PNC Bank 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM

5–

MARKET FOR REGISTRANT

’

S COMMON

EQUITY

,

RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

(a) (1) Our common stock is listed on the New York Stock

Exchange and is traded under the symbol “PNC.” At the close

of business on February 15, 2013, there were 75,100 common

shareholders of record.

Holders of PNC common stock are entitled to receive

dividends when declared by the Board of Directors out of

funds legally available for this purpose. Our Board of

Directors may not pay or set apart dividends on the common

stock until dividends for all past dividend periods on any

series of outstanding preferred stock have been paid or

declared and set apart for payment. The Board presently

intends to continue the policy of paying quarterly cash

dividends. The amount of any future dividends will depend on

economic and market conditions, our financial condition and

operating results, and other factors, including contractual

restrictions and applicable government regulations and

policies (such as those relating to the ability of bank and non-

bank subsidiaries to pay dividends to the parent company and

regulatory capital limitations). The amount of our dividend is

also currently subject to the results of the Federal Reserve’s

2013 Comprehensive Capital Analysis and Review (CCAR) as

part of its supervisory assessment of capital adequacy

described under “Supervision and Regulation” in Item 1 of

this Report.

The Federal Reserve has the power to prohibit us from paying

dividends without its approval. For further information

concerning dividend restrictions and restrictions on loans,

dividends or advances from bank subsidiaries to the parent

company, see “Supervision and Regulation” in Item 1 of this

Report, “Funding and Capital Sources” in the Consolidated

Balance Sheet Review section, “Liquidity Risk Management”

in the Risk Management section, and “Trust Preferred

Securities” in the Off-Balance Sheet Arrangements And

Variable Interest Entities section of Item 7 of this Report, and

Note 14 Capital Securities of Subsidiary Trusts and Perpetual

Trust Securities and Note 22 Regulatory Matters in the Notes

To Consolidated Financial Statements in Item 8 of this Report,

which we include here by reference.

We include here by reference additional information relating

to PNC common stock under the caption “Common Stock

Prices/Dividends Declared” in the Statistical Information

(Unaudited) section of Item 8 of this Report.

We include here by reference the information regarding our

compensation plans under which PNC equity securities are

authorized for issuance as of December 31, 2012 in the table

(with introductory paragraph and notes) that appears in

Item 12 of this Report.

Our registrar, stock transfer agent, and dividend disbursing

agent is:

Computershare Trust Company, N.A.

250 Royall Street

Canton, MA 02021

800-982-7652

We include here by reference the information that appears

under the caption “Common Stock Performance Graph” at the

end of this Item 5.

(a)(2) None.

(b) Not applicable.

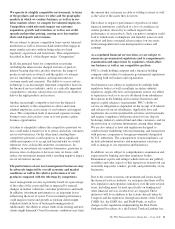

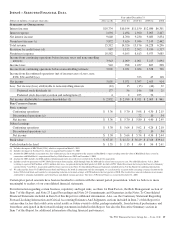

(c) Details of our repurchases of PNC common stock

during the fourth quarter of 2012 are included in the

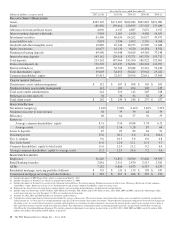

following table:

In thousands, except per share data

2012 period (a)

Total shares

purchased (b)

Average

price

paid per

share

Total shares

purchased as

part of

publicly

announced

programs (c)

Maximum

number of

shares that

may yet be

purchased

under the

programs (c)

October 1 – 31 13 $60.05 22,552

November 1 – 30 750 $55.08 750 21,802

December 1 – 31 292 $55.74 251 21,551

Total 1,055 $55.32 1,001

(a) In addition to the repurchases of PNC common stock during the fourth quarter of

2012 included in the table above, PNC redeemed all 5,001 shares of its Series M

Preferred Stock on December 10, 2012 as further described below.

As part of the National City transaction, we established the PNC Non-Cumulative

Perpetual Preferred Stock, Series M (the “Series M Preferred Stock”), which

mirrored in all material respects the former National City Non-Cumulative Perpetual

Preferred Stock, Series E. On December 10, 2012, PNC issued $500.1 million

aggregate liquidation amount (5,001 shares) of the Series M Preferred Stock to the

National City Preferred Capital Trust I (the “Trust”) as required pursuant to the

settlement of a Stock Purchase Contract Agreement between the Trust and PNC

dated as of January 30, 2008. Immediately upon such issuance, PNC redeemed all

5,001 shares of the Series M Preferred Stock from the Trust on December 10, 2012

at a redemption price equal to $100,000 per share.

(b) Includes PNC common stock purchased under the program referred to in note (c) to

this table and PNC common stock purchased in connection with our various

employee benefit plans. Note 15 Employee Benefit Plans and Note 16 Stock Based

Compensation Plans in the Notes To Consolidated Financial Statements in Item 8 of

this Report include additional information regarding our employee benefit plans that

use PNC common stock.

(c) Our current stock repurchase program allows us to purchase up to 25 million shares

on the open market or in privately negotiated transactions. This program was

authorized on October 4, 2007 and will remain in effect until fully utilized or until

modified, superseded or terminated. The extent and timing of share repurchases

under this program will depend on a number of factors including, among others,

market and general economic conditions, economic capital and regulatory capital

considerations, alternative uses of capital, the potential impact on our credit ratings,

and contractual and regulatory limitations, including the impact of the Federal

Reserve’s supervisory assessment of capital adequacy program.

The PNC Financial Services Group, Inc. – Form 10-K 27