Citibank 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327

|

|

100

Credit Ratings

Citigroup’s funding and liquidity, its funding capacity, ability to access

capital markets and other sources of funds, the cost of these funds, and its

ability to maintain certain deposits are partially dependent on its credit

ratings. The table below sets forth the ratings for Citigroup and Citibank, N.A.

as of December 31, 2014. While not included in the table below, Citigroup

Global Markets Inc. (CGMI) is rated A/A-1 by Standard & Poor’s and A/F1 by

Fitch as of December 31, 2014.

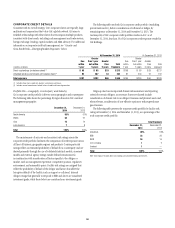

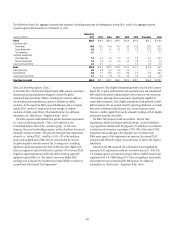

Debt Ratings as of December 31, 2014

Citigroup Inc. Citibank, N.A.

Senior

debt

Commercial

paper Outlook

Long-

term

Short-

term Outlook

Fitch Ratings (Fitch) A F1 Stable A F1 Stable

Moody’s Investors Service (Moody’s) Baa2 P-2 Stable A2 P-1 Stable

Standard & Poor’s (S&P) A- A-2 Negative A A-1 Stable

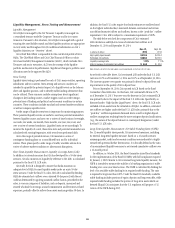

Recent Credit Rating Developments

On December 17, 2014, Fitch issued a bank “criteria exposure draft.” The

document consolidates all bank rating criteria into one report and refines

certain aspects of the criteria, including clarification as to when the agency

might rate an operating company’s long-term rating above its unsupported

rating due to the protection offered to senior creditors by loss absorbing

junior instruments. Since March 2014, Fitch has been contemplating the

introduction of a ratings differential between U.S. bank holding companies

and operating companies due to the evolving regulatory landscape.

Currently, Fitch equalizes holding company and operating company ratings,

reflecting what it views as the close correlation between default probabilities.

On November 24, 2014, S&P issued a proposal to add a component to its

bank rating methodology to address how a bank’s long-term rating may be

higher than the bank’s unsupported rating due to “additional loss absorbing

capacity” (ALAC). The ALAC proposal considers that loss absorption by

instruments subject to bail-in could partly or fully replace a government

bail-out and could reduce the likelihood of default on an operating

company’s senior unsecured debt obligations. S&P continues to evaluate

government support into the ratings of systemically important U.S. bank

holding companies.

On September 9, 2014, Moody’s also released for comment a new bank

rating methodology. The new methodology proposed a streamlined baseline

credit assessment (with removal of the bank financial strength rating) and

introduced a “loss given failure” assessment into the ratings. The comment

period has closed and resolution is expected in early 2015.

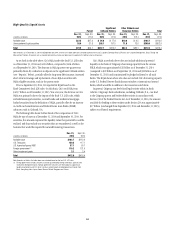

Potential Impacts of Ratings Downgrades

Ratings downgrades by Moody’s, Fitch or S&P could negatively impact

Citigroup’s and/or Citibank, N.A.’s funding and liquidity due to reduced

funding capacity, including derivatives triggers, which could take the form of

cash obligations and collateral requirements.

The following information is provided for the purpose of analyzing the

potential funding and liquidity impact to Citigroup and Citibank, N.A. of

a hypothetical, simultaneous ratings downgrade across all three major

rating agencies. This analysis is subject to certain estimates, estimation

methodologies, and judgments and uncertainties. Uncertainties include

potential ratings limitations that certain entities may have with respect

to permissible counterparties, as well as general subjective counterparty

behavior. For example, certain corporate customers and trading

counterparties could re-evaluate their business relationships with Citi

and limit the trading of certain contracts or market instruments with Citi.

Changes in counterparty behavior could impact Citi’s funding and liquidity,

as well as the results of operations of certain of its businesses. The actual

impact to Citigroup or Citibank, N.A. is unpredictable and may differ

materially from the potential funding and liquidity impacts described below.

For additional information on the impact of credit rating changes on Citi

and its applicable subsidiaries, see “Risk Factors—Liquidity Risks” above.