Citibank 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

Secured Funding Transactions and Short-Term Borrowings

Secured Funding

Secured funding is primarily conducted through Citi’s broker-dealer

subsidiaries to fund efficiently both secured lending activity and a portion of

trading inventory. Citi also conducts a smaller portion of its secured funding

transactions through its bank entities, which is typically collateralized by

foreign government securities. Generally, daily changes in the level of Citi’s

secured funding are primarily due to fluctuations in secured lending activity

in the matched book (as described below) and trading inventory.

Secured funding declined to $173 billion as of December 31, 2014,

compared to $176 billion as of September 30, 2014 and $204 billion as of

December 31, 2013, due to the impact of FX translation and Citi’s continued

optimization of secured funding. Average balances for secured funding

were approximately $187 billion for the quarter ended December 31, 2014,

compared to $182 billion for the quarter ended September 30, 2014 and $211

billion for the quarter ended December 31, 2013.

The portion of secured funding in the broker-dealer subsidiaries that

funds secured lending is commonly referred to as “matched book” activity.

The majority of this activity is secured by high quality, liquid securities such

as U.S. Treasury securities, U.S. agency securities and foreign sovereign

debt. Other secured funding is secured by less liquid securities, including

equity securities, corporate bonds and asset-backed securities. The tenor

of Citi’s matched book liabilities is equal to or longer than the tenor of the

corresponding matched book assets.

The remainder of the secured funding activity in the broker-dealer

subsidiaries serves to fund trading inventory. To maintain reliable funding

under a wide range of market conditions, including under periods of stress,

Citi manages these activities by taking into consideration the quality of the

underlying collateral, and stipulating financing tenor. The weighted average

maturity of Citi’s secured funding of less liquid trading inventory was greater

than 110 days as of December 31, 2014.

Citi manages the risks in its secured funding by conducting daily stress

tests to account for changes in capacity, tenors, haircut, collateral profile and

client actions. Additionally, Citi maintains counterparty diversification by

establishing concentration triggers and assessing counterparty reliability and

stability under stress. Citi generally sources secured funding from more than

150 counterparties.

Short-Term Borrowings

As referenced above, Citi supplements its primary sources of funding with

short-term borrowings. Short-term borrowings generally include (i) secured

funding transactions (securities loaned or sold under agreements to

repurchase, or repos) and (ii) to a lesser extent, short-term borrowings

consisting of commercial paper and borrowings from the FHLB and other

market participants (see Note 18 to the Consolidated Financial Statements

for further information on Citigroup’s and its affiliates’ outstanding

short-term borrowings).

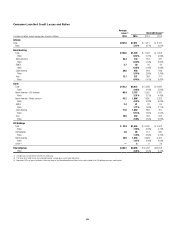

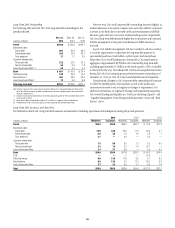

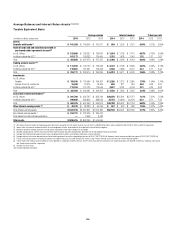

The following table contains the year-end, average and maximum month-end amounts for the following respective short-term borrowings categories at the

end of each of the three prior fiscal years.

Federal funds purchased and

securities sold under

agreements to repurchase

Short-term borrowings (1)

Commercial paper (2) Other short-term borrowings (3)

In billions of dollars 2014 2013 2012 2014 2013 2012 2014 2013 2012

Amounts outstanding at year end $173.4 $203.5 $211.2 $16.2 $17.9 $11.5 $42.1 $41.0 $40.5

Average outstanding during the year (4)(5) 190.0 229.4 223.8 16.8 16.3 17.9 45.3 39.6 36.3

Maximum month-end outstanding 200.1 239.9 237.1 17.9 18.8 21.9 47.1 44.7 40.6

Weighted-average interest rate

During the year (4)(5)(6) 1.00% 1.02% 1.26% 0.21% 0.28% 0.47% 1.20% 1.39% 1.77%

At year end (7) 0.49 0.59 0.81 0.23 0.26 0.38 0.53 0.87 1.06

(1) Original maturities of less than one year.

(2) Substantially all commercial paper outstanding was issued by significant Citibank entities for the periods presented. The increase in commercial paper outstanding during 2013 was due to the consolidation of $7 billion

of borrowings related to trade loans in the second quarter of 2013.

(3) Other short-term borrowings include borrowings from the FHLB and other market participants.

(4) Interest rates and amounts include the effects of risk management activities associated with the respective liability categories.

(5) Average volumes of securities loaned or sold under agreements to repurchase are reported net pursuant to FIN 41 (ASC 210-20-45); average rates exclude the impact of FIN 41 (ASC 210-20-45).

(6) Average rates reflect prevailing local interest rates, including inflationary effects and monetary correction in certain countries.

(7) Based on contractual rates at respective year ends; non-interest-bearing accounts are excluded from the weighted average interest rate calculated at year end.