PNC Bank 2012 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

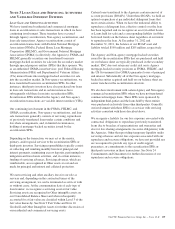

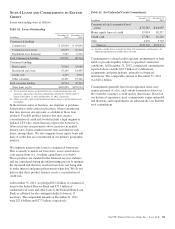

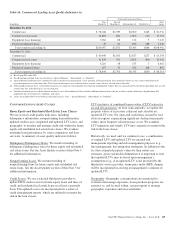

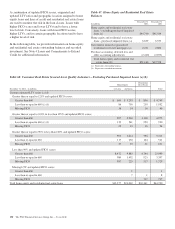

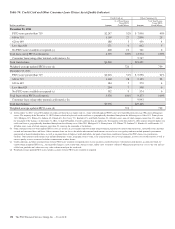

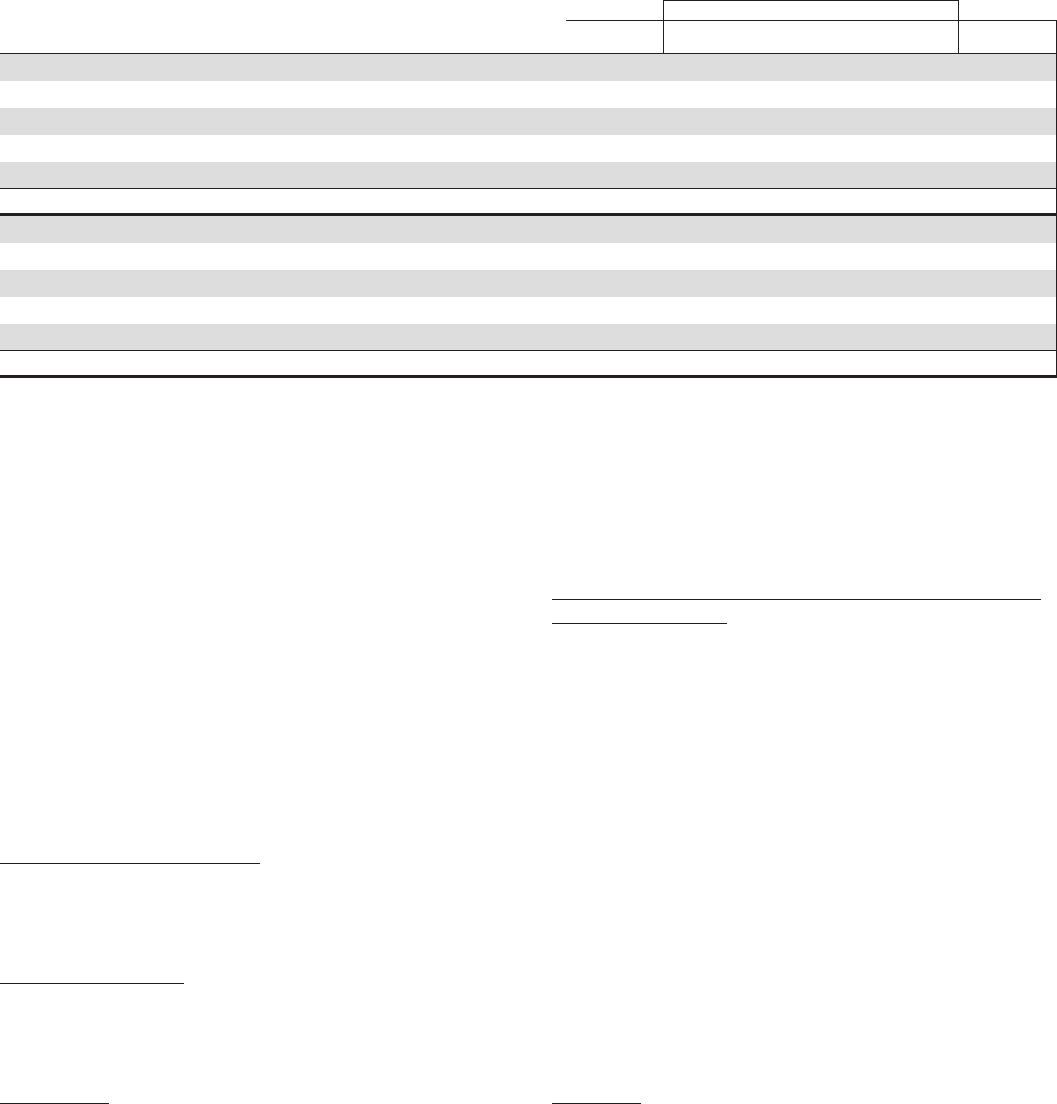

Table 66: Commercial Lending Asset Quality Indicators (a)

