Citibank 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

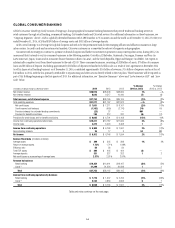

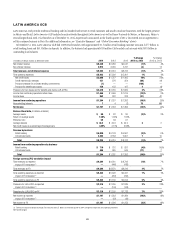

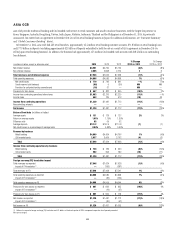

The discussion of the results of operations for Latin America GCB below excludes the impact of FX translation for all periods presented. Presentations

of the results of operations, excluding the impact of FX translation, are non-GAAP financial measures. Citi believes the presentation of Latin America

GCB’s results excluding the impact of FX translation is a more meaningful depiction of the underlying fundamentals of the business. For a

reconciliation of certain of these metrics to the reported results, see the table above.

2014 vs. 2013

Net income decreased 3% as higher expenses and credit costs were partially

offset by higher revenues.

Revenues increased 4%, primarily due to volume growth and spread and

fee growth in Mexico, partially offset by continued spread compression in

the region and slower overall economic growth in certain Latin America

markets, including Mexico and Brazil. Net interest revenue increased 4%

due to increased volumes and stable spreads in Mexico, partially offset by the

ongoing spread compression in other Latin America markets. Non-interest

revenue increased 3%, primarily due to higher fees from increased volumes

in retail banking and cards.

Retail banking revenues increased 3% as average loans increased 6%,

investment sales increased 19% and average deposits increased 6%, partially

offset by lower spreads in Brazil and Colombia. Cards revenues increased 6%

as average loans increased 5% and purchase sales increased 1%, excluding

the impact of Credicard’s results in the prior year period (for additional

information, see Note 2 to the Consolidated Financial Statements). The

increase in cards revenues was partially offset by lower economic growth and

slowing cards purchase sales in Mexico due to the previously disclosed fiscal

reforms enacted in 2013 in Mexico, which included, among other things,

higher income and other taxes that negatively impacted consumer behavior

and spending. Citi expects these trends, as well as spread compression, could

continue to negatively impact revenues in Latin America GCB in 2015.

Expenses increased 5%, primarily due to mandatory salary increases in

certain countries, higher legal and related costs, increased repositioning

charges and higher technology spending, partially offset by productivity and

repositioning savings.

Provisions increased 7%, primarily due to higher net credit losses, which

were partially offset by a lower loan loss reserve build. Net credit losses

increased 22%, driven by portfolio growth and continued seasoning in the

Mexico cards portfolio. Net credit losses were also impacted by both the

slower economic growth and fiscal reforms in Mexico (as discussed above)

as well as a $71 million charge-off in the fourth quarter of 2014 related to

Citi’s homebuilder exposure in Mexico, which was offset by a related release

of previously established loan loss reserves and thus neutral to the cost of

credit. The continued impact of the fiscal reforms and economic slowdown

in Mexico is likely to cause net credit losses in Latin America GCB to

remain elevated.

Argentina/Venezuela

For additional information on Citi’s exposures in Argentina and Venezuela

and the potential impact to Latin America GCB results of operations as a

result of certain developments in these countries, see “Managing Global

Risk—Country and Cross-Border Risk” below.

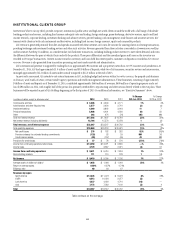

2013 vs. 2012

Net income decreased 9% as higher credit costs, higher expenses and a

higher effective tax rate were partially offset by higher revenues.

Revenues increased 7%, primarily due to volume growth in retail banking

and cards, partially offset by spread compression. Retail banking revenues

increased 5% as average loans increased 12%, investment sales increased 13%

and average deposits increased 2%. Cards revenues increased 10% as average

loans increased 10% and purchase sales increased 12%, excluding the impact

of Credicard’s results.

Expenses increased 3% due to increased volume-related costs, mandatory

salary increases in certain countries and higher regulatory costs, partially

offset by lower repositioning charges and higher repositioning savings.

Provisions increased 25%, primarily due to higher net credit losses as well

as a higher loan loss reserve build. Net credit losses increased 25%, primarily

in the Mexico cards and personal loan portfolios, reflecting both volume

growth and portfolio seasoning. The loan loss reserve build increased 52%,

primarily due to an increase in reserves in Mexico related to the top three

Mexican homebuilders, with the remainder due to portfolio growth and

seasoning and the impact of potential losses related to hurricanes in the

region during September 2013.