PNC Bank 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.M

ORTGAGE

A

ND

O

THER

S

ERVICING

R

IGHTS

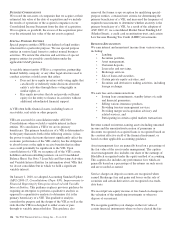

We provide servicing under various loan servicing contracts

for commercial, residential and other consumer loans. These

contracts are either purchased in the open market or retained

as part of a loan securitization or loan sale. All newly acquired

or originated servicing rights are initially measured at fair

value. Fair value is based on the present value of the expected

future cash flows, including assumptions as to:

• Deposit balances and interest rates for escrow and

commercial reserve earnings,

• Discount rates,

• Stated note rates,

• Estimated prepayment speeds, and

• Estimated servicing costs.

For subsequent measurements of these assets, we have elected

to utilize either the amortization method or fair value

measurement based upon the asset class and our risk

management strategy for managing these assets. For

commercial mortgage loan servicing rights, we use the

amortization method. This election was made based on the

unique characteristics of the commercial mortgage loans

underlying these servicing rights with regard to market inputs

used in determining fair value and how we manage the risks

inherent in the commercial mortgage servicing rights assets.

Specific risk characteristics of commercial mortgages include

loan type, currency or exchange rate, interest rates, expected

cash flows and changes in the cost of servicing. We record

these servicing assets as Other intangible assets and amortize

them over their estimated lives based on estimated net

servicing income. On a quarterly basis, we test the assets for

impairment by categorizing the pools of assets underlying the

servicing rights into various strata. If the estimated fair value

of the assets is less than the carrying value, an impairment loss

is recognized and a valuation reserve is established.

For servicing rights related to residential real estate loans, we

apply the fair value method. This election was made to be

consistent with our risk management strategy to hedge

changes in the fair value of these assets. We manage this risk

by hedging the fair value of this asset with derivatives and

securities which are expected to increase in value when the

value of the servicing right declines. The fair value of these

servicing rights is estimated by using a cash flow valuation

model which calculates the present value of estimated future

net servicing cash flows, taking into consideration actual and

expected mortgage loan prepayment rates, discount rates,

servicing costs, and other economic factors which are

determined based on current market conditions.

Revenue from the various loan servicing contracts for

commercial, residential and other consumer loans is reported

on the Consolidated Income Statement in line items Corporate

services, Residential mortgage and Consumer services.

F

AIR

V

ALUE

O

F

F

INANCIAL

I

NSTRUMENTS

The fair value of financial instruments and the methods and

assumptions used in estimating fair value amounts and

financial assets and liabilities for which fair value was elected

are detailed in Note 9 Fair Value.

G

OODWILL

A

ND

O

THER

I

NTANGIBLE

A

SSETS

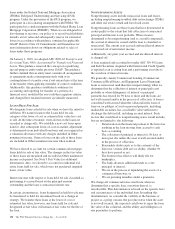

We assess goodwill for impairment at least annually, in the

fourth quarter, or when events or changes in circumstances

indicate the assets might be impaired. Finite-lived intangible

assets are amortized to expense using accelerated or straight-

line methods over their respective estimated useful lives. We

review finite-lived intangible assets for impairment when

events or changes in circumstances indicate that the asset’s

carrying amount may not be recoverable from undiscounted

future cash flows or that it may exceed its fair value.

D

EPRECIATION

A

ND

A

MORTIZATION

For financial reporting purposes, we depreciate premises and

equipment, net of salvage value, principally using the straight-

line method over their estimated useful lives.

We use estimated useful lives for furniture and equipment

ranging from one to 10 years, and depreciate buildings over an

estimated useful life of up to 40 years. We amortize leasehold

improvements over their estimated useful lives of up to 15

years or the respective lease terms, whichever is shorter.

We purchase, as well as internally develop and customize,

certain software to enhance or perform internal business

functions. Software development costs incurred in the

planning and post-development project stages are charged to

Noninterest expense. Costs associated with designing software

configuration and interfaces, installation, coding programs and

testing systems are capitalized and amortized using the

straight-line method over periods ranging from one to seven

years.

R

EPURCHASE

A

ND

R

ESALE

A

GREEMENTS

Repurchase and resale agreements are treated as collateralized

financing transactions and are carried at the amounts at which

the securities will be subsequently reacquired or resold,

including accrued interest, as specified in the respective

agreements. Our policy is to take possession of securities

purchased under agreements to resell. We monitor the market

value of securities to be repurchased and resold and additional

collateral may be obtained where considered appropriate to

protect against credit exposure. We have elected to account

for structured resale agreements at fair value.

O

THER

C

OMPREHENSIVE

I

NCOME

Other comprehensive income consists, on an after-tax basis,

primarily of unrealized gains or losses, excluding OTTI

attributable to credit deterioration, on investment securities

classified as available for sale, unrealized gains or losses on

derivatives designated as cash flow hedges, and changes in

pension and other postretirement benefit plan liability

adjustments. Details of each component are included in Note

20 Other Comprehensive Income.

The PNC Financial Services Group, Inc. – Form 10-K 133