Citibank 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.80

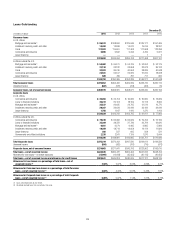

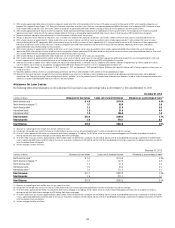

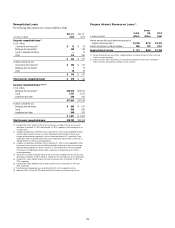

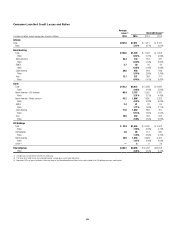

North America Consumer Mortgage Lending

Overview

Citi’s North America consumer mortgage portfolio consists of both

residential first mortgages and home equity loans. At December 31, 2014,

Citi’s North America consumer mortgage portfolio was $95.9 billion

(compared to $107.5 billion at December 31, 2013), of which the residential

first mortgage portfolio was $67.8 billion (compared to $75.9 billion at

December 31, 2013), and the home equity loan portfolio was $28.1 billion

(compared to $31.6 billion at December 31, 2013). At December 31,

2014, $34.4 billion of first mortgages was recorded in Citi Holdings, with

the remaining $33.4 billion recorded in Citicorp. At December 31, 2014,

$24.8 billion of home equity loans was recorded in Citi Holdings, with the

remaining $3.3 billion recorded in Citicorp.

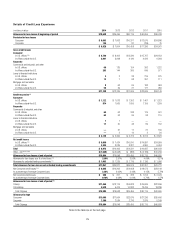

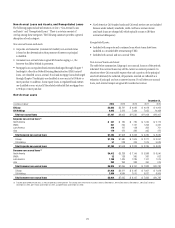

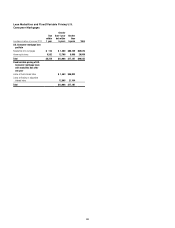

Citi’s residential first mortgage portfolio included $5.2 billion of loans

with FHA insurance or Department of Veterans Affairs (VA) guarantees

at December 31, 2014, compared to $7.7 billion at December 31, 2013.

The decline during the year was primarily attributed to approximately

$2.3 billion of mortgage loans with FHA insurance sold and transferred to

held-for-sale, including $0.9 billion during the fourth quarter of 2014. Citi’s

FHA/VA portfolio consists of loans to low-to-moderate-income borrowers

with lower FICO (Fair Isaac Corporation) scores and generally higher

loan-to-value ratios (LTVs). Credit losses on FHA loans are borne by the

sponsoring governmental agency, provided that the insurance terms have not

been rescinded as a result of an origination defect. With respect to VA loans,

the VA establishes a loan-level loss cap, beyond which Citi is liable for loss.

While FHA and VA loans have high delinquency rates, given the insurance

and guarantees, respectively, Citi has experienced negligible credit losses on

these loans.

In addition, Citi’s residential first mortgage portfolio included $0.8 billion

of loans with origination LTVs above 80% that have insurance through

mortgage insurance companies at December 31, 2014, compared to

$1.1 billion at December 31, 2013. At December 31, 2014, the residential

first mortgage portfolio also had $0.6 billion of loans subject to long-term

standby commitments (LTSCs) with U.S. government-sponsored entities

(GSEs) for which Citi has limited exposure to credit losses, compared to

$0.8 billion at December 31, 2013. At December 31, 2014, Citi’s home equity

loan portfolio also included $0.2 billion of loans subject to LTSCs with GSEs,

compared to $0.3 billion at December 31, 2013, for which Citi also has

limited exposure to credit losses. These guarantees and commitments may

be rescinded in the event of loan origination defects. Citi’s allowance for loan

loss calculations takes into consideration the impact of the guarantees and

commitments described above.

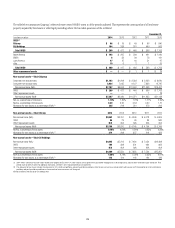

As of December 31, 2014, Citi’s North America residential first mortgage

portfolio contained approximately $3.8 billion of adjustable rate mortgages

that are currently required to make a payment consisting of only accrued

interest for the payment period, or an interest-only payment, compared to

$5.0 billion at December 31, 2013. This decline resulted primarily from

repayments, conversions to amortizing loans and loans sold/transferred

to held-for-sale. Residential first mortgages with this payment feature are

primarily to high-credit-quality borrowers who have on average significantly

higher origination and refreshed FICO scores than other loans in the

residential first mortgage portfolio, and have exhibited significantly lower

30+ delinquency rates as compared with residential first mortgages without

this payment feature. As such, Citi does not believe the residential mortgage

loans with this payment feature represent substantially higher risk in

the portfolio.

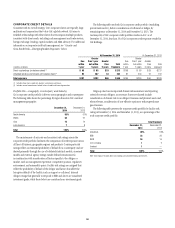

Citi does not offer option-adjustable rate mortgages/negative-amortizing

mortgage products to its customers. As a result, option-adjustable rate

mortgages/negative-amortizing mortgages represent an insignificant portion

of total balances, since they were acquired only incidentally as part of prior

portfolio and business purchases.