PNC Bank 2012 Annual Report Download - page 115

Download and view the complete annual report

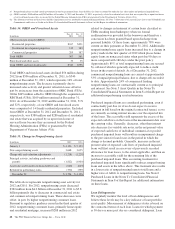

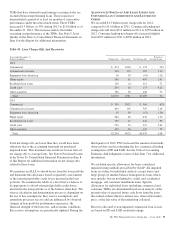

Please find page 115 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our commercial pool reserve methodology is sensitive to

changes in key risk parameters such as PD and LGD; the

results of these parameters are then applied to the loan balance

to determine the amount of the reserve. In general, a given

change in any of the major risk parameters will have a

corresponding change in the pool reserve allocations for non-

impaired commercial loans. To illustrate, if we increase the

pool reserve LGD by 5% for all categories of non-impaired

commercial loans at December 31, 2012, then the aggregate of

the ALLL and allowance for unfunded loan commitments and

letters of credit would increase by $74 million.

The majority of the commercial portfolio is secured by

collateral, including loans to asset-based lending customers

that continue to show demonstrably lower LGD. Further, the

large investment grade or equivalent portion of the loan

portfolio has performed well and has not been subject to

significant deterioration. Additionally, guarantees on loans

greater than $1 million and owner guarantees for small

business loans do not significantly impact our ALLL.

Allocations to non-impaired consumer loan classes are based

upon a roll-rate model which uses statistical relationships,

calculated from historical data that estimate the movement of

loan outstandings through the various stages of delinquency

and ultimately charge-off.

A portion of the ALLL related to qualitative and measurement

factors has been assigned to loan categories. These factors

include, but are not limited to, the following:

• Industry concentrations and conditions,

• Recent credit quality trends,

• Recent loss experience in particular portfolios,

• Recent macro-economic factors,

• Changes in risk selection and underwriting standards,

and

• Timing of available information, including the

performance of first lien positions.

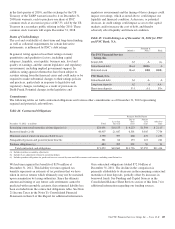

Purchased impaired loans are initially recorded at fair value

and applicable accounting guidance prohibits the carry over or

creation of valuation allowances at acquisition. Because the

initial fair values of these loans already reflect a credit

component, additional reserves are established when

performance is expected to be worse than our expectations as

of the acquisition date. At December 31, 2012, we had

established reserves of $1.1 billion for purchased impaired

loans. In addition, all loans (purchased impaired and non-

impaired) acquired in the RBC Bank (USA) acquisition were

recorded at fair value.No allowance for loan losses was

carried over and no allowance was created at acquisition. See

Note 6 Purchased Loans in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information.

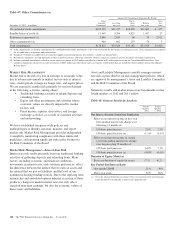

In addition to the ALLL, we maintain an allowance for

unfunded loan commitments and letters of credit. We report

this allowance as a liability on our Consolidated Balance

Sheet. We maintain the allowance for unfunded loan

commitments and letters of credit at a level we believe is

appropriate to absorb estimated probable losses on these

unfunded credit facilities. We determine this amount using

estimates of the probability of the ultimate funding and losses

related to those credit exposures. Other than the estimation of

the probability of funding, this methodology is similar to the

one we use for determining our ALLL.

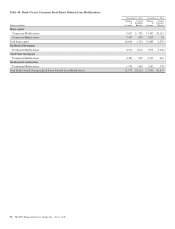

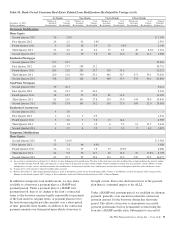

We refer you to Note 5 Asset Quality and Note 7 Allowances

for Loan and Lease Losses and Unfunded Loan Commitments

and Letters of Credit in the Notes To Consolidated Financial

Statements in Item 8 of this Report for further information on

key asset quality indicators that we use to evaluate our

portfolio and establish the allowances.

96 The PNC Financial Services Group, Inc. – Form 10-K