Citibank 2014 Annual Report Download - page 269

Download and view the complete annual report

Please find page 269 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

252

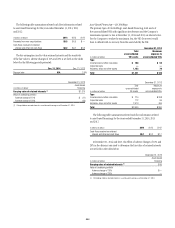

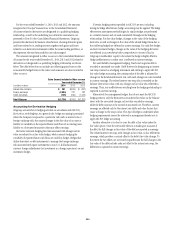

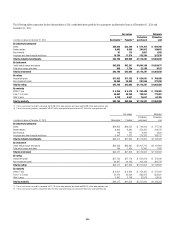

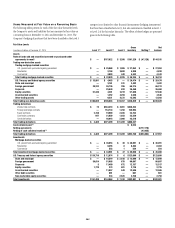

The following table summarizes the gains (losses) on the Company’s fair value hedges for the years ended December 31, 2014 and 2013 and 2012:

Gains (losses) on fair value hedges

Year ended December 31,

(1)

In millions of dollars 2014 2013 2012

Gain (loss) on the derivatives in designated and qualifying fair value hedges

Interest rate contracts $ 1,546 $(3,288) $ 122

Foreign exchange contracts 1,367 265 377

Commodity contracts (221) — —

Total gain (loss) on the derivatives in designated and qualifying fair value hedges $ 2,692 $(3,023) $ 499

Gain (loss) on the hedged item in designated and qualifying fair value hedges

Interest rate hedges $(1,496) $ 3,204 $(371)

Foreign exchange hedges (1,422) (185) (331)

Commodity hedges 250 — —

Total gain (loss) on the hedged item in designated and qualifying fair value hedges $(2,668) $ 3,019 $(702)

Hedge ineffectiveness recognized in earnings on designated and qualifying fair value hedges

Interest rate hedges $ 53 $ (84) $(249)

Foreign exchange hedges (16) (4) 16

Total hedge ineffectiveness recognized in earnings on designated and qualifying fair value hedges $ 37 $ (88) $(233)

Net gain (loss) excluded from assessment of the effectiveness of fair value hedges

Interest rate contracts $ (3) $ — $ —

Foreign exchange contracts (2) (39) 84 30

Commodity hedges (2) 29 — —

Total net gain (loss) excluded from assessment of the effectiveness of fair value hedges $ (13) $ 84 $ 30

(1) Amounts are included in Other revenue on the Consolidated Statement of Income. The accrued interest income on fair value hedges is recorded in Net interest revenue and is excluded from this table.

(2) Amounts relate to the premium associated with forward contracts (differential between spot and contractual forward rates). These amounts are excluded from the assessment of hedge effectiveness and are reflected

directly in earnings.

Cash Flow Hedges

Hedging of benchmark interest rate risk

Citigroup hedges variable cash flows associated with floating-rate liabilities

and the rollover (re-issuance) of liabilities. Variable cash flows from those

liabilities are converted to fixed-rate cash flows by entering into receive-

variable, pay-fixed interest rate swaps and receive-variable, pay-fixed

forward-starting interest rate swaps. Citi also hedges variable cash flows from

recognized and forecasted floating-rate assets. Variable cash flows from those

assets are converted to fixed-rate cash flows by entering into receive-fixed,

pay-variable interest rate swaps. These cash-flow hedging relationships use

either regression analysis or dollar-offset ratio analysis to assess whether

the hedging relationships are highly effective at inception and on an

ongoing basis. When certain variable interest rates, associated with hedged

items, do not qualify as benchmark interest rates, Citigroup designates the

risk being hedged as the risk of overall changes in the hedged cash flows.

Since efforts are made to match the terms of the derivatives to those of the

hedged forecasted cash flows as closely as possible, the amount of hedge

ineffectiveness is not significant.

Hedging of foreign exchange risk

Citigroup locks in the functional currency equivalent cash flows of long-

term debt and short-term borrowings that are denominated in currencies

other than the functional currency of the issuing entity. Depending on the

risk management objectives, these types of hedges are designated as either

cash flow hedges of only foreign exchange risk or cash flow hedges of both

foreign exchange and interest rate risk, and the hedging instruments used

are foreign exchange cross-currency swaps and forward contracts. These

cash flow hedge relationships use dollar-offset ratio analysis to determine

whether the hedging relationships are highly effective at inception and on an

ongoing basis.

Hedging of overall changes in cash flows

Citigroup makes purchases of certain “to-be-announced” (TBA) mortgage-

backed securities that meet the definition of a derivative (i.e. a forward

securities purchase). Citigroup commonly designates these derivatives as

hedges of the overall cash flow variability related to the forecasted acquisition

of the TBA mortgage-backed securities. Since the hedged transaction is the

gross settlement of the forward contract, hedge effectiveness is assessed by

assuring that the terms of the hedging instrument and the hedged forecasted

transaction are the same and that delivery of the securities remains probable.