PNC Bank 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

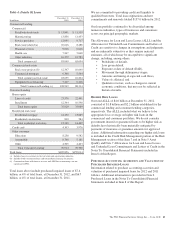

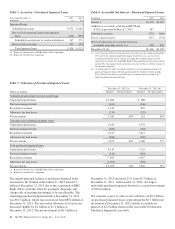

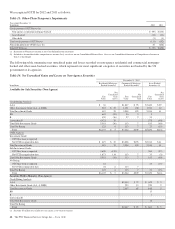

Table 5: Accretion – Purchased Impaired Loans

Year ended December 31

In millions

2012

(a)

2011

(b)

Impaired loans

Scheduled accretion $ 671 $ 666

Reversal of contractual interest on impaired

loans (404) (395)

Scheduled accretion net of contractual interest 267 271

Excess cash recoveries 157 254

Total impaired loans $ 424 $ 525

(a) Represents National City and RBC Bank (USA) acquisitions.

(b) Represents National City acquisition.

Table 6: Accretable Net Interest – Purchased Impaired Loans

In millions 2012 2011

January 1 $2,109 $2,185

Addition of accretable yield due to RBC Bank

(USA) acquisition on March 2, 2012 587

Scheduled accretion (671) (666)

Excess cash recoveries (157) (254)

Net reclassifications to accretable from non-

accretable and other activity (a) 298 844

December 31 (b) $2,166 $2,109

(a) Over 85 percent of the net reclassifications were driven by the commercial portfolio.

Over half of the commercial portfolio impact related to excess cash recoveries

recognized during the period, with the remaining due to improvements of cash

expected to be collected on both RBC Bank (USA) and National City loans in future

periods. The remaining net reclassifications were due to future cash flow changes in

the consumer portfolio.

(b) As of December 31, 2012 we estimate that the reversal of contractual interest on

purchased impaired loans will total approximately $1.2 billion in future periods.

This will offset the total net accretable interest in future interest income of $2.2

billion on purchased impaired loans.

Table 7: Valuation of Purchased Impaired Loans

December 31, 2012 (a) December 31, 2011 (b)

Dollars in millions Balance Net Investment Balance Net Investment

Commercial and commercial real estate loans:

Unpaid principal balance $ 1,680 $ 988

Purchased impaired mark (431) (136)

Recorded investment 1,249 852

Allowance for loan losses (239) (229)

Net investment 1,010 60% 623 63%

Consumer and residential mortgage loans:

Unpaid principal balance 6,639 6,533

Purchased impaired mark (482) (718)

Recorded investment 6,157 5,815

Allowance for loan losses (858) (769)

Net investment 5,299 80% 5,046 77%

Total purchased impaired loans:

Unpaid principal balance 8,319 7,521

Purchased impaired mark (913) (854)

Recorded investment 7,406 6,667

Allowance for loan losses (1,097) (998)

Net investment $ 6,309 76% 5,669 75%

(a) Represents National City and RBC Bank (USA) acquisitions.

(b) Represents National City acquisition.

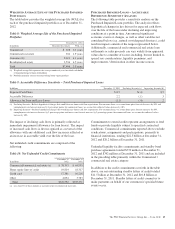

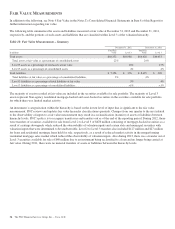

The unpaid principal balance of purchased impaired loans

increased to $8.3 billion at December 31, 2012 from $7.5

billion at December 31, 2011 due to the acquisition of RBC

Bank (USA), partially offset by payments, disposals, and

charge-offs of amounts determined to be uncollectible. The

remaining purchased impaired mark at December 31, 2012

was $913 million, which was an increase from $854 million at

December 31, 2011. The associated allowance for loan losses

increased slightly by $.1 billion to $1.1 billion at

December 31, 2012. The net investment of $6.3 billion at

December 31, 2012 increased 11% from $5.7 billion at

December 31, 2011. At December 31, 2012, our largest

individual purchased impaired loan had a recorded investment

of $18.6 million.

We currently expect to collect total cash flows of $8.5 billion

on purchased impaired loans, representing the $6.3 billion net

investment at December 31, 2012 and the accretable net

interest of $2.2 billion shown in the Accretable Net Interest-

Purchased Impaired Loans table.

44 The PNC Financial Services Group, Inc. – Form 10-K