PNC Bank 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

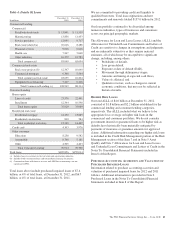

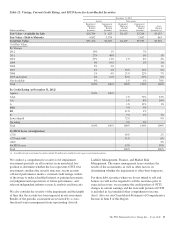

Table 3: Summarized Balance Sheet Data

In millions

December 31

2012

December 31

2011

Assets

Loans $185,856 $159,014

Investment securities 61,406 60,634

Cash and short-term investments 12,763 9,992

Loans held for sale 3,693 2,936

Goodwill and other intangible assets 10,869 10,144

Equity investments 10,877 10,134

Other, net 19,643 18,351

Total assets $305,107 $271,205

Liabilities

Deposits $213,142 $187,966

Borrowed funds

Commercial paper 8,453 4,271

Other 32,454 32,433

Other 9,293 9,289

Total liabilities 263,342 233,959

Total shareholders’ equity 39,003 34,053

Noncontrolling interests 2,762 3,193

Total equity 41,765 37,246

Total liabilities and equity $305,107 $271,205

The summarized balance sheet data above is based upon the

Consolidated Balance Sheet in Item 8 of this Report.

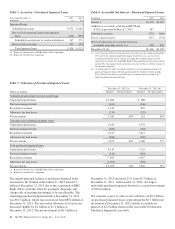

The increase in total assets of $33.9 billion at December 31,

2012 compared with December 31, 2011 was primarily due to

the addition of assets from the RBC Bank (USA) acquisition

and organic loan growth. Total liabilities increased $29.4

billion at December 31, 2012 compared with December 31,

2011 primarily due to the addition of deposits from the RBC

Bank (USA) acquisition, organic growth in transaction

deposits, and higher commercial paper and Federal Home

Loan Bank borrowings, partially offset by the maturity of

retail certificates of deposit and lower bank notes and senior

and subordinated debt.

An analysis of changes in selected balance sheet categories

follows.

L

OANS

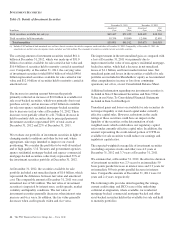

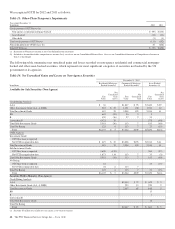

A summary of the major categories of loans outstanding

follows. Outstanding loan balances of $185.9 billion at

December 31, 2012 and $159.0 billion at December 31, 2011

were net of unearned income, net deferred loan fees,

unamortized discounts and premiums, and purchase discounts

and premiums of $2.7 billion at December 31, 2012 and $2.3

billion at December 31, 2011, respectively. The balances

include purchased impaired loans but do not include future

accretable net interest (i.e., the difference between the

undiscounted expected cash flows and the carrying value of

the loan) on those loans.

Loans increased $26.9 billion as of December 31, 2012

compared with December 31, 2011. On March 2, 2012, our

RBC Bank (USA) acquisition added $14.5 billion of loans,

which included $6.3 billion of commercial, $2.7 billion of

commercial real estate, $3.3 billion of consumer (including

$3.0 billion of home equity loans and $.3 billion of credit card

loans), $2.1 billion of residential real estate, and $.1 billion of

equipment lease financing loans. Excluding acquisition

activity, the increase in commercial loans was due to growth

primarily in asset-based lending, real estate, healthcare, and

public finance loans while the growth in consumer loans was

primarily driven by organic growth in automobile loans and

the acquisition of an indirect automobile loan portfolio in the

third quarter, partially offset by lower education loans. In

addition, excluding acquisition activity, residential real estate

loans declined due to continued run-off.

Loans represented 61% of total assets at December 31, 2012

and 59% of total assets at December 31, 2011. Commercial

lending represented 59% of the loan portfolio at December 31,

2012 and 56% at December 31, 2011. Consumer lending

represented 41% of the loan portfolio at December 31, 2012

and 44% at December 31, 2011.

Commercial real estate loans represented 6% of total assets at

both December 31, 2012 and December 31, 2011.

42 The PNC Financial Services Group, Inc. – Form 10-K