Citibank 2014 Annual Report Download - page 260

Download and view the complete annual report

Please find page 260 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.243

Municipal Securities Tender Option Bond (TOB) Trusts

TOB trusts hold fixed- and floating-rate, taxable and tax-exempt securities

issued by state and local governments and municipalities. The trusts are

typically single-issuer trusts whose assets are purchased from the Company

or from other investors in the municipal securities market. The TOB trusts

fund the purchase of their assets by issuing long-term, putable floating rate

certificates (Floaters) and residual certificates (Residuals). The trusts are

referred to as TOB trusts because the Floater holders have the ability to tender

their interests periodically back to the issuing trust, as described further

below. The Floaters and Residuals evidence beneficial ownership interests in,

and are collateralized by, the underlying assets of the trust. The Floaters are

held by third-party investors, typically tax-exempt money market funds. The

Residuals are typically held by the original owner of the municipal securities

being financed.

The Floaters and the Residuals have a tenor that is equal to or shorter

than the tenor of the underlying municipal bonds. The Residuals entitle their

holders to the residual cash flows from the issuing trust, the interest income

generated by the underlying municipal securities net of interest paid on the

Floaters and trust expenses. The Residuals are rated based on the long-term

rating of the underlying municipal bond. The Floaters bear variable interest

rates that are reset periodically to a new market rate based on a spread to a

high grade, short-term, tax-exempt index. The Floaters have a long-term

rating based on the long-term rating of the underlying municipal bond and

a short-term rating based on that of the liquidity provider to the trust.

There are two kinds of TOB trusts: customer TOB trusts and non-customer

TOB trusts. Customer TOB trusts are trusts through which customers

finance their investments in municipal securities. The Residuals are held

by customers and the Floaters by third-party investors, typically tax-exempt

money market funds. Non-customer TOB trusts are trusts through which

the Company finances its own investments in municipal securities. In such

trusts, the Company holds the Residuals, and third-party investors, typically

tax-exempt money market funds, hold the Floaters.

The Company serves as remarketing agent to the trusts, placing the

Floaters with third-party investors at inception, facilitating the periodic

reset of the variable rate of interest on the Floaters, and remarketing any

tendered Floaters. If Floaters are tendered and the Company (in its role

as remarketing agent) is unable to find a new investor within a specified

period of time, it can declare a failed remarketing, in which case the trust is

unwound. The Company may, but is not obligated to, buy the Floaters into

its own inventory. The level of the Company’s inventory of Floaters fluctuates

over time. At December 31, 2014 and 2013, the Company held $3 million

and $176 million, respectively, of Floaters related to both customer and non-

customer TOB trusts.

For certain non-customer trusts, the Company also provides credit

enhancement. At December 31, 2014 and 2013 approximately $198 million

and $230 million, respectively, of the municipal bonds owned by TOB trusts

have a credit guarantee provided by the Company.

The Company provides liquidity to many of the outstanding trusts. If

a trust is unwound early due to an event other than a credit event on the

underlying municipal bond, the underlying municipal bonds are sold in the

market. If there is a shortfall in the trust’s cash flows between the redemption

price of the tendered Floaters and the proceeds from the sale of the

underlying municipal bonds, the trust draws on a liquidity agreement in an

amount equal to the shortfall. For customer TOBs where the Residual is less

than 25% of the trust’s capital structure, the Company has a reimbursement

agreement with the Residual holder under which the Residual holder

reimburses the Company for any payment made under the liquidity

arrangement. Through this reimbursement agreement, the Residual holder

remains economically exposed to fluctuations in value of the underlying

municipal bonds. These reimbursement agreements are generally subject

to daily margining based on changes in value of the underlying municipal

bond. In cases where a third party provides liquidity to a non-customer TOB

trust, a similar reimbursement arrangement is made whereby the Company

(or a consolidated subsidiary of the Company) as Residual holder absorbs

any losses incurred by the liquidity provider.

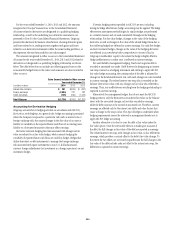

At December 31, 2014 and 2013, liquidity agreements provided with

respect to customer TOB trusts totaled $3.7 billion and $3.9 billion,

respectively, of which $2.6 billion and $2.8 billion, respectively, were offset

by reimbursement agreements. For the remaining exposure related to TOB

transactions, where the Residual owned by the customer was at least 25%

of the bond value at the inception of the transaction, no reimbursement

agreement was executed. The Company also provides other liquidity

agreements or letters of credit to customer-sponsored municipal investment

funds, which are not variable interest entities, and municipality-related

issuers that totaled $7.4 billion and $5.4 billion as of December 31, 2014 and

2013, respectively. These liquidity agreements and letters of credit are offset

by reimbursement agreements with various term-out provisions.

The Company considers the customer and non-customer TOB trusts to

be VIEs. Customer TOB trusts are not consolidated by the Company. The

Company has concluded that the power to direct the activities that most

significantly impact the economic performance of the customer TOB trusts

is primarily held by the customer Residual holder, which may unilaterally

cause the sale of the trust’s bonds.

Non-customer TOB trusts generally are consolidated. Similar to customer

TOB trusts, the Company has concluded that the power over the non-

customer TOB trusts is primarily held by the Residual holder, which may

unilaterally cause the sale of the trust’s bonds. Because the Company holds

the Residual interest, and thus has the power to direct the activities that most

significantly impact the trust’s economic performance, it consolidates the

non-customer TOB trusts.