PNC Bank 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.C

REDIT

R

ISK

M

ANAGEMENT

Credit risk represents the possibility that a customer,

counterparty or issuer may not perform in accordance with

contractual terms. Credit risk is inherent in the financial

services business and results from extending credit to

customers, purchasing securities, and entering into financial

derivative transactions and certain guarantee contracts. Credit

risk is one of our most significant risks. Our processes for

managing credit risk are embedded in PNC’s risk culture and

in our decision-making processes using a systematic approach

whereby credit risks and related exposures are: identified and

assessed; managed through specific policies and processes;

measured and evaluated against our risk tolerance limits; and

reported, along with specific mitigation activities, to

management and the board through our governance structure.

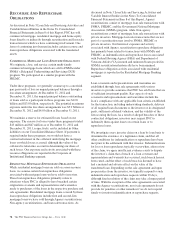

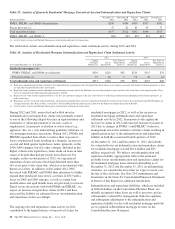

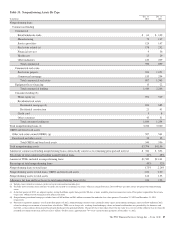

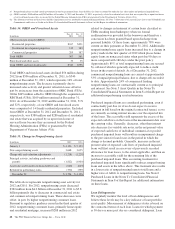

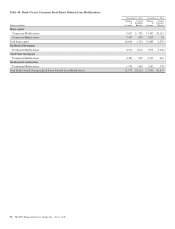

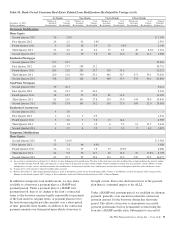

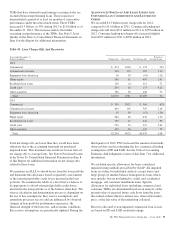

Asset Quality Overview

Overall asset quality trends in 2012 improved from

December 31, 2011 and included the following:

• Nonperforming loans decreased $306 million, or 9%,

to $3.3 billion as of December 31, 2012 compared

with $3.6 billion as of December 31, 2011. This

decrease was mainly attributable to decreases in

commercial real estate and commercial

nonperforming loans, which were partially offset by

the acquisition of RBC Bank (USA) and higher

nonperforming consumer loans. Pursuant to

regulatory guidance issued in the third quarter of

2012, nonperforming consumer loans, primarily

home equity and residential mortgage, increased

$288 million in 2012 related to changes in treatment

of certain loans classified as TDRs, net of charge-

offs, resulting from bankruptcy where no formal

reaffirmation was provided by the borrower and

therefore a concession has been granted based upon

discharge from personal liability. Of these loans,

approximately 78% were current on their payments at

December 31, 2012. Additionally, nonperforming

home equity loans increased due to a change in

policy made in the first quarter of 2012 which places

home equity loans on nonaccrual status when past

due 90 days or more compared with 180 days under

the prior policy.

• Overall loan delinquencies decreased $797 million,

or 18%, from year-end 2011. The reduction was

mainly due to a decline in government insured

residential real estate loans in addition to a first

quarter of 2012 policy change for home equity loans

whereby loans are placed on nonaccrual status when

past due 90 days compared to prior policy of placing

loans on nonaccrual status when past due 180 days.

In addition, consumer loan delinquencies, primarily

residential real estate delinquencies, decreased

pursuant to regulatory guidance issued in the third

quarter of 2012 related to treatment of certain loans

classified as TDRs resulting from bankruptcy as

discussed above. These decreases were partially

offset by an increase in commercial real estate

delinquencies.

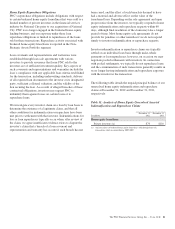

• Net charge-offs were $1.3 billion in 2012, down 21%

from 2011 net charge-offs of $1.6 billion. Pursuant to

regulatory guidance issued in the third quarter of

2012, additional consumer charge-offs of $128.1

million have been taken in 2012 related to changes in

treatment of certain loans where borrowers have been

discharged from personal liability under bankruptcy

protection where no formal reaffirmation was

provided by the borrower. Such loans have been

classified as TDRs and have been measured at the

fair value of the collateral less costs to sell.

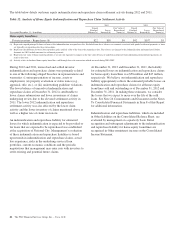

• The provision for credit losses declined 14% to $1.0

billion for 2012 compared with $1.2 billion for 2011.

• The level of ALLL decreased 7% to $4.0 billion at

December 31, 2012 from $4.3 billion at

December 31, 2011.

The PNC Financial Services Group, Inc. – Form 10-K 85