Citibank 2014 Annual Report Download - page 286

Download and view the complete annual report

Please find page 286 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

269

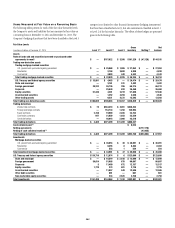

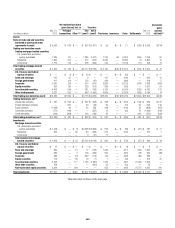

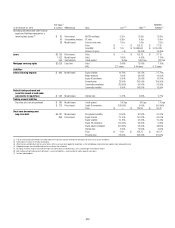

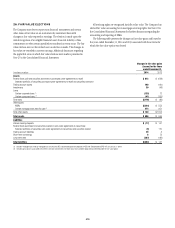

In millions of dollars

Dec. 31,

2012

Net realized/unrealized

gains (losses) incl. in Transfers

Purchases Issuances Sales Settlements

Dec. 31,

2013

Unrealized

gains

(losses)

still held (3)

Principal

transactions Other (1)(2)

into

Level 3

out of

Level 3

Loans $ 4,931 $ — $ (24) $ 353 $ — $ 179 $ 652 $ (192) $(1,756) $ 4,143 $ (122)

Mortgage servicing rights 1,942 — 555 — — — 634 (2) (411) 2,718 553

Other financial assets measured on

a recurring basis 2,452 — 63 1 — 216 474 (2,046) (979) 181 (5)

Liabilities

Interest-bearing deposits $ 786 $ — $(125) $ 32 $ (21) $ — $ 86 $ — $ (118) $ 890 $ (41)

Federal funds purchased and

securities loaned or sold under

agreements to repurchase 841 91 — 216 (17) 36 — 40 (123) 902 50

Trading account liabilities

Securities sold, not yet purchased 365 42 — 89 (52) — — 612 (382) 590 73

Short-term borrowings 112 53 — 2 (10) — 316 — (338) 29 (5)

Long-term debt 6,726 292 153 3,738 (2,531) — 1,466 (1) (1,332) 7,621 758

Other financial liabilities measured

on a recurring basis 24 — (215) 5 (2) (5) 104 — (331) 10 (9)

(1) Changes in fair value for available-for-sale investments are recorded in Accumulated other comprehensive income (loss), unless other-than-temporarily impaired, while gains and losses from sales are recorded in

Realized gains (losses) from sales of investments on the Consolidated Statement of Income.

(2) Unrealized gains (losses) on MSRs are recorded in Other revenue on the Consolidated Statement of Income.

(3) Represents the amount of total gains or losses for the period, included in earnings (and Accumulated other comprehensive income (loss) for changes in fair value of available-for-sale investments), attributable to the

change in fair value relating to assets and liabilities classified as Level 3 that are still held at December 31, 2013.

(4) Total Level 3 derivative assets and liabilities have been netted in these tables for presentation purposes only.

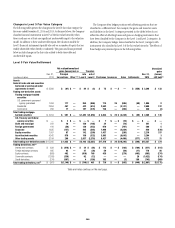

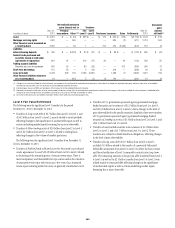

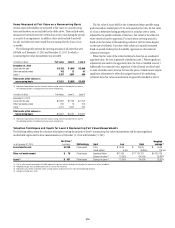

Level 3 Fair Value Rollforward

The following were the significant Level 3 transfers for the period

December 31, 2013 to December 31, 2014:

•Transfers of Long-term debt of $2.7 billion from Level 2 to Level 3, and

of $4.2 billion from Level 3 to Level 2, mainly related to structured debt,

reflecting changes in the significance of unobservable inputs as well as

certain underlying market inputs becoming less or more observable.

•Transfers of Other trading assets of $2.6 billion from Level 2 to Level 3,

and of $2.3 billion from Level 3 to Level 2, related to trading loans,

reflecting changes in the volume of market quotations.

The following were the significant Level 3 transfers from December 31,

2012 to December 31, 2013:

•Transfers of Federal funds sold and securities borrowed or purchased

under agreements to resell of $1.9 billion from Level 3 to Level 2 related

to shortening of the remaining tenor of certain reverse repos. There is

more transparency and observability for repo curves used in the valuation

of structured reverse repos with tenors up to five years; thus, structured

reverse repos maturing within five years are generally classified as Level 2.

•Transfers of U.S. government-sponsored agency guaranteed mortgage-

backed securities in Investments of $2.1 billion from Level 2 to Level 3,

and of $3.8 billion from Level 3 to Level 2, due to changes in the level of

price observability for the specific securities. Similarly, there were transfers

of U.S. government-sponsored agency guaranteed mortgage-backed

securities in Trading securities of $1.4 billion from Level 2 to Level 3, and

of $1.5 billion from Level 3 to Level 2.

•Transfers of asset-backed securities in Investments of $1.2 billion from

Level 2 to Level 3, and of $1.7 billion from Level 3 to Level 2. These

transfers were related to collateralized loan obligations, reflecting changes

in the level of price observability.

•Transfers of Long-term debt of $3.7 billion from Level 2 to Level 3,

included $1.3 billion related to the transfer of a previously bifurcated

hybrid debt instrument from Level 2 to Level 3 to reflect the host contract

and the reclassification of Level 3 commodity contracts into Long-term

debt. The remaining amounts of Long-term debt transferred from Level 2

to Level 3 as well as the $2.5 billion transfer from Level 3 to Level 2 were

related mainly to structured debt reflecting changes in the significance

of unobservable inputs as well as certain underlying market inputs

becoming less or more observable.