Citibank 2014 Annual Report Download - page 273

Download and view the complete annual report

Please find page 273 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.256

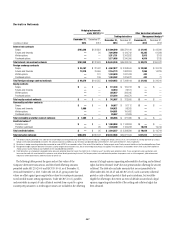

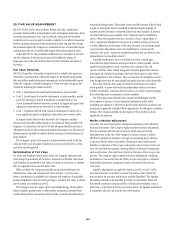

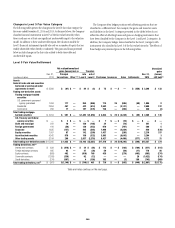

Fair values included in the above tables are prior to application of any

netting agreements and cash collateral. For notional amounts, Citi generally

has a mismatch between the total notional amounts of protection purchased

and sold, and it may hold the reference assets directly, rather than entering

into offsetting credit derivative contracts as and when desired. The open risk

exposures from credit derivative contracts are largely matched after certain

cash positions in reference assets are considered and after notional amounts

are adjusted, either to a duration-based equivalent basis or to reflect the level

of subordination in tranched structures. The ratings of the credit derivatives

portfolio presented in the tables and used to evaluate payment/performance

risk are based on the assigned internal or external ratings of the referenced

asset or entity. Where external ratings are used, investment-grade ratings are

considered to be ‘Baa/BBB’ and above, while anything below is considered

non-investment grade. Citi’s internal ratings are in line with the related

external rating system.

Citigroup evaluates the payment/performance risk of the credit derivatives

for which it stands as a protection seller based on the credit rating assigned to

the underlying referenced credit. Credit derivatives written on an underlying

non-investment grade reference credit represent greater payment risk to

the Company. The non-investment grade category in the table above also

includes credit derivatives where the underlying referenced entity has been

downgraded subsequent to the inception of the derivative.

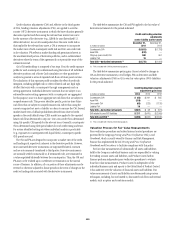

The maximum potential amount of future payments under credit

derivative contracts presented in the table above is based on the notional

value of the derivatives. The Company believes that the notional amount for

credit protection sold is not representative of the actual loss exposure based

on historical experience. This amount has not been reduced by the value

of the reference assets and the related cash flows. In accordance with most

credit derivative contracts, should a credit event occur, the Company usually

is liable for the difference between the protection sold and the value of the

reference assets. Furthermore, the notional amount for credit protection sold

has not been reduced for any cash collateral paid to a given counterparty,

as such payments would be calculated after netting all derivative exposures,

including any credit derivatives with that counterparty in accordance

with a related master netting agreement. Due to such netting processes,

determining the amount of collateral that corresponds to credit derivative

exposures alone is not possible. The Company actively monitors open credit-

risk exposures and manages this exposure by using a variety of strategies,

including purchased credit derivatives, cash collateral or direct holdings

of the referenced assets. This risk mitigation activity is not captured in the

table above.

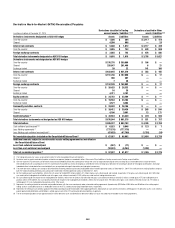

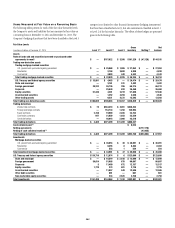

Credit-Risk-Related Contingent Features in Derivatives

Certain derivative instruments contain provisions that require the Company

to either post additional collateral or immediately settle any outstanding

liability balances upon the occurrence of a specified event related to the

credit risk of the Company. These events, which are defined by the existing

derivative contracts, are primarily downgrades in the credit ratings of the

Company and its affiliates. The fair value (excluding CVA) of all derivative

instruments with credit-risk-related contingent features that were in a

net liability position at December 31, 2014 and December 31, 2013 was

$30 billion and $26 billion, respectively. The Company had posted $27 billion

and $24 billion as collateral for this exposure in the normal course of

business as of December 31, 2014 and December 31, 2013, respectively.

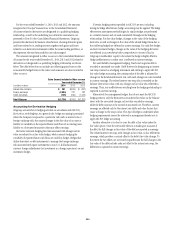

Each downgrade would trigger additional collateral or cash settlement

requirements for the Company and its affiliates. In the event that each

legal entity was downgraded a single notch by the three rating agencies

as of December 31, 2014, the Company would be required to post an

additional $2.0 billion as either collateral or settlement of the derivative

transactions. Additionally, the Company would be required to segregate

with third-party custodians collateral previously received from existing

derivative counterparties in the amount of $0.1 billion upon the single

notch downgrade, resulting in aggregate cash obligations and collateral

requirements of approximately $2.1 billion.