PNC Bank 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

ALE OF

PNC G

LOBAL

I

NVESTMENT

S

ERVICING

On July 1, 2010, we sold PNC Global Investment Servicing

Inc. (GIS), a leading provider of processing, technology and

business intelligence services to asset managers, broker-

dealers and financial advisors worldwide, for $2.3 billion in

cash. The pretax gain in discontinued operations recorded in

the third quarter of 2010 related to this sale was $639 million,

net of transaction costs, or $328 million after taxes.

Results of operations of GIS through June 30, 2010 are

presented as income from discontinued operations, net of

income taxes, on our Consolidated Income Statement in this

Report. Once we entered into the sales agreement, GIS was no

longer a reportable business segment. See Note 2 Acquisition

and Divestiture Activity in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

C

APITAL AND

L

IQUIDITY

A

CTIONS

Our ability to take certain capital actions, including plans to

pay or increase common stock dividends or to repurchase

shares under current or future programs, is subject to the

results of the supervisory assessment of capital adequacy

undertaken by the Board of Governors of the Federal Reserve

System (Federal Reserve) and our primary bank regulators as

part of the Comprehensive Capital Analysis and Review

(CCAR) process. This capital adequacy assessment is based

on a review of a comprehensive capital plan submitted to the

Federal Reserve. In connection with the 2013 CCAR, PNC

filed its capital plan and stress testing results with the Federal

Reserve on January 7, 2013. PNC expects to receive the

Federal Reserve’s response (either a non-objection or

objection) to the capital plan submitted as part of the 2013

CCAR by March 15, 2013. For additional information

concerning the CCAR process and the factors the Federal

Reserve takes into consideration in evaluating capital plans,

see Item 1 Business – Supervision and Regulation of this

Report.

A summary of 2012 capital and liquidity actions follows.

D

EBT

S

ECURITIES

I

SSUED

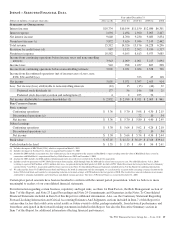

On March 8, 2012, PNC Funding Corp issued $1 billion of

senior notes, unconditionally guaranteed by The PNC

Financial Services Group, Inc., due March 8, 2022. Interest is

paid semi-annually at a fixed rate of 3.30%. The offering

resulted in gross proceeds to us of $990 million before

offering related expenses. We used the net proceeds from this

offering for general corporate purposes, which included

advances to PNC and its subsidiaries to finance their

activities, repayment of outstanding indebtedness, and

repurchases and redemptions of issued and outstanding

securities of PNC and its subsidiaries.

On June 20, 2012, PNC Bank, N.A. issued $1.0 billion of

senior extendible floating rate bank notes with an initial

maturity date of July 20, 2013, subject to the holder’s monthly

option to extend, and a final maturity date of June 20, 2014.

Interest is paid at the 3-month LIBOR rate, reset quarterly,

plus a spread of 22.5 basis points, which spread is subject to

four potential one basis point increases in the event of certain

extensions of maturity by the holder.

On October 22, 2012, PNC Bank, N.A. issued $1.0 billion of

subordinated notes with a maturity date of November 1, 2022.

Interest is payable semi-annually, at a fixed rate of 2.70%, on

May 1 and November 1 of each year, beginning on May 1,

2013.

T

RUST

P

REFERRED

S

ECURITIES

R

EDEEMED

On April 25, 2012 we redeemed $300 million of trust

preferred securities issued by PNC Capital Trust D with a

current distribution rate of 6.125% and $6 million of trust

preferred securities issued by Yardville Capital Trust III with

a current distribution rate of 10.18%. In addition, on May 25,

2012 we redeemed $500 million of trust preferred securities

issued by National City Capital Trust III with a current

distribution rate of 6.625%. These redemptions together

resulted in a noncash charge for unamortized discounts of

approximately $130 million in the second quarter of 2012.

On July 30, 2012 we redeemed $450 million of trust preferred

securities issued by PNC Capital Trust E with a current

distribution rate of 7.750% and $517.5 million of enhanced

trust preferred securities issued by National City Capital Trust

IV with a current distribution rate of 8.000%. These

redemptions together resulted in a noncash charge for

unamortized discounts of approximately $95 million in the

third quarter of 2012.

P

REFERRED

S

TOCK

I

SSUED

On April 24, 2012, we issued 60 million depositary shares,

each representing a 1/4,000th interest in a share of our Fixed-

to-Floating Rate Non-Cumulative Perpetual Preferred Stock,

Series P, in an underwritten public offering resulting in gross

proceeds of $1.5 billion to us before commissions and

expenses. We used the net proceeds from the sale of the

depositary shares for general corporate purposes, which

included repurchases and redemptions of issued and

outstanding securities of PNC and its subsidiaries, including

trust preferred securities.

On September 21, 2012 we issued 18 million depositary

shares, each representing a 1/4,000th interest in a share of our

5.375% Non-Cumulative Perpetual Preferred Stock, Series Q,

in an underwritten public offering resulting in gross proceeds

of $450 million to us before commissions and expenses. On

October 9, 2012, pursuant to the underwriting agreement for

this offering, we issued an additional 1.2 million depositary

shares in satisfaction of an option granted to the underwriters

in the underwriting agreement to cover over-allotments,

resulting in additional gross proceeds of $30 million. We used

the net proceeds from the sales of the depositary shares for

general corporate purposes, which included advances to our

subsidiaries to finance their activities, repayment of

32 The PNC Financial Services Group, Inc. – Form 10-K