PNC Bank 2012 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

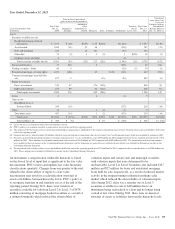

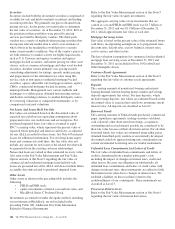

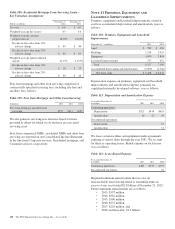

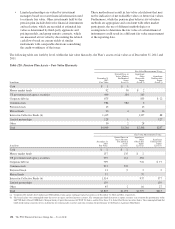

Changes in the residential MSRs follow:

Table 106: Residential Mortgage Servicing Rights

In millions 2012 2011 2010

January 1 $ 647 $ 1,033 $ 1,332

Additions:

From loans sold with

servicing retained 117 118 95

RBC Bank (USA)

acquisition 16

Purchases 175 65

Changes in fair value due to:

Time and payoffs (a) (167) (163) (185)

Other (b) (138) (406) (209)

December 31 $ 650 $ 647 $ 1,033

Unpaid principal balance of

loans serviced for others

at December 31 $119,262 $118,058 $125,806

(a) Represents decrease in MSR value due to passage of time, including the impact from

both regularly scheduled loan principal payments and loans that were paid down or

paid off during the period.

(b) Represents MSR value changes resulting primarily from market-driven changes in

interest rates, as well as changes in assumptions such as prepayments and servicing

costs.

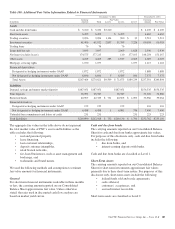

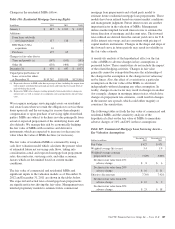

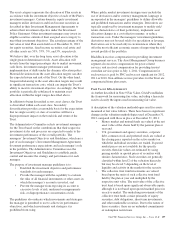

We recognize mortgage servicing right assets on residential

real estate loans when we retain the obligation to service these

loans upon sale and the servicing fee is more than adequate

compensation or upon purchase of servicing rights from third

parties. MSRs are subject to declines in value principally from

actual or expected prepayment of the underlying loans and

also defaults. We manage this risk by economically hedging

the fair value of MSRs with securities and derivative

instruments which are expected to increase (or decrease) in

value when the value of MSRs declines (or increases).

The fair value of residential MSRs is estimated by using a

cash flow valuation model which calculates the present value

of estimated future net servicing cash flows, taking into

consideration actual and expected mortgage loan prepayment

rates, discount rates, servicing costs, and other economic

factors which are determined based on current market

conditions.

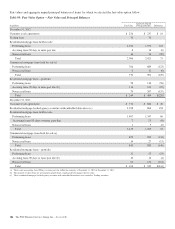

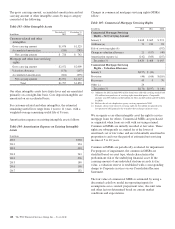

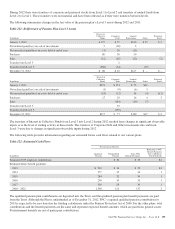

The fair value of commercial and residential MSRs and

significant inputs to the valuation models as of December 31,

2012 and December 31, 2011 are shown in the tables below.

The expected and actual rates of mortgage loan prepayments

are significant factors driving the fair value. Management uses

internal proprietary models to estimate future commercial

mortgage loan prepayments and a third party model to

estimate future residential mortgage loan prepayments. These

models have been refined based on current market conditions

and management judgment. Future interest rates are another

important factor in the valuation of MSRs. Management

utilizes market implied forward interest rates to estimate the

future direction of mortgage and discount rates. The forward

rates utilized are derived from the current yield curve for U.S.

dollar interest rate swaps and are consistent with pricing of

capital markets instruments. Changes in the shape and slope of

the forward curve in future periods may result in volatility in

the fair value estimate.

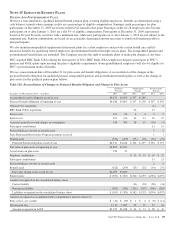

A sensitivity analysis of the hypothetical effect on the fair

value of MSRs to adverse changes in key assumptions is

presented below. These sensitivities do not include the impact

of the related hedging activities. Changes in fair value

generally cannot be extrapolated because the relationship of

the change in the assumption to the change in fair value may

not be linear. Also, the effect of a variation in a particular

assumption on the fair value of the MSRs is calculated

independently without changing any other assumption. In

reality, changes in one factor may result in changes in another

(for example, changes in mortgage interest rates, which drive

changes in prepayment rate estimates, could result in changes

in the interest rate spread), which could either magnify or

counteract the sensitivities.

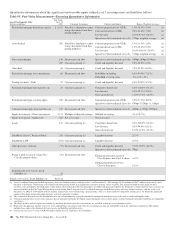

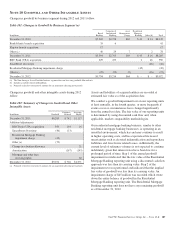

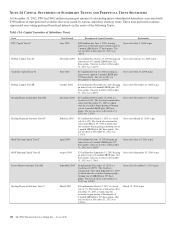

The following tables set forth the fair value of commercial and

residential MSRs and the sensitivity analysis of the

hypothetical effect on the fair value of MSRs to immediate

adverse changes of 10% and 20% in those assumptions:

Table 107: Commercial Mortgage Loan Servicing Assets –

Key Valuation Assumptions

Dollars in millions

December 31

2012

December 31

2011

Fair Value $ 427 $ 471

Weighted-average life (years) 5.4 5.9

Weighted-average constant

prepayment rate 7.63% 5.08%

Decline in fair value from 10%

adverse change $ 8 $ 6

Decline in fair value from 20%

adverse change $ 16 $ 11

Effective discount rate 7.70% 7.92%

Decline in fair value from 10%

adverse change $ 12 $ 9

Decline in fair value from 20%

adverse change $ 23 $ 18

The PNC Financial Services Group, Inc. – Form 10-K 189