Citibank 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

Citi’s Results of Operations Could Be Negatively Impacted

as Its Revolving Home Equity Lines of Credit Continue

to “Reset.”

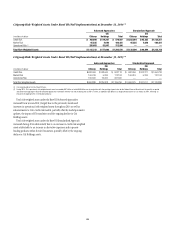

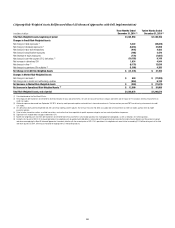

As of December 31, 2014, Citi’s home equity loan portfolio of approximately

$28.1 billion included approximately $16.7 billion of home equity lines of

credit that were still within their revolving period and had not commenced

amortization, or “reset” (Revolving HELOCs). Of these Revolving HELOCs,

approximately 78% will commence amortization during the period of

2015–2017 (for additional information, see “Managing Global Risk—Credit

Risk—North America Consumer Mortgage Lending” below).

Before commencing amortization, Revolving HELOC borrowers are

required to pay only interest on their loans. Upon amortization, these

borrowers are required to pay both interest, usually at a variable rate, and

principal that typically amortizes over 20 years, rather than the typical

30-year amortization. As a result, Citi’s customers with Revolving HELOCs

that reset could experience “payment shock” due to the higher required

payments on the loans. Increases in interest rates could further increase

these payments, given the variable nature of the interest rates on these loans

post-reset.

Based on the limited number of Citi’s Revolving HELOCs that have reset

as of December 31, 2014, Citi has experienced a higher 30+ days past due

delinquency rate on its amortizing home equity loans as compared to its total

outstanding home equity loan portfolio (amortizing and non-amortizing).

Moreover, a portion of the resets that have occurred to date occurred during

a period of declining interest rates, which Citi believes likely reduced the

overall payment shock to borrowers. While Citi continues to monitor this

reset risk closely and review and take additional actions to offset potential

reset risk, increasing interest rates, stricter lending criteria and high borrower

loan-to-value positions could limit Citi’s ability to reduce or mitigate this

reset risk going forward. Accordingly, as these loans continue to reset, Citi

could experience higher delinquency rates and increased loan loss reserves

and net credit losses in future periods, which could be significant and would

negatively impact its results of operations.

Concentrations of Risk Can Increase the Potential for Citi

to Incur Significant Losses.

Concentrations of risk, particularly credit and market risk, can increase Citi’s

risk of significant losses. As of December 31, 2014, Citi’s most significant

concentration of credit risk was with the U.S. government and its agencies,

which primarily results from trading assets and investments issued by the

U.S. government and its agencies (for additional information, see Note

24 to the Consolidated Financial Statements). Citi also routinely executes

a high volume of securities, trading, derivative and foreign exchange

transactions with counterparties in the financial services industry, including

banks, other financial institutions, insurance companies, investment banks

and government and central banks. To the extent regulatory or market

developments lead to increased centralization of trading activity through

particular clearing houses, central agents or exchanges, this could also

increase Citi’s concentration of risk in this industry. Concentrations of risk

can limit, and have limited, the effectiveness of Citi’s hedging strategies and

have caused Citi to incur significant losses, and they may do so again in

the future.

LIQUIDITY RISKS

Citi’s Liquidity Planning, Management and Funding Could

Be Negatively Impacted by the Heightened Regulatory

Focus on and Continued Changes to Liquidity Standards

and Requirements.

In September 2014, the U.S. banking agencies adopted final rules with

respect to the U.S. Basel III Liquidity Coverage Ratio (LCR) (for additional

information on the final LCR requirements, see “Managing Global Risk—

Market Risk—Funding and Liquidity Risk” below). Implementation of

the final LCR requirements requires Citi to maintain extensive compliance

procedures and systems, including systems to calculate Citi’s LCR daily

once the rules are fully implemented. Moreover, Citi’s liquidity planning,

stress testing and management remains subject to heightened regulatory

scrutiny and review, including pursuant to the Federal Reserve Board’s

Comprehensive Liquidity Analysis and Review (CLAR) as well as regulators’

enhanced prudential standards authority. If Citi’s interpretation or

implementation of the LCR requirements, or its overall liquidity planning

and management, is not consistent with regulatory expectations or

requirements, Citi’s funding and liquidity could be negatively impacted and

it could incur increased compliance risks and costs.

In addition, in October 2014, the Basel Committee adopted final rules

relating to the Net Stable Funding Ratio (NSFR), and the U.S. banking

agencies are expected to propose U.S. NSFR rules during 2015 (for additional

information on the Basel Committee’s final NSFR rules, see “Managing

Global Risk—Market Risk—Funding and Liquidity Risk” below). Several

aspects of the Basel Committee’s final NSFR rules will likely require further

analysis and clarification, including with respect to the calculation of

derivative assets and liabilities and netting of these assets. The final rules also

leave discretion to national supervisors (i.e., the U.S. banking agencies) in

several areas. Accordingly, like other areas of regulatory reform, it remains

uncertain whether the U.S. NSFR rules might be more restrictive than the

Basel Committee’s final NSFR. It also remains uncertain whether other

entities or subsidiaries within Citi’s structure will be required to comply with

the NSFR requirements, as well as the parameters of any such requirements.

Until these parameters are known, it is not possible to determine

the potential impact to Citi’s, or its subsidiaries’, liquidity planning,

management or funding. Moreover, to the extent other jurisdictions propose

or adopt quantitative liquidity requirements that differ from any of the Basel

Committee’s or the U.S. liquidity requirements, Citi could be at a competitive

disadvantage because of its global footprint or could be required to meet

different minimum liquidity standards in some or all of the jurisdictions in

which it operates.

For a discussion of the potential negative impacts to Citi’s liquidity

planning, management and funding resulting from the U.S. GSIB

capital surcharge proposal and the FSB’s TLAC proposal, see “Regulatory

Risks” above.