Citibank 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

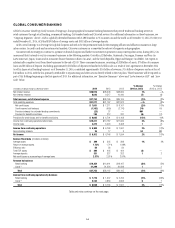

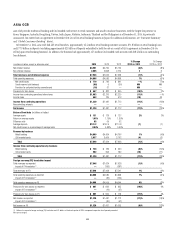

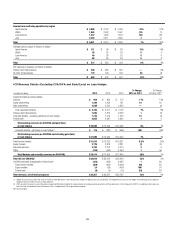

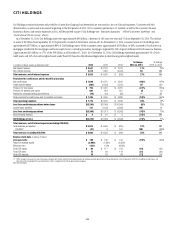

The discussion of the results of operations for Asia GCB below excludes the impact of FX translation for all periods presented. Presentations of the results

of operations, excluding the impact of FX translation, are non-GAAP financial measures. Citi believes the presentation of Asia GCB’s results excluding

the impact of FX translation is a more meaningful depiction of the underlying fundamentals of the business. For a reconciliation of certain of these

metrics to the reported results, see the table above.

2014 vs. 2013

Net income decreased 9%, primarily due to higher expenses, partially offset

by lower credit costs and higher revenues.

Revenues increased 1%, as higher non-interest revenue was partially

offset by a decline in net interest revenue. Non-interest revenue increased

5%, primarily driven by higher fee revenues (largely due to the previously

disclosed distribution agreement that commenced during the first quarter of

2014), partially offset by a decline in investment sales revenues. Net interest

revenue declined 2%, driven by the ongoing impact of regulatory changes,

continued spread compression and the repositioning of the franchise

in Korea.

Retail banking revenues increased 2%, due to the higher insurance

fee revenues, partially offset by lower investment sales revenues and the

repositioning of the franchise in Korea. Investment sales revenues decreased

2%, due to weaker investor sentiment reflecting overall market trends and

strong prior year performance, particularly in the first half of 2013. Citi

expects investment sales revenues will continue to reflect the overall capital

markets environment in the region, including seasonal trends. Average

retail deposits increased 1% (2% excluding Korea) and average retail loans

increased 7% (9% excluding Korea).

Cards revenues decreased 1%, due to the impact of regulatory changes,

particularly in Korea, Indonesia and Singapore, spread compression and

customer deleveraging, largely offset by a 2% increase in average loans and

a 5% increase (8% excluding Korea) in purchase sales driven by growth in

China, India, Singapore and Hong Kong.

While repositioning in Korea continued to have a negative impact on

year-over-year revenue comparisons in Asia GCB, revenues in Korea largely

stabilized in the second half of 2014. Citi expects spread compression and

regulatory changes in several markets across the region will continue to have

a negative impact on Asia GCB revenues in 2015.

Expenses increased 9%, primarily due to higher repositioning charges in

Korea, investment spending and volume-related growth, partially offset by

higher efficiency savings.

Provisions decreased 17%, primarily due to higher loan loss reserve

releases. Overall credit quality remained stable across the region during 2014.

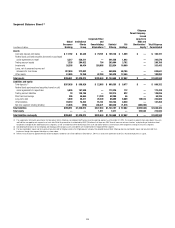

2013 vs. 2012

Net income decreased 12%, primarily due to a higher effective tax rate and

lower revenues, partially offset by lower expenses.

Revenues decreased 1%, as lower net interest revenue was partially offset

by higher non-interest revenue. Net interest revenue declined 5%, primarily

driven by spread compression and the repositioning of the franchise in Korea.

Non-interest revenue increased 7%, mainly driven by growth in investment

sales volume, despite a decrease in volumes in the second half of the year due

to investor sentiment, reflecting overall market uncertainty. Retail banking

revenues decreased 3%, primarily driven by spread compression and the

impact of regulatory changes, partially offset by a 12% increase in investment

sales revenues. Cards revenues increased 2%, as cards purchase sales

increased 7% with growth across the region, partially offset by the continued

impact of regulatory changes and customer deleveraging.

Expenses declined 3%, as lower repositioning charges and efficiency and

repositioning savings were partially offset by increased investment spending,

particularly in China cards.

Provisions increased 4%, reflecting a higher loan loss reserve build due

to volume growth in China, Hong Kong, India and Singapore as well as

regulatory requirements in Korea, partially offset by lower net credit losses.