PNC Bank 2012 Annual Report Download - page 91

Download and view the complete annual report

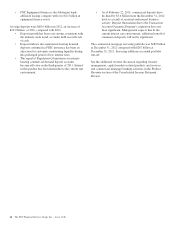

Please find page 91 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To the extent actual outcomes differ from our estimates,

additional provision for credit losses may be required that

would reduce future earnings. See the following for additional

information:

• Allowances For Loan And Lease Losses And

Unfunded Loan Commitments And Letters Of Credit

in the Credit Risk Management section of this Item 7

(which includes an illustration of the estimated

impact on the aggregate of the ALLL and allowance

for unfunded loan commitments and letters of credit

assuming we increased pool reserve loss rates for

certain loan categories), and

• Note 7 Allowances for Loan and Lease Losses and

Unfunded Loan Commitments and Letters of Credit

in the Notes To Consolidated Financial Statements

and Allocation Of Allowance For Loan And Lease

Losses in the Statistical Information (Unaudited)

section of Item 8 of this Report.

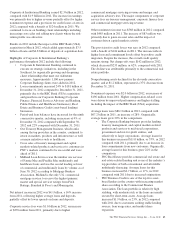

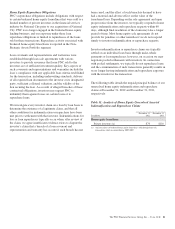

Estimated Cash Flows On Purchased Impaired Loans

ASC 310-30 Loans and Debt Securities Acquired with

Deteriorated Credit Quality (formerly SOP 03-3) provides the

GAAP guidance for accounting for certain loans. These loans

have experienced a deterioration of credit quality from

origination to acquisition for which it is probable that the

investor will be unable to collect all contractually required

payments receivable, including both principal and interest.

In our assessment of credit quality deterioration, we must

make numerous assumptions, interpretations and judgments,

using internal and third-party credit quality information to

determine whether it is probable that we will be able to collect

all contractually required payments. This point in time

assessment is inherently subjective due to the nature of the

available information and judgment involved.

Those loans that qualify under ASC 310-30 are recorded at

fair value at acquisition, which involves estimating the

expected cash flows to be received. Measurement of the fair

value of the loan is based on the provisions of ASC 820. ASC

310-30 prohibits the carryover or establishment of an

allowance for loan losses on the acquisition date.

Subsequent to the acquisition of the loan, we are required to

continue to estimate cash flows expected to be collected over

the life of the loan. The measurement of expected cash flows

involves assumptions and judgments as to credit risk, interest

rate risk, prepayment risk, default rates, loss severity, payment

speeds and collateral values. All of these factors are inherently

subjective and can result in significant changes in the cash

flow estimates over the life of the loan. Such changes in

expected cash flows could increase future earnings volatility

due to increases or decreases in the accretable yield (i.e., the

difference between the undiscounted expected cash flows and

the recorded investment in the loan). The accretable yield is

recognized as interest income on a constant effective yield

method over the life of the loan. In addition, changes in

expected cash flows could result in the recognition of

impairment through provision for credit losses if the decline in

expected cash flows is attributable to a decline in credit

quality.

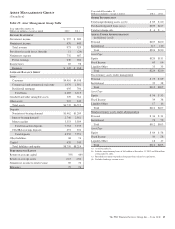

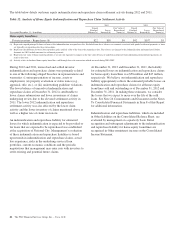

Goodwill

Goodwill arising from business acquisitions represents the

value attributable to unidentifiable intangible elements in the

business acquired. Most of our goodwill relates to value

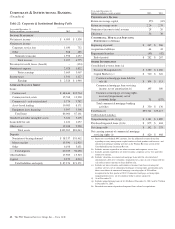

inherent in the Retail Banking and Corporate & Institutional

Banking businesses. The value of this goodwill is dependent

upon our ability to provide quality, cost-effective services in

the face of competition from other market participants on a

national and, with respect to some products and services, an

international basis. We also rely upon continuing investments

in processing systems, the development of value-added

service features, and the ease of access by customers to our

services.

As such, the value of goodwill is supported by earnings, which

is driven by transaction volume and, for certain businesses, the

market value of assets under administration or for which

processing services are provided. Lower earnings resulting

from a lack of growth or our inability to deliver cost-effective

services over sustained periods can lead to impairment of

goodwill, which could result in a current period charge to

earnings. At least annually, in the fourth quarter, or more

frequently if events occur or circumstances have changed

significantly from the annual test date, management reviews

the current operating environment and strategic direction of

each reporting unit taking into consideration any events or

changes in circumstances that may have an effect on the unit.

For this review, inputs are generated and used in calculating

the fair value of the reporting unit, which is compared to its

carrying amount (“Step 1” of the goodwill impairment test) as

further discussed below. The fair values of our reporting units

are determined using a discounted cash flow valuation model

with assumptions based upon market comparables.

Additionally, we may also evaluate certain financial metrics

that are indicative of fair value, including price to earnings

ratios and recent acquisitions involving other financial

institutions. A reporting unit is defined as an operating

segment or one level below an operating segment. If the fair

value of the reporting unit exceeds its carrying amount, the

reporting unit is not considered impaired. However, if the fair

value of the reporting unit is less than its carrying amount, the

reporting unit’s goodwill would be evaluated for impairment.

In this circumstance, the implied fair value of reporting unit

goodwill would be compared to the carrying amount of that

goodwill (“Step 2” of the goodwill impairment test). If the

carrying amount of goodwill exceeds the implied fair value of

goodwill, the difference is recognized as an impairment loss.

The implied fair value of reporting unit goodwill is

determined by assigning the fair value of a reporting unit to its

assets and liabilities (including any unrecognized intangible

assets) with the residual amount equal to the implied fair value

of goodwill as if the reporting unit had been acquired in a

business combination.

72 The PNC Financial Services Group, Inc. – Form 10-K