Citibank 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

Citi May Incur Significant Losses If Its Risk Management

Models, Processes or Strategies Are Ineffective.

Citi employs a broad and diversified set of risk management and mitigation

processes and strategies, including the use of various risk models, in

analyzing and monitoring the various risks Citi assumes in conducting

its activities, such as credit, market and operational risks (for additional

information regarding these areas of risk as well as risk management at Citi,

see “Managing Global Risk” below). For example, Citi uses models as part of

its various stress testing initiatives across the firm. Management of these risks

is made even more challenging within a global financial institution such as

Citi, particularly given the complex, diverse and rapidly changing financial

markets and conditions in which Citi operates.

These models, processes and strategies are inherently limited because

they involve techniques, including the use of historical data in some

circumstances, and judgments that cannot anticipate every economic

and financial outcome in the markets in which Citi operates nor can they

anticipate the specifics and timing of such outcomes. Citi could incur

significant losses if its risk management models, processes or strategies are

ineffective in properly anticipating or managing these risks.

Citi’s Performance and the Performance of Its Individual

Businesses Could Be Negatively Impacted If Citi Is Not Able

to Hire and Retain Qualified Employees for Any Reason.

Citi’s performance and the performance of its individual businesses is

largely dependent on the talents and efforts of highly skilled employees.

Specifically, Citi’s continued ability to compete in its businesses, to manage

its businesses effectively and to continue to execute its overall global strategy

depends on its ability to attract new employees and to retain and motivate its

existing employees. Citi’s ability to attract and retain employees depends on

numerous factors, including its culture, compensation, the management and

leadership of the company as well as its individual businesses, Citi’s presence

in the particular market or region at issue and the professional opportunities

it offers.

The banking industry has and may continue to experience more stringent

regulation of employee compensation, including limitations relating to

incentive-based compensation, clawback requirements and special taxation.

Moreover, given its continued focus on the emerging markets, Citi is often

competing for qualified employees in these markets with entities that have a

significantly greater presence in the region or are not subject to significant

regulatory restrictions on the structure of incentive compensation. If Citi

is unable to continue to attract and retain qualified employees for any

reason, Citi’s performance, including its competitive position, the successful

execution of its overall strategy and its results of operations could be

negatively impacted.

Incorrect Assumptions or Estimates in Citi’s Financial

Statements Could Cause Significant Unexpected Losses

in the Future, and Changes to Financial Accounting and

Reporting Standards or Interpretations Could Have a

Material Impact on How Citi Records and Reports Its

Financial Condition and Results of Operations.

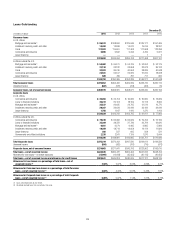

Citi is required to use certain assumptions and estimates in preparing its

financial statements under U.S. GAAP, including determining credit loss

reserves, reserves related to litigation and regulatory exposures, valuation of

DTAs and the fair values of certain assets and liabilities, among other items.

If Citi’s assumptions or estimates underlying its financial statements are

incorrect or differ from actual future events, Citi could experience unexpected

losses, some of which could be significant.

Moreover, the Financial Accounting Standards Board (FASB) is currently

reviewing, or has proposed or issued, changes to several financial accounting

and reporting standards that govern key aspects of Citi’s financial statements

or interpretations thereof, including those areas where Citi is required to

make assumptions or estimates. For example, the FASB has proposed a new

accounting model intended to require earlier recognition of credit losses

on financial instruments. The proposed accounting model would require

that lifetime “expected credit losses” on financial assets not recorded at fair

value through net income, such as loans and held-to-maturity securities, be

recorded at inception of the financial asset, replacing the multiple existing

impairment models under U.S. GAAP which generally require that a loss be

“incurred” before it is recognized. For additional information on this and

other proposed changes, see Note 1 to the Consolidated Financial Statements.

Changes to financial accounting or reporting standards or interpretations,

whether promulgated or required by the FASB or other regulators, could

present operational challenges and could require Citi to change certain of

the assumptions or estimates it previously used in preparing its financial

statements, which could negatively impact how it records and reports its

financial condition and results of operations generally and/or with respect

to particular businesses. In addition, the FASB is seeking to converge U.S.

GAAP with International Financial Reporting Standards (IFRS) to the extent

IFRS provides an improvement to accounting standards. Any transition to

IFRS could further have a material impact on how Citi records and reports

its financial results. For additional information on the key areas for which

assumptions and estimates are used in preparing Citi’s financial statements,

see “Significant Accounting Policies and Significant Estimates” below and

Note 28 to the Consolidated Financial Statements.