Citibank 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

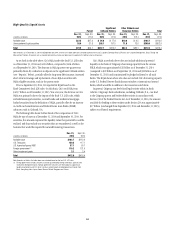

The following table sets forth the estimated impact to Citi’s net interest revenue, OCI and the Common Equity Tier 1 Capital ratio (on a fully implemented

basis), each assuming an unanticipated parallel instantaneous 100 basis point increase in interest rates.

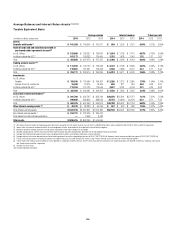

In millions of dollars (unless otherwise noted)

Dec. 31,

2014

Sept. 30,

2014

Dec. 31,

2013

Estimated annualized impact to net interest revenue

U.S. dollar (1) $ 1,123 $ 1,159 $ 1,229

All other currencies 629 713 609

Total $ 1,752 $ 1,872 $ 1,838

As a % of average interest-earning assets 0.11% 0.11% 0.11%

Estimated initial impact to OCI (after-tax) (2) $(3,961) $(3,621) (3,070)

Estimated initial impact on Common Equity Tier 1 Capital ratio (bps) (3) (44) (41) (37)

(1) Certain trading-oriented businesses within Citi have accrual-accounted positions that are excluded from the estimated impact to net interest revenue in the table since these exposures are managed economically

in combination with mark-to-market positions. The U.S. dollar interest rate exposure associated with these businesses was $(148) million for a 100 basis point instantaneous increase in interest rates as of

December 31, 2014.

(2) Includes the effect of changes in interest rates on OCI related to investment securities, cash flow hedges and pension liability adjustments.

(3) The estimated initial impact to the Common Equity Tier 1 Capital ratio considers the effect of Citi’s deferred tax asset position and is based on only the estimated initial OCI impact above.

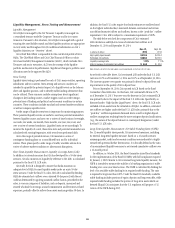

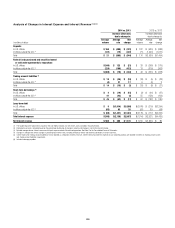

The decrease in the estimated impact to net interest revenue from the prior

year primarily reflected Citi Treasury actions (as described under “Mitigation

and Hedging of Interest Rate Risk” above), which more than offset changes

in balance sheet composition, including the continued seasoning of Citi’s

deposit balances and increases in Citi’s capital base. The change in the

estimated impact to OCI and the Common Equity Tier 1 Capital ratio

from the prior year primarily reflected changes in the composition of Citi

Treasury’s investment and interest rate derivatives portfolio.

In the event of an unanticipated parallel instantaneous 100 basis point

increase in interest rates, Citi expects the negative impact to OCI would

be offset in shareholders’ equity through the combination of expected

incremental net interest revenue and the expected recovery of the impact on

OCI through accretion of Citi’s investment portfolio over a period of time.

As of December 31, 2014, Citi expects that the negative $4.0 billion impact

to OCI in such a scenario could potentially be offset over approximately

22 months.

As noted above, Citi routinely evaluates multiple interest rate scenarios,

including interest rate increases and decreases and steepening and flattening

of the yield curve, to anticipate how net interest revenue and OCI might

be impacted in different interest rate environments. The following table

sets forth the estimated impact to Citi’s net interest revenue, OCI and the

Common Equity Tier 1 Capital ratio (on a fully implemented basis) under

four different changes in interest rates for the U.S. dollar and Citi’s other

currencies. While Citi also monitors the impact of a parallel decrease

in interest rates, a 100 basis point decrease in short-term interest rates

is not meaningful, as it would imply negative interest rates in many of

Citi’s markets.

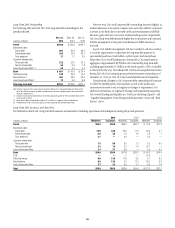

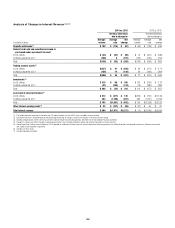

In millions of dollars (unless otherwise noted) Scenario 1 Scenario 2 Scenario 3 Scenario 4

Overnight rate change (bps) 100 100 — —

10-year rate change (bps) 100 — 100 (100)

Estimated annualized impact to net interest revenue

U.S. dollar $ 1,123 $ 1,082 $ 95 $ (161)

All other currencies 629 586 36 (36)

Total $ 1,752 $ 1,668 $ 131 $ (197)

Estimated initial impact to OCI (after-tax) (1) $(3,961) $(2,543) $(1,597) $1,372

Estimated initial impact to Common Equity Tier 1 Capital ratio (bps) (2) (44) (28) (18) 15

Note: Each scenario in the table above assumes that the rate change will occur instantaneously. Changes in interest rates for maturities between the overnight rate and the 10-year are interpolated.

(1) Includes the effect of changes in interest rates on OCI related to investment securities, cash flow hedges and pension liability adjustments.

(2) The estimated initial impact to the Common Equity Tier 1 Capital ratio considers the effect of Citi’s deferred tax asset position and is based on only the estimated OCI impact above.

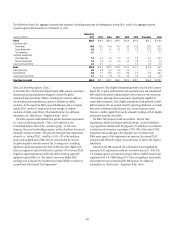

As shown in the table above, the magnitude of the impact to Citi’s

net interest revenue and OCI is greater under scenario 2 as compared to

scenario 3. This is because the combination of changes to Citi’s investment

portfolio, partially offset by changes related to Citi’s pension liabilities, results

in a net position that is more sensitive to rates at shorter and intermediate

term maturities.