Citibank 2014 Annual Report Download - page 277

Download and view the complete annual report

Please find page 277 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.260

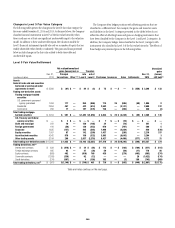

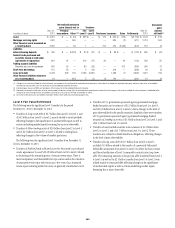

Basedontheobservabilityofinputsused,ProductControlclassifiesthe

inventoryasLevel1,Level2orLevel3ofthefairvaluehierarchy.When

a position involves one or more significant inputs that are not directly

observable, price verification procedures are performed that may include

reviewing relevant historical data, analyzing profit and loss, valuing

each component of a structured trade individually, and benchmarking,

among others.

ReportsofinventorythatisclassifiedwithinLevel3ofthefairvalue

hierarchyaredistributedtoseniormanagementinFinance,Riskandthe

business.ThisinventoryisalsodiscussedinRiskCommitteesandinmonthly

meetings with senior trading management. As deemed necessary, reports may

gototheAuditCommitteeoftheBoardofDirectorsortothefullBoardof

Directors. Whenever an adjustment is needed to bring the price of an asset or

liability to its exit price, Product Control reports it to management along with

other price verification results.

In addition, the pricing models used in measuring fair value are governed

by an independent control framework. Although the models are developed

and tested by the individual business units, they are independently validated

bytheModelValidationGroupwithinRiskManagementandreviewedby

Finance with respect to their impact on the price verification procedures. The

purpose of this independent control framework is to assess model risk arising

from models’ theoretical soundness, calibration techniques where needed,

and the appropriateness of the model for a specific product in a defined

market. To ensure their continued applicability, models are independently

reviewedannually.Inaddition,RiskManagementapprovesandmaintains

a list of products permitted to be valued under each approved model for a

given business.

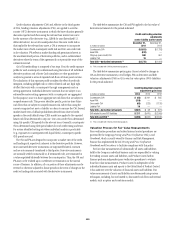

Securities purchased under agreements to resell and

securities sold under agreements to repurchase

No quoted prices exist for such instruments, so fair value is determined using

a discounted cash-flow technique. Cash flows are estimated based on the

terms of the contract, taking into account any embedded derivative or other

features. Expected cash flows are discounted using interest rates appropriate

to the maturity of the instrument as well as the nature of the underlying

collateral. Generally, when such instruments are held at fair value, they are

classifiedwithinLevel2ofthefairvaluehierarchy,astheinputsusedinthe

valuation are readily observable. However, certain long-dated positions are

classifiedwithinLevel3ofthefairvaluehierarchy.

Trading account assets and liabilities—trading securities

and trading loans

When available, the Company generally uses quoted market prices in active

markets to determine the fair value of trading securities; such items are

classifiedasLevel1ofthefairvaluehierarchy.Examplesincludesome

government securities and exchange-traded equity securities.

For bonds and secondary market loans traded over the counter, the

Company generally determines fair value utilizing valuation techniques,

including discounted cash flows, price-based and internal models, such as

Black-ScholesandMonteCarlosimulation.Fairvalueestimatesfromthese

internal valuation techniques are verified, where possible, to prices obtained

fromindependentsources,includingthird-partyvendors.Vendorscompile

prices from various sources and may apply matrix pricing for similar bonds

or loans where no price is observable. A price-based methodology utilizes,

where available, quoted prices or other market information obtained from

recent trading activity of assets with similar characteristics to the bond

or loan being valued. The yields used in discounted cash flow models are

derived from the same price information. Trading securities and loans priced

usingsuchmethodsaregenerallyclassifiedasLevel2.However,whenless

liquidity exists for a security or loan, a quoted price is stale, a significant

adjustment to the price of a similar security or loan is necessary to reflect

differences in the terms of the actual security or loan being valued, or

prices from independent sources are insufficient to corroborate valuation,

aloanorsecurityisgenerallyclassifiedasLevel3.Thepriceinputusedin

a price-based methodology may be zero for a security, such as a subprime

CDO, that is not receiving any principal or interest and is currently written

down to zero.

Where the Company’s principal market for a portfolio of loans is the

securitization market, the Company uses the securitization price to determine

the fair value of the portfolio. The securitization price is determined from

the assumed proceeds of a hypothetical securitization in the current market,

adjusted for transformation costs (i.e., direct costs other than transaction

costs) and securitization uncertainties such as market conditions and

liquidity. As a result of the severe reduction in the level of activity in

certain securitization markets since the second half of 2007, observable

securitization prices for certain directly comparable portfolios of loans

have not been readily available. Therefore, such portfolios of loans are

generallyclassifiedasLevel3ofthefairvaluehierarchy.However,forother

loan securitization markets, such as commercial real estate loans, price

verification of the hypothetical securitizations has been possible, since these

markets have remained active. Accordingly, this loan portfolio is classified as

Level2ofthefairvaluehierarchy.

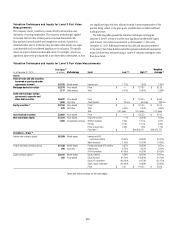

Trading account assets and liabilities—derivatives

Exchange-traded derivatives, measured at fair value using quoted

(i.e., exchange) prices in active markets, where available, are classified as

Level1ofthefairvaluehierarchy.

Derivatives without a quoted price in an active market and derivatives

executed over the counter are valued using internal valuation techniques.

ThesederivativeinstrumentsareclassifiedaseitherLevel2orLevel3

depending upon the observability of the significant inputs to the model.

The valuation techniques and inputs depend on the type of derivative

and the nature of the underlying instrument. The principal techniques used

to value these instruments are discounted cash flows and internal models,

includingBlack-ScholesandMonteCarlosimulation.

The key inputs depend upon the type of derivative and the nature

of the underlying instrument and include interest rate yield curves,

foreign-exchange rates, volatilities and correlation. The Company uses

overnight indexed swap (OIS) curves as fair value measurement inputs

for the valuation of certain collateralized derivatives. Citi uses the relevant

benchmarkcurveforthecurrencyofthederivative(e.g.,theLondon

InterbankOfferedRateforU.S.dollarderivatives)asthediscountratefor

uncollateralized derivatives.