PNC Bank 2012 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

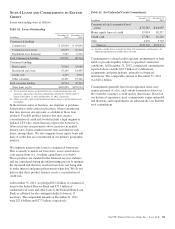

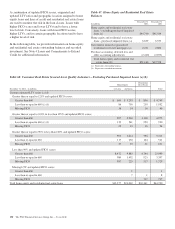

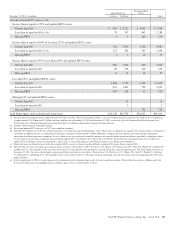

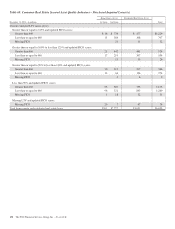

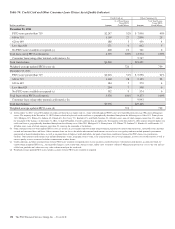

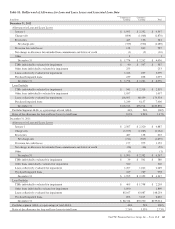

Home Equity (b) (c) (f)

Residential Real

Estate (b) (c)

December 31, 2011 - in millions 1st Liens 2nd Liens Total

Current estimated LTV ratios (d) (e)

Greater than or equal to 125% and updated FICO scores:

Greater than 660 $ 15 $ 833 $ 361 $1,209

Less than or equal to 660 15 513 681 1,209

Missing FICO 23 38 61

Greater than or equal to 100% to less than 125% and updated FICO scores:

Greater than 660 17 509 229 755

Less than or equal to 660 16 286 375 677

Missing FICO 19 7 26

Greater than or equal to 90% to less than 100% and updated FICO scores:

Greater than 660 10 127 116 253

Less than or equal to 660 11 79 208 298

Missing FICO 549

Less than 90% and updated FICO scores:

Greater than 660 46 423 404 873

Less than or equal to 660 72 366 679 1,117

Missing FICO 117 22 40

Missing LTV and updated FICO scores:

Greater than 660 11

Less than or equal to 660 112

Missing FICO 123

Total home equity and residential real estate loans $203 $3,202 $3,128 $6,533

(a) Amounts shown represent outstanding balance. See Note 6 Purchased Loans for additional information.

(b) For the estimate of cash flows utilized in our purchased impaired loan accounting, other assumptions and estimates are made, including amortization of first lien balances, pre-payment

rates, etc., which are not reflected in this table.

(c) The following states have the highest percentage of loans at December 31, 2012: California 21%, Florida 14%, Illinois 11%, Ohio 7%, Michigan 5%, North Carolina 5% and Georgia

at 5%, respectively. The remainder of the states have lower than a 4% concentration of purchased impaired loans individually, and collectively they represent approximately 32% of

the purchased impaired portfolio. At December 31, 2011, the states with the highest percentage of loans were as follows: California 22%, Florida 13%, Illinois 12%, Ohio 9%,

Michigan 5% and New York 4%. The remainder of the states have lower than a 4% concentration of purchased impaired loans individually, and collectively they represent

approximately 35% of the purchased impaired portfolio.

(d) Based upon updated LTV (inclusive of CLTV for second lien positions).

(e) Updated LTV (inclusive of CLTV for second lien positions) are estimated using modeled property values. These ratios are updated semi-annually. The related estimates and inputs are

based upon an approach that uses a combination of third-party AVMs, HPI indices, property location, internal and external balance information, origination data and management

assumptions. In cases where we are in an originated second lien position, we generally utilize origination balances provided by a third-party which do not include an amortization

assumption when calculating updated LTV. Accordingly, the results of these calculations do not represent actual appraised loan level collateral or updated LTV based upon a current

first lien balance, and as such, are necessarily imprecise and subject to change as we enhance our methodology.

(f) In the second quarter of 2012, we made changes to the assumptions used to determine lien position. This resulted in a decrease in Home equity 1st liens of $65 million and a

corresponding increase in Home equity 2nd liens as of December 31, 2011.

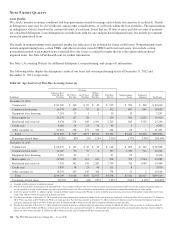

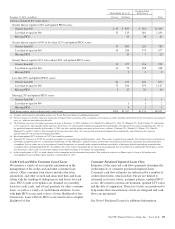

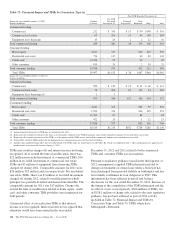

Credit Card and Other Consumer Loan Classes

We monitor a variety of asset quality information in the

management of the credit card and other consumer loan

classes. Other consumer loan classes include education,

automobile, and other secured and unsecured lines and loans.

Along with the trending of delinquencies and losses for each

class, FICO credit score updates are obtained on a monthly

basis for credit cards, and at least quarterly for other consumer

loans, as well as a variety of credit bureau attributes. Loans

with high FICO scores tend to have a lower likelihood of loss.

Conversely, loans with low FICO scores tend to have a higher

likelihood of loss.

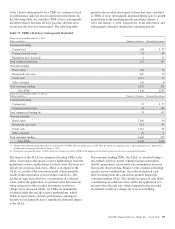

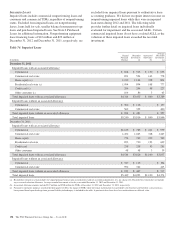

Consumer Purchased Impaired Loans Class

Estimates of the expected cash flows primarily determine the

credit impacts of consumer purchased impaired loans.

Consumer cash flow estimates are influenced by a number of

credit related items, which include, but are not limited to:

estimated real estate values, payment patterns, updated FICO

scores, the current economic environment, updated LTV ratios

and the date of origination. These key factors are monitored to

help ensure that concentrations of risk are mitigated and cash

flows are maximized.

See Note 6 Purchased Loans for additional information.

The PNC Financial Services Group, Inc. – Form 10-K 153