PNC Bank 2012 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

6P

URCHASED

L

OANS

P

URCHASED

I

MPAIRED

L

OANS

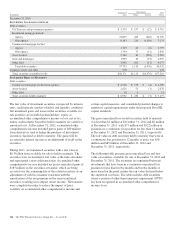

Purchased impaired loans are accounted for under ASC 310-

30, which addresses accounting for differences between

contractual cash flows and cash flows expected to be collected

from the initial investment in loans if those differences are

attributable, at least in part, to credit quality. Several factors

were considered when evaluating whether a loan was

considered a purchased impaired loan, including the

delinquency status of the loan, updated borrower credit status,

geographic information, and updated loan-to-values (LTV).

GAAP allows purchasers to aggregate purchased impaired

loans acquired in the same fiscal quarter into one or more

pools, provided that the loans have common risk

characteristics. A pool is then accounted for as a single asset

with a single composite interest rate and an aggregate

expectation of cash flows. Purchased impaired loans with

homogeneous consumer, residential real estate and smaller

balance commercial loans with common risk characteristics

are aggregated into pools where appropriate. Commercial

loans with a total commitment greater than a defined threshold

are accounted for individually. The excess of cash flows

expected at acquisition over the estimated fair value is referred

to as the accretable yield and is recognized as interest income

over the remaining life of the loan using the constant effective

yield method. The difference between contractually required

payments at acquisition and the cash flows expected to be

collected at acquisition is referred to as the nonaccretable

difference. Subsequent changes in the expected cash flows of

individual or pooled purchased impaired loans from the date

of acquisition will either impact the accretable yield or result

in an impairment charge to provision for credit losses in the

period in which the changes become probable. Decreases to

the net present value of expected cash flows will generally

result in an impairment charge recorded as a provision for

credit losses, resulting in an increase to the allowance for loan

and lease losses, and a reclassification from accretable yield to

nonaccretable difference. Prepayments and interest rate

decreases for variable rate notes are treated as a reduction of

cash flows expected to be collected and a reduction of

projections of contractual cash flows such that the

nonaccretable difference is not affected. Thus, for decreases in

cash flows expected to be collected resulting from

prepayments and interest rate decreases for variable rate notes,

the effect will be to reduce the yield prospectively.

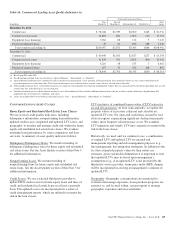

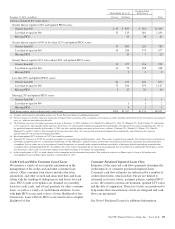

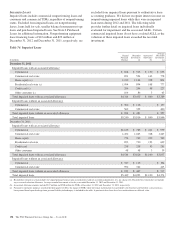

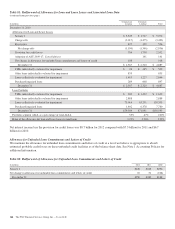

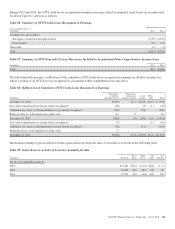

The following table provides purchased impaired loans at December 31, 2012 and December 31, 2011:

Table 75: Purchased Impaired Loans –Balances

December 31, 2012 (a) December 31, 2011 (b)

In millions

Recorded

Investment

Outstanding

Balance

Recorded

Investment

Outstanding

Balance

Commercial Lending

Commercial $ 308 $ 524 $ 140 $ 245

Commercial real estate 941 1,156 712 743

Total Commercial Lending 1,249 1,680 852 988

Consumer Lending

Consumer 2,621 2,988 2,766 3,405

Residential real estate 3,536 3,651 3,049 3,128

Total Consumer Lending 6,157 6,639 5,815 6,533

Total $7,406 $8,319 $6,667 $7,521

(a) Represents National City and RBC Bank (USA) acquisitions.

(b) Represents National City acquisition.

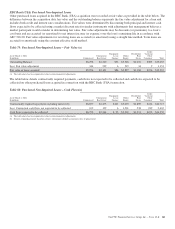

As of December 31, 2011, the allowance for loan and lease

losses related to purchased impaired loans was $998 million.

During 2012, $173 million of provision and $74 million of

charge-offs were recorded on purchased impaired loans. At

December 31, 2012, the allowance for loan and lease losses

was $1.1 billion on $6.0 billion of purchased impaired loans

while the remaining $1.4 billion of purchased impaired loans

required no allowance as the net present value of expected

cash flows equaled or exceeded the recorded investment. If

any allowance for loan losses is recognized on a purchased

impaired pool, which is accounted for as a single asset, the

entire balance of that pool would be disclosed as requiring an

allowance. Subsequent increases in the net present value of

cash flows will result in a recovery of any previously recorded

allowance for loan and lease losses, to the extent applicable,

and/or a reclassification from non-accretable difference to

accretable yield, which will be recognized prospectively.

Disposals of loans, which may include sales of loans or

foreclosures, result in removal of the loan from the purchased

impaired loan portfolio. The cash flow re-estimation process is

completed quarterly to evaluate the appropriateness of the

allowance associated with the purchased impaired loans.

The PNC Financial Services Group, Inc. – Form 10-K 159