Citibank 2014 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

165

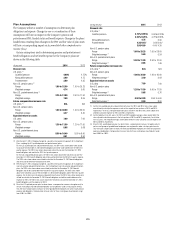

Profit Sharing Plan

The 2010 Key Employee Profit Sharing Plan (KEPSP) entitled participants

to profit-sharing payments calculated with reference to the pretax income of

Citicorp (as defined in the KEPSP) over a performance measurement period

of January 1, 2010, through December 31, 2013. Generally, if a participant

remained employed and all other conditions to vesting and payment were

satisfied, the participant became entitled to payment. Payments were made in

cash, except for U.K. participants who, pursuant to regulatory requirements,

received 50% of their payment in Citigroup common stock that was subject to

a six-month sale restriction.

Independent risk function employees were not eligible to participate in the

KEPSP, as the independent risk function participates in the determination of

whether payouts will be made under the KEPSP. Instead, they were eligible to

receive deferred cash retention awards.

Other Variable Incentive Compensation

Citigroup has various incentive plans globally that are used to motivate and

reward performance primarily in the areas of sales, operational excellence

and customer satisfaction. Participation in these plans is generally limited to

employees who are not eligible for discretionary annual incentive awards.

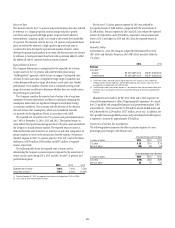

Summary

Except for awards subject to variable accounting, the total expense

recognized for stock awards represents the grant date fair value of such

awards, which is generally recognized as a charge to income ratably over the

vesting period, other than for awards to retirement-eligible employees and

immediately vested awards. Whenever awards are made or are expected to be

made to retirement-eligible employees, the charge to income is accelerated

based on when the applicable conditions to retirement eligibility were or will

be met. If the employee is retirement eligible on the grant date, or the award

is vested at grant date, the entire expense is recognized in the year prior

to grant.

Recipients of Citigroup stock awards generally do not have any

stockholder rights until shares are delivered upon vesting or exercise, or

after the expiration of applicable required holding periods. Recipients of

restricted or deferred stock awards and stock unit awards, however, may be

entitled to receive dividends or dividend-equivalent payments during the

vesting period. Recipients of restricted stock awards generally are entitled to

vote the shares in their award during the vesting period. Once a stock award

vests, the shares are freely transferable, unless they are subject to a restriction

on sale or transfer for a specified period. Pursuant to a stock ownership

commitment, certain executives have committed to holding most of their

vested shares indefinitely.

All equity awards granted since April 19, 2005, have been made pursuant

to stockholder-approved stock incentive plans that are administered by the

Personnel and Compensation Committee of the Citigroup Board of Directors,

which is composed entirely of independent non-employee directors.

At December 31, 2014, approximately 51.6 million shares of Citigroup

common stock were authorized and available for grant under Citigroup’s

2014 Stock Incentive Plan, the only plan from which equity awards are

currently granted.

The 2014 Stock Incentive Plan and predecessor plans permit the use of

treasury stock or newly issued shares in connection with awards granted

under the plans. Newly issued shares were distributed to settle the vesting of

annual deferred stock awards in January 2012, 2013, 2014 and 2015. The use

of treasury stock or newly issued shares to settle stock awards does not affect

the compensation expense recorded in the Consolidated Statement of Income

for equity awards.

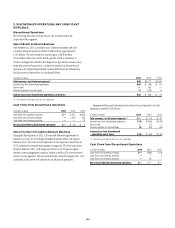

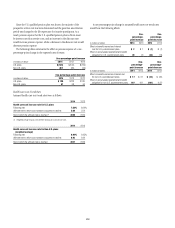

Incentive Compensation Cost

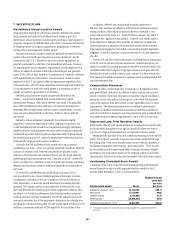

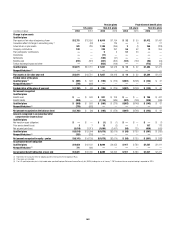

The following table shows components of compensation expense, relating

to the above incentive compensation programs, recorded during 2014, 2013

and 2012:

In millions of dollars 2014 2013 2012

Charges for estimated awards

to retirement-eligible employees $ 525 $ 468 $ 444

Amortization of deferred cash awards,

deferred cash stock units and performance

stock units 311 323 345

Immediately vested stock award expense (1) 51 54 60

Amortization of restricted and deferred

stock awards (2) 668 862 864

Option expense 110 99

Other variable incentive compensation 803 1,076 670

Profit sharing plan 178 246

Total $ 2,360 $ 2,871 $ 2,728

(1) Represents expense for immediately vested stock awards that generally were stock payments in lieu

of cash compensation. The expense is generally accrued as cash incentive compensation in the year

prior to grant.

(2) All periods include amortization expense for all unvested awards to non-retirement-eligible employees.

Amortization is recognized net of estimated forfeitures of awards.

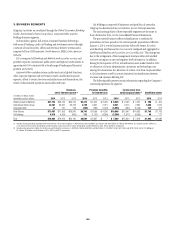

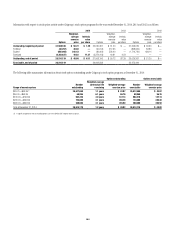

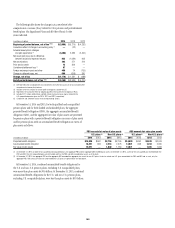

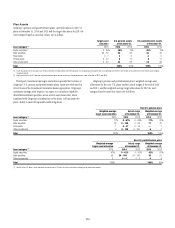

Future Expenses Associated with Outstanding (Unvested) Awards

Citi expects to record compensation expense in future periods as a result of

awards granted for performance in 2014 and years prior. Because the awards

contain service or other conditions that will be satisfied in the future, the

expense of these already-granted awards is recognized over those future

period(s). Citi’s expected future expenses, excluding the impact of forfeitures,

cancellations, clawbacks and repositioning-related accelerations that have

not yet occurred, are summarized in the table below. The portion of these

awards that is subject to variable accounting will cause the expense amount

to fluctuate with changes in Citigroup’s common stock price.

In millions of dollars 2015 2016 2017

2018 and

beyond (1) Total (2)

Awards granted in 2014 and prior:

Deferred Stock Awards $ 357 $ 204 $ 92 $ 6 $ 659

Deferred Cash Awards 232 123 51 3 409

Future expense related to awards

already granted $ 589 $ 327 $ 143 $ 9 $1,068

Future expense related to awards

granted in 2015 (3) $ 400 $ 290 $ 188 $ 164 $1,042

Total $ 989 $ 617 $ 331 $ 173 $2,110

(1) Principally 2018.

(2) $1.8 billion of which is attributable to ICG.

(3) Refers to awards granted on or about February 16, 2015, as part Citi’s discretionary annual incentive

awards for services performed in 2014, and 2015 compensation allowances.