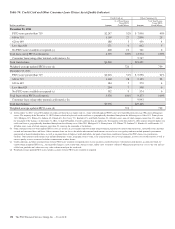

Loans outstanding were as follows:

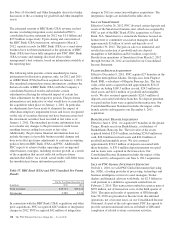

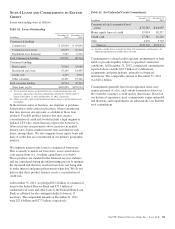

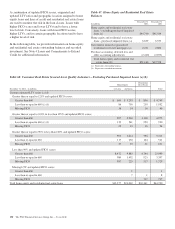

Table 62: Loans Outstanding

In millions

December 31

2012

December 31

2011

Commercial lending

Commercial $ 83,040 $ 65,694

Commercial real estate 18,655 16,204

Equipment lease financing 7,247 6,416

Total Commercial Lending 108,942 88,314

Consumer lending

Home equity 35,920 33,089

Residential real estate 15,240 14,469

Credit card 4,303 3,976

Other consumer 21,451 19,166

Total consumer lending 76,914 70,700

Total loans (a) (b) $185,856 $159,014

(a) Net of unearned income, net deferred loan fees, unamortized discounts and

premiums, and purchase discounts and premiums totaling $2.7 billion and $2.3

billion at December 31, 2012 and December 31, 2011, respectively.

(b) Future accretable yield related to purchased impaired loans is not included in loans

outstanding.

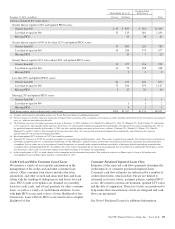

In the normal course of business, we originate or purchase

loan products with contractual features, when concentrated,

that may increase our exposure as a holder of those loan

products. Possible product features that may create a

concentration of credit risk would include a high original or

updated LTV ratio, terms that may expose the borrower to

future increases in repayments above increases in market

interest rates, below-market interest rates and interest-only

loans, among others. We also originate home equity loans and

lines of credit that are concentrated in our primary geographic

markets.

We originate interest-only loans to commercial borrowers.

This is usually to match our borrowers’ asset conversion to

cash expectations (i.e., working capital lines, revolvers).

These products are standard in the financial services industry

and are considered during the underwriting process to mitigate

the increased risk that may result in borrowers not being able

to make interest and principal payments when due. We do not

believe that these product features create a concentration of

credit risk.

At December 31, 2012, we pledged $23.2 billion of commercial

loans to the Federal Reserve Bank and $37.3 billion of

residential real estate and other loans to the Federal Home Loan

Bank as collateral for the contingent ability to borrow, if

necessary. The comparable amounts at December 31, 2011

were $21.8 billion and $27.7 billion, respectively.

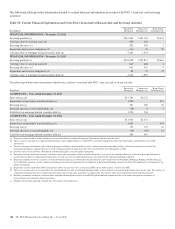

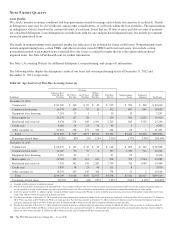

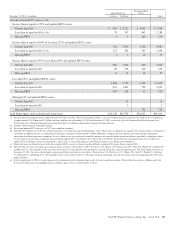

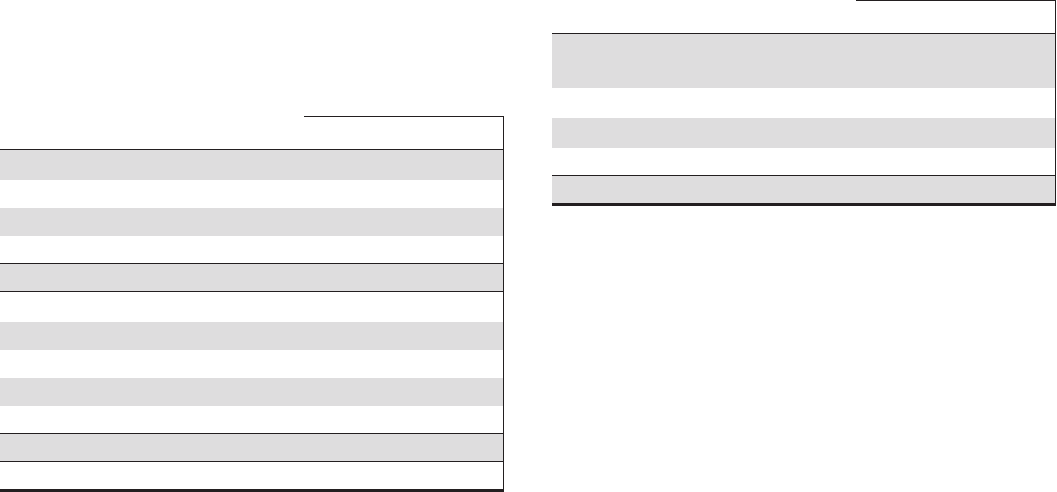

Table 63: Net Unfunded Credit Commitments

In millions

December 31

2012

December 31

2011

Commercial and commercial real

estate $ 78,703 $ 64,955

Home equity lines of credit 19,814 18,317

Credit card 17,381 16,216

Other 4,694 3,783

Total (a) $120,592 $103,271

(a) Excludes standby letters of credit. See Note 24 Commitments and Guarantees for

additional information on standby letters of credit.

Commitments to extend credit represent arrangements to lend

funds or provide liquidity subject to specified contractual

conditions. At December 31, 2012, commercial commitments

reported above exclude $22.5 billion of syndications,

assignments and participations, primarily to financial

institutions. The comparable amount at December 31, 2011

was $20.2 billion.

Commitments generally have fixed expiration dates, may

require payment of a fee, and contain termination clauses in

the event the customer’s credit quality deteriorates. Based on

our historical experience, most commitments expire unfunded,

and therefore cash requirements are substantially less than the

total commitment.

The PNC Financial Services Group, Inc. – Form 10-K 145