PNC Bank 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investment Securities

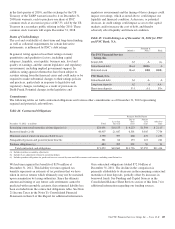

The carrying amount of investment securities totaled $60.6

billion at December 31, 2011, a decrease of $3.6 billion, or

6%, from $64.3 billion at December 31, 2010. The decline

resulted from principal payments and net sales activity related

to US Treasury and government agency and non-agency

residential mortgage-backed securities. Investment securities

represented 22% of total assets at December 31, 2011 and

24% of total assets at December 31, 2010.

Average investment securities increased $1.7 billion, to $59.7

billion, in 2011 compared with 2010. Average securities held

to maturity increased $2.3 billion, to $9.4 billion, in 2011

compared to 2010. This increase was partially offset by the

decrease in average securities available for sale of $.6 billion,

to $50.3 billion, in 2011 compared with 2010. The increase in

average securities held to maturity was primarily a result of

transfers totaling $6.3 billion from securities available for sale

to securities held to maturity during the second and third

quarters of 2011. The transfers were completed in order to

reduce the impact of price volatility on accumulated other

comprehensive income and certain capital measures, and

considered potential changes to regulatory capital

requirements under the proposed Basel III capital standards.

At December 31, 2011, the securities available for sale

portfolio included a net unrealized loss of $41 million, which

represented the difference between fair value and amortized

cost. The comparable amount at December 31, 2010 was a net

unrealized loss of $861 million. The expected weighted-

average life of investment securities (excluding corporate

stocks and other) was 3.7 years at December 31, 2011 and 4.7

years at December 31, 2010.

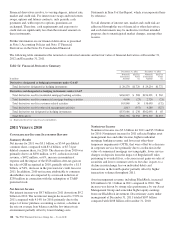

Loans Held For Sale

Loans held for sale totaled $2.9 billion at December 31, 2011

compared with $3.5 billion at December 31, 2010. We stopped

originating commercial mortgage loans held for sale

designated at fair value in 2008 and have pursued

opportunities to reduce these positions at appropriate prices.

At December 31, 2011, the balance relating to these loans was

$843 million, compared to $877 million at December 31,

2010. We sold $25 million in unpaid principal balances of

these commercial mortgage loans held for sale carried at fair

value in 2011 and sold $241 million in 2010.

We sold $2.4 billion of commercial mortgages held for sale

carried at the lower of cost or market to government agencies

in 2011 compared to $2.1 billion in 2010. The increase in

these loans to $451 million at December 31, 2011, compared

to $330 million at December 31, 2010, was due to an increase

in loans awaiting sales to government agencies.

Residential mortgage loan origination volume was $11.4

billion in 2011. Substantially all such loans were originated

under agency or FHA standards. We sold $11.9 billion of

loans and recognized related gains of $282 million during

2011. The comparable amounts for 2010 were $10.0 billion

and $231 million, respectively.

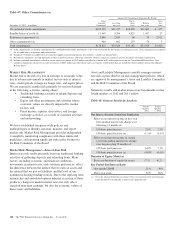

Asset Quality

Overall credit quality continued to improve during 2011.

Nonperforming assets declined $967 million, or 19%, to $4.2

billion as of December 31, 2011 from December 31, 2010.

Accruing loans past due increased $12 million, or less than

1%, during 2011 to $4.5 billion at year end primarily

attributable to government insured or guaranteed loans. Net

charge-offs declined significantly to $1.6 billion at

December 31, 2011, down 44% from 2010 net charge-offs of

$2.9 billion.

The ALLL was $4.3 billion, or 2.73% of total loans and 122%

of nonperforming loans, as of December 31, 2011.

At December 31, 2011, our largest nonperforming asset was

$28 million in the Accommodation and Food Services

Industry and our average nonperforming loan associated with

commercial lending was under $1 million.

Goodwill and Other Intangible Assets

Goodwill and other intangible assets totaled $10.1 billion at

December 31, 2011 and $10.8 billion at December, 31, 2010.

Goodwill increased $.1 billion, to $8.3 billion, at

December 31, 2011 compared with the December 31, 2010

balance primarily due to the BankAtlantic and Flagstar branch

acquisitions and the correction of amounts for an acquisition

affecting prior periods. The $.7 billion decline in other

intangible assets from December 31, 2010 included $.2 billion

and $.4 billion declines in commercial and residential

mortgage servicing rights, respectively.

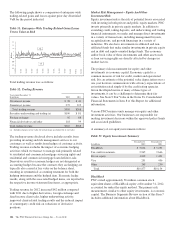

Funding Sources

Total funding sources were $224.7 billion at December 31,

2011 and $222.9 billion at December 31, 2010.

Total deposits increased $4.6 billion, or 2%, at December 31,

2011 compared with December 31, 2010 due to an increase in

money market and demand deposits, partially offset by net

redemptions of retail certificates of deposit.

Average total deposits were $183.0 billion for 2011 compared

with $181.9 billion for 2010. Average deposits remained

essentially flat from 2010 primarily as a result of decreases of

$8.9 billion in average retail certificates of deposit and $.8

billion in average time deposits in foreign offices and other

time, which were offset by increases of $6.6 billion in average

noninterest-bearing deposits, $2.5 billion in average interest-

bearing demand deposits and $1.2 billion in average savings

deposits.

Total borrowed funds decreased $2.8 billion to $36.7 billion at

December 31, 2011 compared to December 31, 2010. The

decline from December 31, 2010 was primarily due to

maturities of federal funds purchased and repurchase

agreements, bank notes and senior debt, and subordinated debt

partially offset by issuances of FHLB borrowings and senior

notes.

110 The PNC Financial Services Group, Inc. – Form 10-K