Citibank 2014 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

194

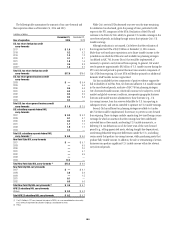

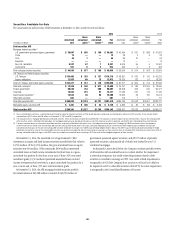

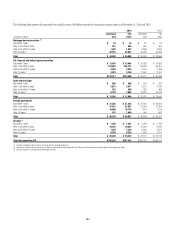

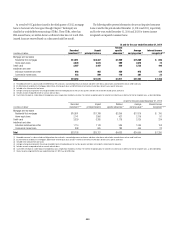

Debt Securities Held-to-Maturity

The carrying value and fair value of debt securities HTM at December 31, 2014 and 2013 were as follows:

In millions of dollars

Amortized

cost basis (1)

Net unrealized

gains (losses)

recognized in

AOCI

Carrying

value (2)

Gross

unrealized

gains

Gross

unrealized

(losses)

Fair

value

December 31, 2014

Debt securities held-to-maturity

Mortgage-backed securities (3)

U.S. government agency guaranteed $ 8,795 $ 95 $ 8,890 $ 106 $ (6) $ 8,990

Prime 60 (12) 48 6 (1) 53

Alt-A 1,125 (213) 912 537 (287) 1,162

Subprime 6 (1) 5 15 — 20

Non-U.S. residential 983 (137) 846 92 — 938

Commercial 8 — 8 1 — 9

Total mortgage-backed securities $10,977 $(268) $10,709 $ 757 $(294) $11,172

State and municipal (4) $ 8,443 $(494) $ 7,949 $ 227 $ (57) $ 8,119

Foreign government 4,725 — 4,725 77 — 4,802

Corporate — — — — — —

Asset-backed securities (3) 556 (18) 538 50 (10) 578

Total debt securities held-to-maturity (5) $24,701 $(780) $23,921 $ 1,111 $(361) $24,671

December 31, 2013

Debt securities held-to-maturity

Mortgage-backed securities (3)

Prime $ 72 $ (16) $ 56 $ 5 $ (2) $ 59

Alt-A 1,379 (287) 1,092 449 (263) 1,278

Subprime 2 — 2 1 — 3

Non-U.S. residential 1,372 (206) 1,166 60 (20) 1,206

Commercial 10 — 10 1 — 11

Total mortgage-backed securities $ 2,835 $(509) $ 2,326 $ 516 $(285) $ 2,557

State and municipal $ 1,394 $ (62) $ 1,332 $ 50 $ (70) $ 1,312

Foreign government 5,628 — 5,628 70 (10) 5,688

Corporate 818 (78) 740 111 — 851

Asset-backed securities (3) 599 (26) 573 22 (10) 585

Total debt securities held-to-maturity $11,274 $(675) $10,599 $ 769 $(375) $10,993

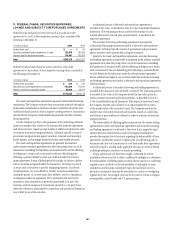

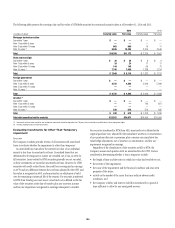

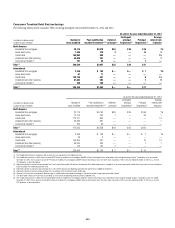

(1) For securities transferred to HTM from Trading account assets, amortized cost basis is defined as the fair value of the securities at the date of transfer plus any accretion income and less any impairments recognized

in earnings subsequent to transfer. For securities transferred to HTM from AFS, amortized cost is defined as the original purchase cost, adjusted for the cumulative accretion or amortization of any purchase discount or

premium, plus or minus any cumulative fair value hedge adjustments, net of accretion or amortization, and less any other-than-temporary impairment recognized in earnings.

(2) HTM securities are carried on the Consolidated Balance Sheet at amortized cost basis, plus or minus any unamortized unrealized gains and losses and fair value hedge adjustments recognized in AOCI prior to

reclassifying the securities from AFS to HTM. Changes in the values of these securities are not reported in the financial statements, except for the amortization of any difference between the carrying value at the

transfer date and par value of the securities, and the recognition of any non-credit fair value adjustments in AOCI in connection with the recognition of any credit impairment in earnings related to securities the

Company continues to intend to hold until maturity.

(3) The Company invests in mortgage-backed and asset-backed securities. These securitizations are generally considered VIEs. The Company’s maximum exposure to loss from these VIEs is equal to the carrying amount

of the securities, which is reflected in the table above. For mortgage-backed and asset-backed securitizations in which the Company has other involvement, see Note 22 to the Consolidated Financial Statements.

(4) The net unrealized losses recognized in AOCI on state and municipal debt securities are primarily attributable to the effects of fair value hedge accounting applied when these debt securities were classified as AFS.

Specifically, Citi hedged the LIBOR-benchmark interest rate component of certain fixed-rate tax-exempt state and municipal debt securities utilizing LIBOR-based interest rate swaps. During the hedge period, losses

incurred on the LIBOR-hedging swaps recorded in earnings were substantially offset by gains on the state and municipal debt securities attributable to changes in the LIBOR swap rate being hedged. However, because

the LIBOR swap rate decreased significantly during the hedge period while the overall fair value of the municipal debt securities was relatively unchanged, the effect of reclassifying fair value gains on these securities

from AOCI to earnings attributable solely to changes in the LIBOR swap rate resulted in net unrealized losses remaining in AOCI that relate to the unhedged components of these securities. Upon transfer of these debt

securities to HTM, all hedges have been de-designated and hedge accounting has ceased.

(5) During the second quarter of 2014, securities with a total fair value of approximately $11.8 billion were transferred from AFS to HTM and comprised $5.4 billion of U.S. government agency mortgage-backed securities

and $6.4 billion of obligations of U.S. states and municipalities. The transfer reflects the Company’s intent to hold these securities to maturity or to issuer call in order to reduce the impact of price volatility on AOCI

and certain capital measures under Basel III. While these securities were transferred to HTM at fair value as of the transfer date, no subsequent changes in value may be recorded, other than in connection with the

recognition of any subsequent other-than-temporary impairment and the amortization of differences between the carrying values at the transfer date and the par values of each security as an adjustment of yield over

the remaining contractual life of each security. Any net unrealized holding losses within AOCI related to the respective securities at the date of transfer, inclusive of any cumulative fair value hedge adjustments, will be

amortized over the remaining contractual life of each security as an adjustment of yield in a manner consistent with the amortization of any premium or discount.