PNC Bank 2012 Annual Report Download - page 85

Download and view the complete annual report

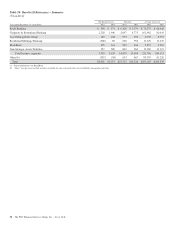

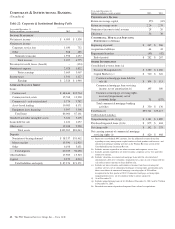

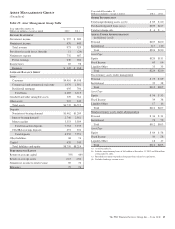

Please find page 85 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset Management Group earned $145 million in 2012

compared with $168 million in 2011. Revenue increased $44

million in the year over year comparison as strong sales and

higher average equity markets increased noninterest income

by 4% and higher average deposit balances increased net

interest income by 6%. The revenue increase was offset by

higher noninterest expense from strategic business

investments and higher provision for credit losses. During

2012 the business continued to focus on client acquisition and

asset and revenue growth.

The core growth strategies for the business continue to

include: investing in higher growth geographies including the

Southeast region, increasing internal referral sales and adding

new front line sales staff throughout our footprint. For 2012,

the business delivered strong sales production, grew high

value clients and benefited from significant referrals from

other PNC lines of business. Over time, the successful

execution of these strategies and the accumulation of our

strong sales performance are expected to create meaningful

growth in assets under management and noninterest income.

Highlights of Asset Management Group’s performance during

2012 include the following:

• Assets under administration of $224 billion with

positive net flows of $2.5 billion in discretionary

assets under management after adjustments to total

net flows for cyclical client activities,

• Strong sales production, up 32% over the prior year

including a 37% increase in the acquisition of new

primary clients,

• Significant referrals from other PNC lines of

business, reflecting an increase of approximately

39% over 2011,

• Continuing levels of new business investment and

focused hiring to drive growth, with over 360

external new hires, and

• PNC Wealth Insight®was awarded a “2012 CIO 100

Award” by CIO Magazine. The online client

reporting tool now enables clients to view their PNC

Investments brokerage accounts and access all client

information through a mobile application that

supports a number of smartphone platforms.

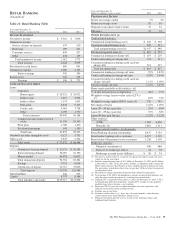

Assets under administration increased to $224 billion at

December 31, 2012 from $210 billion at December 31, 2011.

Discretionary assets under management were $112 billion at

December 31, 2012 compared with $107 billion at

December 31, 2011. The increase in the comparisons was

driven by stronger average equity markets, positive net flows,

and strong sales performance.

Total revenue for 2012 was $973 million compared with $929

million for 2011. Noninterest income was $676 million for

2012, an increase of $27 million from the prior year

attributable to stronger average equity markets, increased sales

and new client acquisition. Net interest income was $297

million for 2012 compared with $280 million for 2011. The

increase was primarily a result of growth in transaction

deposit balances.

Provision for credit losses of $11 million in 2012 increased

$35 million compared to a benefit of $24 million for 2011.

Noninterest expense was $732 million in 2012, an increase of

$45 million, or 7%, from the prior year. The increase was

attributable to investments in the business including the

Southeast region and higher compensation-related costs. Asset

Management Group remains focused on disciplined expense

management as it invests in these strategic growth

opportunities.

Average deposits of $8.3 billion for 2012 increased $461

million, or 6%, over the prior year. Average transaction

deposits grew 8% compared with 2011 and were partially

offset by the strategic run-off of maturing certificates of

deposit in the comparison.

Average loan balances of $6.2 billion increased $72 million,

or 1%, from the prior year primarily due to increased

consumer loan activity partially offset by decreases in

commercial and commercial real estate loans.

66 The PNC Financial Services Group, Inc. – Form 10-K