PNC Bank 2012 Annual Report Download - page 250

Download and view the complete annual report

Please find page 250 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

25 P

ARENT

C

OMPANY

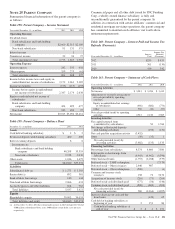

Summarized financial information of the parent company is

as follows:

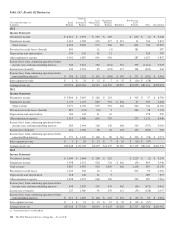

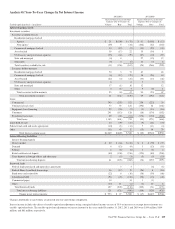

Table 158: Parent Company – Income Statement

Year ended December 31 – in millions 2012 2011 2010

Operating Revenue

Dividends from:

Bank subsidiaries and bank holding

company $2,660 $2,513 $2,180

Non-bank subsidiaries 91 131 575

Interest income 1

Noninterest income 22 24 27

Total operating revenue 2,773 2,669 2,782

Operating Expense

Interest expense 242 333 458

Other expense 359 275 (61)

Total operating expense 601 608 397

Income before income taxes and equity in

undistributed net income of subsidiaries 2,172 2,061 2,385

Income tax benefits (175) (113) (253)

Income before equity in undistributed

net income of subsidiaries 2,347 2,174 2,638

Equity in undistributed net income of

subsidiaries:

Bank subsidiaries and bank holding

company 424 699 677

Non-bank subsidiaries 242 183 97

Net income $3,013 $3,056 $3,412

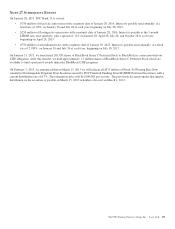

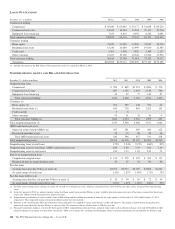

Table 159: Parent Company – Balance Sheet

December 31 – in millions 2012 2011

Assets

Cash held at banking subsidiary $ 2 $ 2

Restricted deposits with banking subsidiary 400 400

Interest-earning deposits 6 6

Investments in:

Bank subsidiaries and bank holding

company 40,208 35,355

Non-bank subsidiaries 2,238 2,036

Other assets 1,186 1,675

Total assets $44,040 $39,474

Liabilities

Subordinated debt (a) $ 1,275 $ 3,303

Senior debt (a) 892 381

Bank affiliate borrowings 140 144

Non-bank affiliate borrowings 2,066 631

Accrued expenses and other liabilities 664 962

Total liabilities 5,037 5,421

Equity

Shareholder’s equity 39,003 34,053

Total liabilities and equity $44,040 $39,474

(a) At December 31, 2012, debt that contractually matures in 2013 through 2017 totaled

$300 million (subordinated debt), zero, $400 million (senior debt), zero and zero,

respectively.

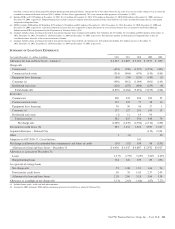

Commercial paper and all other debt issued by PNC Funding

Corp, a wholly owned finance subsidiary, is fully and

unconditionally guaranteed by the parent company. In

addition, in connection with certain affiliates’ commercial and

residential mortgage servicing operations, the parent company

has committed to maintain such affiliates’ net worth above

minimum requirements.

Table 160: Parent Company – Interest Paid and Income Tax

Refunds (Payments)

Year ended December 31 – in millions

Interest

Paid

Income Tax

Refunds /

(Payments)

2012 $255 $ 453

2011 361 (130)

2010 419 342

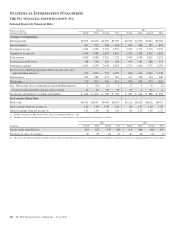

Table 161: Parent Company – Statement of Cash Flows

Year ended December 31 – in millions 2012 2011 2010

Operating Activities

Net income $ 3,013 $ 3,056 $ 3,412

Adjustments to reconcile net income to

net cash provided by operating

activities:

Equity in undistributed net earnings

of subsidiaries (666) (882) (774)

Other 566 (24) (53)

Net cash provided (used) by operating

activities 2,913 2,150 2,585

Investing Activities

Net capital returned from

(contributed to) subsidiaries 50 1,766

Net change in Restricted deposits

with banking subsidiary (150) (232)

Net cash paid for acquisition activity (3,432)

Other (50) (35) 1

Net cash provided (used) by

investing activities (3,482) (135) 1,535

Financing Activities

Borrowings from subsidiaries 8,374 4,660 7,580

Repayments on borrowings from

subsidiaries (6,943) (4,962) (6,596)

Other borrowed funds (1,753) (2,188) (379)

Preferred stock – TARP redemption (7,579)

Preferred stock – Other issuances 2,446 987

Preferred stock – Other redemptions (500) (1)

Common and treasury stock

issuances 158 72 3,474

Acquisition of treasury stock (216) (73) (204)

Preferred stock cash dividends paid (177) (56) (146)

Common stock cash dividends paid (820) (604) (204)

Net cash provided (used) by

financing activities 569 (2,164) (4,055)

Increase (decrease) in cash and due

from banks – (149) 65

Cash held at banking subsidiary at

beginning of year 2 151 86

Cash held at banking subsidiary at

end of year $ 2 $ 2 $ 151

The PNC Financial Services Group, Inc. – Form 10-K 231