PNC Bank 2012 Annual Report Download - page 226

Download and view the complete annual report

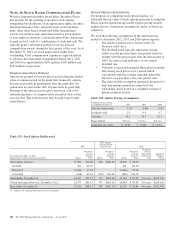

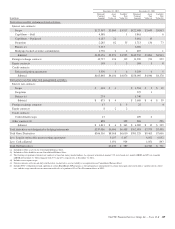

Please find page 226 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Included in the customer, mortgage banking risk management,

and other risk management portfolios are written interest-rate

caps and floors entered into with customers and for risk

management purposes. We receive an upfront premium from

the counterparty and are obligated to make payments to the

counterparty if the underlying market interest rate rises above

or falls below a certain level designated in the contract. Our

ultimate obligation under written options is based on future

market conditions and is only quantifiable at settlement.

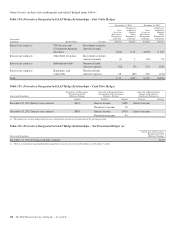

In connection with sales of a portion of our Visa Class B

common shares in 2012, we entered into swap agreements

with the purchaser in which we will make or receive payments

based on subsequent changes in the conversion rate of Class B

into Class A common shares and to make payments calculated

by reference to the market price of the Class A common

shares. The fair value of the swaps, included in Other

liabilities on our Consolidated Balance Sheet, was $43 million

at December 31, 2012.

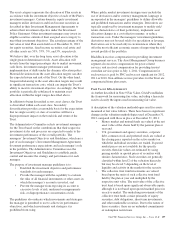

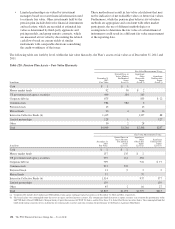

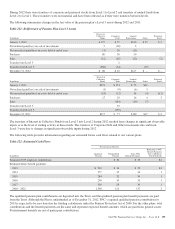

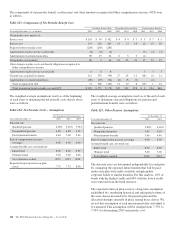

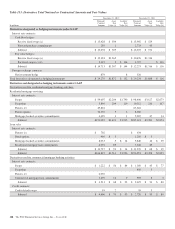

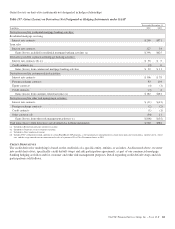

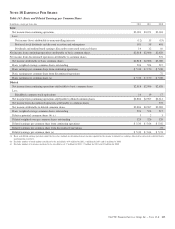

Further detail regarding the derivatives not designated in

hedging relationships is presented in the tables that follow.

D

ERIVATIVE

C

OUNTERPARTY

C

REDIT

R

ISK

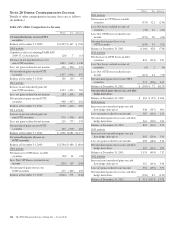

By entering into derivative contracts we are exposed to credit

risk. We seek to minimize credit risk through internal credit

approvals, limits, monitoring procedures, executing master

netting agreements and collateral requirements. We generally

enter into transactions with counterparties that carry high

quality credit ratings. Nonperformance risk including credit

risk is included in the determination of the estimated net fair

value.

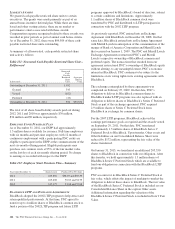

We generally have established agreements with our major

derivative dealer counterparties that provide for exchanges of

marketable securities or cash to collateralize either party’s

positions. At December 31, 2012, we held cash, U.S.

government securities and mortgage-backed securities totaling

$1.2 billion under these agreements. We pledged cash and

U.S. government securities of $978 million under these

agreements. To the extent not netted against derivative fair

values under a master netting agreement, the receivable for

cash pledged is included in Other assets and the obligation for

cash held is included in Other borrowed funds on our

Consolidated Balance Sheet.

The credit risk associated with derivatives executed with

customers is essentially the same as that involved in extending

loans and is subject to normal credit policies. We may obtain

collateral based on our assessment of the customer’s credit

quality.

We periodically enter into risk participation agreements to

share some of the credit exposure with other counterparties

related to interest rate derivative contracts or to take on credit

exposure to generate revenue. We will make/receive payments

under these agreements if a customer defaults on its obligation

to perform under certain derivative swap contracts. Risk

participation agreements are included in the derivatives table

that follows. Our exposure related to risk participations where

we sold protection is discussed in the Credit Derivatives

section below.

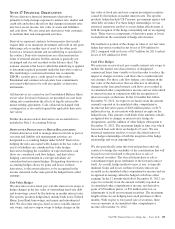

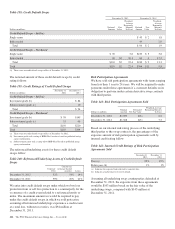

C

ONTINGENT

F

EATURES

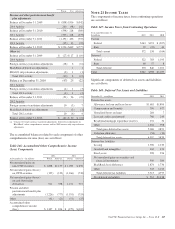

Some of PNC’s derivative instruments contain provisions that

require PNC’s debt to maintain an investment grade credit

rating from each of the major credit rating agencies. If PNC’s

debt ratings were to fall below investment grade, it would be

in violation of these provisions, and the counterparties to the

derivative instruments could request immediate payment or

demand immediate and ongoing full overnight

collateralization on derivative instruments in net liability

positions.

The aggregate fair value of all derivative instruments with

credit-risk-related contingent features that were in a net

liability position on December 31, 2012 was $1.1 billion for

which PNC had posted collateral of $942 million in the

normal course of business. The maximum amount of collateral

PNC would have been required to post if the credit-risk-

related contingent features underlying these agreements had

been triggered on December 31, 2012, would be an additional

$139 million.

The PNC Financial Services Group, Inc. – Form 10-K 207