PNC Bank 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

borrower performance under the trial payment period, we will

capitalize the original contractual amount past due and

restructure the loan’s contractual terms, along with bringing

the restructured account to current. As the borrower is often

already delinquent at the time of participation in the HAMP

trial payment period, there is not a significant increase in the

ALLL. If the trial payment period is unsuccessful, the loan

will be evaluated for further action based upon our existing

policies.

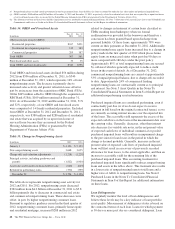

Residential conforming and certain residential construction

loans have been permanently modified under HAMP or, if

they do not qualify for a HAMP modification, under PNC-

developed programs, which in some cases may operate

similarly to HAMP. These programs first require a reduction

of the interest rate followed by an extension of term and, if

appropriate, deferral of principal payments. As of

December 31, 2012 and December 31, 2011, 4,188 accounts

with a balance of $627 million and 2,701 accounts with a

balance of $478 million, respectively, of residential real estate

loans have been modified under HAMP and were still

outstanding on our balance sheet.

We do not re-modify a defaulted modified loan except for

subsequent significant life events. A re-modified loan

continues to be classified as a TDR for the remainder of its

term regardless of subsequent payment performance.

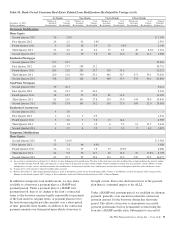

Commercial Loan Modifications and Payment Plans

Modifications of terms for large commercial loans are based

on individual facts and circumstances. Commercial loan

modifications may involve reduction of the interest rate,

extension of the term of the loan and/or forgiveness of

principal. Modified large commercial loans are usually

already nonperforming prior to modification. We evaluate

these modifications for TDR classification based upon

whether we granted a concession to a borrower experiencing

financial difficulties. Additional detail on TDRs is discussed

below as well as in Note 5 Asset Quality in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

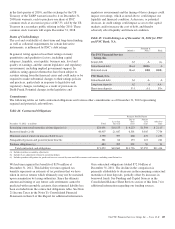

Beginning in 2010, we established certain commercial loan

modification and payment programs for small business loans,

Small Business Administration loans, and investment real

estate loans. As of December 31, 2012 and December 31,

2011, $68 million and $81 million, respectively, in loan

balances were covered under these modification and payment

plan programs. Of these loan balances, $24 million have been

determined to be TDRs as of both December 31, 2012 and

December 31, 2011.

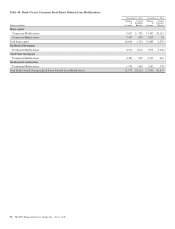

Troubled Debt Restructurings

A TDR is a loan whose terms have been restructured in a

manner that grants a concession to a borrower experiencing

financial difficulties. TDRs typically result from our loss

mitigation activities and include rate reductions, principal

forgiveness, postponement/reduction of scheduled

amortization, extensions, and bankruptcy discharges from

personal liability, which are intended to minimize economic

loss and to avoid foreclosure or repossession of collateral. For

the year ended December 31, 2012, $3.1 billion of loans held

for sale, loans accounted for under the fair value option,

pooled purchased impaired loans, as well as certain consumer

government insured or guaranteed loans which were evaluated

for TDR consideration, are not classified as TDRs. The

comparable amount for the year ended December 31, 2011

was $2.7 billion.

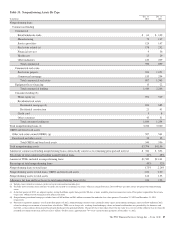

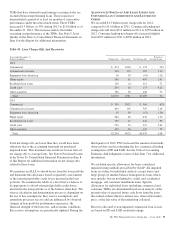

Table 42: Summary of Troubled Debt Restructurings

In millions

Dec. 31

2012

Dec. 31

2011

Consumer lending:

Real estate-related $2,028 $1,492

Credit card (a) 233 291

Other consumer 57 15

Total consumer lending (b) 2,318 1,798

Total commercial lending 541 405

Total TDRs $2,859 $2,203

Nonperforming $1,589 $1,141

Accruing (c) 1,037 771

Credit card (a) 233 291

Total TDRs $2,859 $2,203

(a) Includes credit cards and certain small business and consumer credit agreements

whose terms have been restructured and are TDRs. However, since our policy is to

exempt these loans from being placed on nonaccrual status as permitted by

regulatory guidance as generally these loans are directly charged off in the period

that they become 180 days past due, these loans are excluded from nonperforming

loans.

(b) Pursuant to regulatory guidance issued in the third quarter of 2012, additional

troubled debt restructurings related to changes in treatment of certain loans of $366

million in 2012, net of charge-offs, resulting from bankruptcy where no formal

reaffirmation was provided by the borrower and therefore a concession has been

granted based upon discharge from personal liability were added to the consumer

lending population. The additional TDR population increased nonperforming loans

by $288 million. Charge-offs have been taken where the fair value less costs to sell

the collateral was less than the recorded investment of the loan and were $128.1

million. Of these nonperforming loans, approximately 78% were current on their

payments at December 31, 2012.

(c) Accruing loans have demonstrated a period of at least six months of performance

under the restructured terms and are excluded from nonperforming loans.

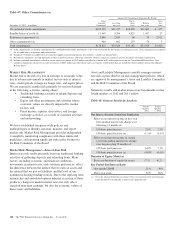

Total TDRs increased $656 million or 30% during the year

ended December 31, 2012 to $2.9 billion. Of this total,

nonperforming TDRs totaled $1.6 billion, which represents

approximately 49% of total nonperforming loans.

94 The PNC Financial Services Group, Inc. – Form 10-K