Citibank 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

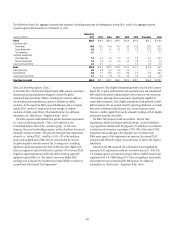

95

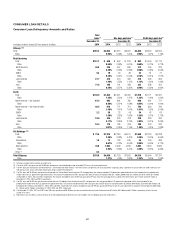

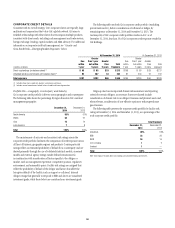

Deposits

Deposits are the primary and lowest cost funding source for Citi’s bank

subsidiaries. The table below sets forth the end-of-period deposits, by

business and/or segment, and the total average deposits for each of the

periods indicated.

In billions of dollars

Dec. 31,

2014

Sept. 30,

2014

Dec. 31,

2013

Global Consumer Banking

North America $171.4 $171.7 $170.2

EMEA 12.8 13.0 13.1

Latin America 45.5 45.9 47.4

Asia (1) 77.9 101.3 101.4

Total $307.6 $331.9 $332.1

ICG

Treasury and trade solutions (TTS) $378.6 $381.1 $379.8

Banking ex-TTS 85.9 91.0 97.4

Markets and securities services 94.4 95.3 96.9

Total $558.9 $567.4 $574.1

Corporate/Other 22.8 29.0 26.1

Total Citicorp $889.3 $928.3 $932.3

Total Citi Holdings (2) 10.0 14.4 36.0

Total Citigroup deposits (EOP) $899.3 $942.7 $968.3

Total Citigroup deposits (AVG) $938.7 $954.2 $956.4

(1) December 31, 2014 deposit balance reflects the reclassification to held-for-sale of approximately

$21 billion of deposits as a result of Citigroup’s entry into an agreement in December 2014 to sell its

Japan retail banking business.

(2) Included within Citi Holding’s end-of-period deposit balance as of December 31, 2014 was

approximately $9 billion of deposits related to Morgan Stanley Smith Barney (MSSB) customers that,

as previously disclosed, will be transferred to Morgan Stanley by MSSB, with remaining balances

transferred in the amount of approximately $5 billion per quarter through the end of the second

quarter of 2015.

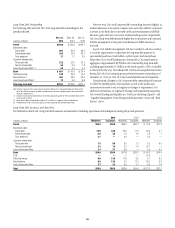

End-of-period deposits decreased 7% year-over-year and 5% quarter-

over-quarter, each primarily due to the reclassification to held-for-sale of

approximately $21 billion of deposits as a result of Citigroup’s entry into an

agreement in December 2014 to sell its Japan retail banking business, as well

as the impact of FX translation.

Excluding these items, Citigroup deposits declined 2% year-over-year,

as 1% growth in Citicorp deposits was more than offset by the continued

decline in Citi Holdings due to the ongoing transfer of MSSB deposits to

Morgan Stanley. Within Citicorp, GCB deposits increased 2% year-over-year,

with growth in all four regions. North America GCB deposits increased

1% year-over-year, with a continued focus on growing checking account

balances, and international deposits grew 3% year-over-year. ICG deposits

increased 1% year-over-year, with 3% growth in treasury and trade solutions

balances, partially offset by reductions in markets-related businesses. Average

deposits were relatively unchanged year-over-year and quarter-over-quarter,

as growth in Citicorp was offset by the ongoing transfer of MSSB deposits to

Morgan Stanley.

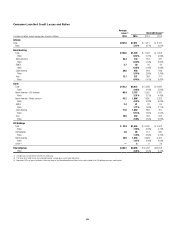

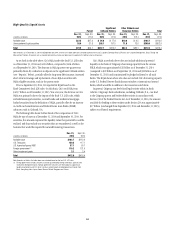

Citi monitors its deposit base across multiple dimensions, including what

Citi refers to as “LCR value” or the liquidity value of the deposit base under

the LCR rules. Under LCR rules, deposits are assigned liquidity values based

on expected behavior under stress, the type of deposit and the type of client.

Generally, the final U.S. LCR rules prioritize operating accounts of consumers

(including retail and commercial banking deposits) and corporations, while

assigning lower liquidity values to non-operating balances of financial

institutions. Citi estimates that as of December 31, 2014, its total deposits had

a liquidity value of approximately 73% under the LCR rules, up from 72% as

of September 30, 2014 and 71% as of December 31, 2013, with the gradual

increase primarily driven by reductions in lower LCR value deposits.

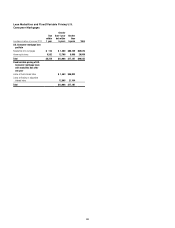

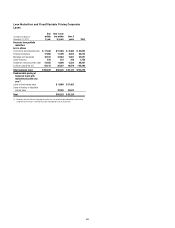

Long-Term Debt

Long-term debt (generally defined as debt with original maturities of one

year or more) represents the most significant component of Citi’s funding

for the parent entities and is a supplementary source of funding for the

bank entities.

Long-term debt is an important funding source due in part to its multi-

year maturity structure. The weighted-average maturities of unsecured

long-term debt issued by Citigroup and its affiliates (including Citibank,

N.A.) with a remaining life greater than one year (excluding remaining

trust preferred securities outstanding) was approximately 6.9 years as of

December 31, 2014, largely unchanged from the prior quarter and year. Citi

believes this term structure enables it to meet its business needs and maintain

adequate liquidity.

Citi’s long-term debt outstanding at the parent includes benchmark debt

and what Citi refers to as customer-related debt, consisting of structured

notes, such as equity- and credit-linked notes, as well as non-structured

notes. Citi’s issuance of customer-related debt is generally driven by customer

demand and supplements benchmark debt issuance as a source of funding

for Citi’s parent entities. Citi’s long-term debt at the bank includes FHLB

advances and securitizations.