Citibank 2014 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327

|

|

189

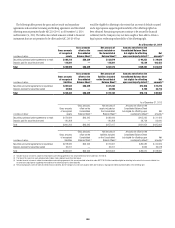

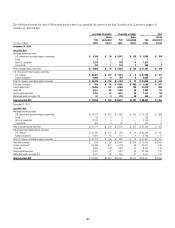

12. BROKERAGE RECEIVABLES AND BROKERAGE

PAYABLES

The Company has receivables and payables for financial instruments sold

to and purchased from brokers, dealers and customers, which arise in the

ordinary course of business. The Company is exposed to risk of loss from the

inability of brokers, dealers or customers to pay for purchases or to deliver the

financial instruments sold, in which case the Company would have to sell or

purchase the financial instruments at prevailing market prices. Credit risk

is reduced to the extent that an exchange or clearing organization acts as a

counterparty to the transaction and replaces the broker, dealer or customer

in question.

The Company seeks to protect itself from the risks associated with

customer activities by requiring customers to maintain margin collateral

in compliance with regulatory and internal guidelines. Margin levels are

monitored daily, and customers deposit additional collateral as required.

Where customers cannot meet collateral requirements, the Company will

liquidate sufficient underlying financial instruments to bring the customer

into compliance with the required margin level.

Exposure to credit risk is impacted by market volatility, which may impair

the ability of clients to satisfy their obligations to the Company. Credit limits

are established and closely monitored for customers and for brokers and

dealers engaged in forwards, futures and other transactions deemed to be

credit sensitive.

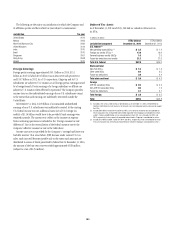

Brokerage receivables and Brokerage payables consisted of the

following at December 31:

In millions of dollars 2014 2013

Receivables from customers $10,380 $ 5,811

Receivables from brokers, dealers, and clearing organizations 18,039 19,863

Total brokerage receivables (1) $28,419 $25,674

Payables to customers $33,984 $34,751

Payables to brokers, dealers, and clearing organizations 18,196 18,956

Total brokerage payables (1) $52,180 $53,707

(1) Brokerage receivables and payables are accounted for in accordance with ASC 940-320.

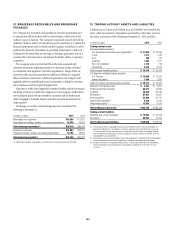

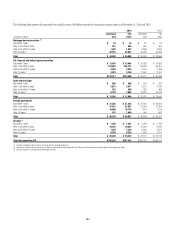

13. TRADING ACCOUNT ASSETS AND LIABILITIES

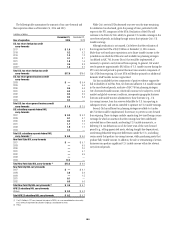

Trading account assets and Trading account liabilities are carried at fair

value, other than physical commodities accounted for at the lower of cost or

fair value, and consist of the following at December 31, 2014 and 2013:

In millions of dollars 2014 2013

Trading account assets

Mortgage-backed securities (1)

U.S. government-sponsored agency guaranteed $ 27,053 $ 23,955

Prime 1,271 1,422

Alt-A 709 721

Subprime 1,382 1,211

Non-U.S. residential 1,476 723

Commercial 4,343 2,574

Total mortgage-backed securities $ 36,234 $ 30,606

U.S. Treasury and federal agency securities

U.S. Treasury $ 18,906 $ 13,537

Agency obligations 1,568 1,300

Total U.S. Treasury and federal agency securities $ 20,474 $ 14,837

State and municipal securities $ 3,402 $ 3,207

Foreign government securities 66,274 74,856

Corporate 26,460 30,534

Derivatives (2) 67,957 52,821

Equity securities 57,846 61,776

Asset-backed securities (1) 4,546 5,616

Other trading assets (3) 13,593 11,675

Total trading account assets $296,786 $285,928

Trading account liabilities

Securities sold, not yet purchased $ 70,944 $ 61,508

Derivatives (2) 68,092 47,254

Total trading account liabilities $139,036 $108,762

(1) The Company invests in mortgage-backed and asset-backed securities. These securitizations are

generally considered VIEs. The Company’s maximum exposure to loss from these VIEs is equal to

the carrying amount of the securities, which is reflected in the table above. For mortgage-backed

and asset-backed securitizations in which the Company has other involvement, see Note 22 to the

Consolidated Financial Statements.

(2) Presented net, pursuant to enforceable master netting agreements. See Note 23 to the Consolidated

Financial Statements for a discussion regarding the accounting and reporting for derivatives.

(3) Includes investments in unallocated precious metals, as discussed in Note 26 to the Consolidated

Financial Statements. Also includes physical commodities accounted for at the lower of cost or

fair value.