Citibank 2014 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.145

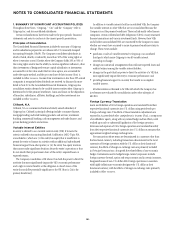

Corporate loans

Corporate loans represent loans and leases managed by ICG or, to a much

lesser extent, Citi Holdings. Corporate loans are identified as impaired and

placed on a cash (non-accrual) basis when it is determined, based on actual

experience and a forward-looking assessment of the collectability of the loan

in full, that the payment of interest or principal is doubtful or when interest

or principal is 90 days past due, except when the loan is well collateralized

and in the process of collection. Any interest accrued on impaired corporate

loans and leases is reversed at 90 days and charged against current earnings,

and interest is thereafter included in earnings only to the extent actually

received in cash. When there is doubt regarding the ultimate collectability

of principal, all cash receipts are thereafter applied to reduce the recorded

investment in the loan.

Impaired corporate loans and leases are written down to the extent that

principal is deemed to be uncollectable. Impaired collateral-dependent loans

and leases, where repayment is expected to be provided solely by the sale

of the underlying collateral and there are no other available and reliable

sources of repayment, are written down to the lower of cost or collateral

value. Cash-basis loans are returned to accrual status when all contractual

principal and interest amounts are reasonably assured of repayment and

there is a sustained period of repayment performance in accordance with the

contractual terms.

Loans Held-for-Sale

Corporate and consumer loans that have been identified for sale are classified

as loans held-for-sale and included in Other assets. The practice of Citi’s U.S.

prime mortgage business has been to sell substantially all of its conforming

loans. As such, U.S. prime mortgage conforming loans are classified as

held-for-sale and the fair value option is elected at origination, with changes

in fair value recorded in Other revenue. With the exception of those loans

for which the fair value option has been elected, held-for-sale loans are

accounted for at the lower of cost or market value, with any write-downs or

subsequent recoveries charged to Other revenue. The related cash flows are

classified in the Consolidated Statement of Cash Flows in the cash flows from

operating activities category on the line Change in loans held-for-sale.

Allowance for Loan Losses

Allowance for loan losses represents management’s best estimate of probable

losses inherent in the portfolio, including probable losses related to large

individually evaluated impaired loans and troubled debt restructurings.

Attribution of the allowance is made for analytical purposes only, and

the entire allowance is available to absorb probable loan losses inherent

in the overall portfolio. Additions to the allowance are made through the

Provision for loan losses. Loan losses are deducted from the allowance and

subsequent recoveries are added. Assets received in exchange for loan claims

in a restructuring are initially recorded at fair value, with any gain or loss

reflected as a recovery or charge-off to the provision.

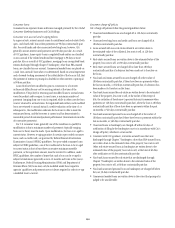

Consumer loans

For consumer loans, each portfolio of non-modified smaller-balance,

homogeneous loans is independently evaluated by product type

(e.g., residential mortgage, credit card, etc.) for impairment in accordance

with ASC 450-20. The allowance for loan losses attributed to these loans

is established via a process that estimates the probable losses inherent in

the specific portfolio. This process includes migration analysis, in which

historical delinquency and credit loss experience is applied to the current

aging of the portfolio, together with analyses that reflect current and

anticipated economic conditions, including changes in housing prices and

unemployment trends. Citi’s allowance for loan losses under ASC 450 only

considers contractual principal amounts due, except for credit card loans

where estimated loss amounts related to accrued interest receivable are

also included.

Management also considers overall portfolio indicators, including

historical credit losses, delinquent, non-performing and classified loans,

trends in volumes and terms of loans, an evaluation of overall credit quality,

the credit process, including lending policies and procedures, and economic,

geographical, product and other environmental factors.

Separate valuation allowances are determined for impaired smaller-

balance homogeneous loans whose terms have been modified in a troubled

debt restructuring (TDR). Long-term modification programs, as well as

short-term (less than 12 months) modifications originated beginning

January 1, 2011 that provide concessions (such as interest rate reductions)

to borrowers in financial difficulty, are reported as TDRs. In addition, loan

modifications that involve a trial period are reported as TDRs at the start

of the trial period. The allowance for loan losses for TDRs is determined

in accordance with ASC 310-10-35 considering all available evidence,

including, as appropriate, the present value of the expected future cash flows

discounted at the loan’s original contractual effective rate, the secondary

market value of the loan and the fair value of collateral less disposal costs.

These expected cash flows incorporate modification program default rate

assumptions. The original contractual effective rate for credit card loans is

the pre-modification rate, which may include interest rate increases under

the original contractual agreement with the borrower.

Valuation allowances for commercial market loans, which are classifiably

managed Consumer loans, are determined in the same manner as for

Corporate loans and are described in more detail in the following section.

Generally, an asset-specific component is calculated under ASC 310-10-35

on an individual basis for larger-balance, non-homogeneous loans

that are considered impaired and the allowance for the remainder of

the classifiably managed Consumer loan portfolio is calculated under

ASC 450 using a statistical methodology that may be supplemented by

management adjustment.