Criticized Commercial Loans

In millions

Pass

Rated (b)

Special

Mention (c) Substandard (d) Doubtful (e)

Total

Loans

December 31, 2012

Commercial $ 78,048 $1,939 $2,600 $145 $ 82,732

Commercial real estate 14,898 804 1,802 210 17,714

Equipment lease financing 7,062 68 112 5 7,247

Purchased impaired loans 49 60 852 288 1,249

Total commercial lending (f) $100,057 $2,871 $5,366 $648 $108,942

December 31, 2011

Commercial $ 60,649 $1,831 $2,817 $257 $ 65,554

Commercial real estate 11,478 791 2,823 400 15,492

Equipment lease financing 6,210 48 153 5 6,416

Purchased impaired loans 107 35 542 168 852

Total commercial lending (f) $ 78,444 $2,705 $6,335 $830 $ 88,314

(a) Based upon PDs and LGDs.

(b) Pass Rated loans include loans not classified as “Special Mention”, “Substandard”, or “Doubtful”.

(c) Special Mention rated loans have a potential weakness that deserves management’s close attention. If left uncorrected, these potential weaknesses may result in deterioration of

repayment prospects at some future date. These loans do not expose us to sufficient risk to warrant a more adverse classification at this time.

(d) Substandard rated loans have a well-defined weakness or weaknesses that jeopardize the collection or liquidation of debt. They are characterized by the distinct possibility that we will

sustain some loss if the deficiencies are not corrected.

(e) Doubtful rated loans possess all the inherent weaknesses of a Substandard rated loan with the additional characteristics that the weakness makes collection or liquidation in full

improbable due to existing facts, conditions, and values.

(f) Loans are included above based on their contractual terms as “Pass”, “Special Mention”, “Substandard” or “Doubtful”.

C

ONSUMER

L

ENDING

A

SSET

C

LASSES

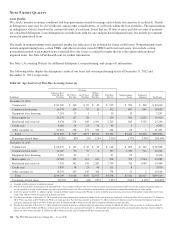

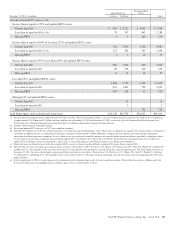

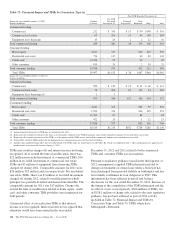

Home Equity and Residential Real Estate Loan Classes

We use several credit quality indicators, including

delinquency information, nonperforming loan information,

updated credit scores, originated and updated LTV ratios, and

geography, to monitor and manage credit risk within the home

equity and residential real estate loan classes. We evaluate

mortgage loan performance by source originators and loan

servicers. A summary of asset quality indicators follows:

Delinquency/Delinquency Rates: We monitor trending of

delinquency/delinquency rates for home equity and residential

real estate loans. See the Asset Quality section of this Note 5

for additional information.

Nonperforming Loans: We monitor trending of

nonperforming loans for home equity and residential real

estate loans. See the Asset Quality section of this Note 5 for

additional information.

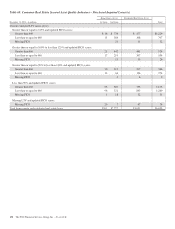

Credit Scores: We use a national third-party provider to

update FICO credit scores for home equity loans and lines of

credit and residential real estate loans on at least a quarterly

basis. The updated scores are incorporated into a series of

credit management reports, which are utilized to monitor the

risk in the loan classes.

LTV (inclusive of combined loan-to-value (CLTV) ratios for

second lien positions): At least semi-annually, we update the

property values of real estate collateral and calculate an

updated LTV ratio. For open-end credit lines secured by real

estate in regions experiencing significant declines in property

values, more frequent valuations may occur. We examine

LTV migration and stratify LTV into categories to monitor the

risk in the loan classes.

Historically, we used, and we continue to use, a combination

of original LTV and updated LTV for internal risk

management reporting and risk management purposes (e.g.,

line management, loss mitigation strategies). In addition to the

fact that estimated property values by their nature are

estimates, given certain data limitations it is important to note

that updated LTVs may be based upon management’s

assumptions (e.g., if an updated LTV is not provided by the

third-party service provider, home price index (HPI) changes

will be incorporated in arriving at management’s estimate of

updated LTV).

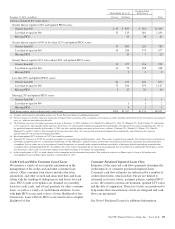

Geography: Geographic concentrations are monitored to

evaluate and manage exposures. Loan purchase programs are

sensitive to, and focused within, certain regions to manage

geographic exposures and associated risks.

The PNC Financial Services Group, Inc. – Form 10-K 149